4835

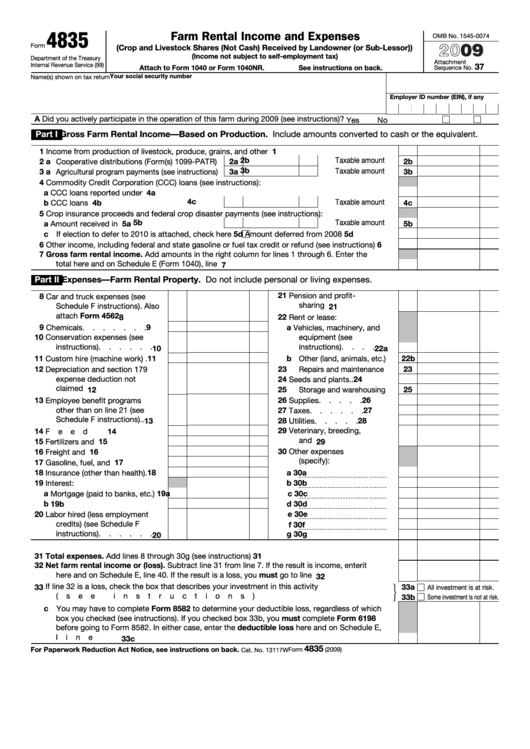

Farm Rental Income and Expenses

OMB No. 1545-0074

2009

Form

(Crop and Livestock Shares (Not Cash) Received by Landowner (or Sub-Lessor))

(Income not subject to self-employment tax)

Department of the Treasury

Attachment

Internal Revenue Service (99)

37

Attach to Form 1040 or Form 1040NR.

See instructions on back.

Sequence No.

Your social security number

Name(s) shown on tax return

Employer ID number (EIN), if any

A

Did you actively participate in the operation of this farm during 2009 (see instructions)? .

.

.

.

.

.

.

Yes

No

Part I

Gross Farm Rental Income—Based on Production. Include amounts converted to cash or the equivalent.

1

1

Income from production of livestock, produce, grains, and other crops .

.

.

.

.

.

.

.

2b Taxable amount

2 a Cooperative distributions (Form(s) 1099-PATR)

2a

2b

3b Taxable amount

3 a Agricultural program payments (see instructions)

3a

3b

4

Commodity Credit Corporation (CCC) loans (see instructions):

a CCC loans reported under election

4a

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4c Taxable amount

b CCC loans forfeited

.

.

.

.

.

.

.

.

4b

4c

5

Crop insurance proceeds and federal crop disaster payments (see instructions):

5b Taxable amount

a Amount received in 2009 .

5a

5b

.

.

.

.

.

.

c If election to defer to 2010 is attached, check here

5d Amount deferred from 2008

5d

6

Other income, including federal and state gasoline or fuel tax credit or refund (see instructions)

6

7

Gross farm rental income. Add amounts in the right column for lines 1 through 6. Enter the

total here and on Schedule E (Form 1040), line 42.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

7

Part II

Expenses—Farm Rental Property. Do not include personal or living expenses.

21

Pension and profit-

8

Car and truck expenses (see

sharing plans .

.

.

Schedule F instructions). Also

21

attach Form 4562 .

.

.

.

8

22

Rent or lease:

9

9

a Vehicles, machinery, and

Chemicals .

.

.

.

.

.

.

10

Conservation expenses (see

equipment (see

instructions) .

.

.

.

.

.

instructions) .

.

.

.

10

22a

11

11

b Other (land, animals, etc.)

22b

Custom hire (machine work) .

12

23

23

Depreciation and section 179

Repairs and maintenance

expense deduction not

24

Seeds and plants .

.

24

claimed elsewhere .

.

.

.

12

25

Storage and warehousing

25

13

26

26

Employee benefit programs

Supplies .

.

.

.

.

other than on line 21 (see

27

Taxes .

.

.

.

.

.

27

Schedule F instructions) .

.

13

28

Utilities .

.

.

.

.

28

29

Veterinary, breeding,

14

14

Feed

.

.

.

.

.

.

.

.

and medicine .

.

.

15

Fertilizers and lime .

.

.

.

15

29

30

Other expenses

16

Freight and trucking

.

.

.

16

(specify):

17

17

Gasoline, fuel, and oil .

.

.

18

18

a

30a

Insurance (other than health).

19

Interest:

b

30b

a Mortgage (paid to banks, etc.)

19a

c

30c

b Other .

19b

d

30d

.

.

.

.

.

.

.

20

e

30e

Labor hired (less employment

credits) (see Schedule F

f

30f

instructions) .

.

.

.

.

.

g

30g

20

31

Total expenses. Add lines 8 through 30g (see instructions)

.

.

.

.

.

.

.

.

.

.

.

31

32

Net farm rental income or (loss). Subtract line 31 from line 7. If the result is income, enter it

here and on Schedule E, line 40. If the result is a loss, you must go to line 33

.

.

.

.

.

32

If line 32 is a loss, check the box that describes your investment in this activity

33

33a

All investment is at risk.

(see instructions)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

33b

Some investment is not at risk.

c You may have to complete Form 8582 to determine your deductible loss, regardless of which

box you checked (see instructions). If you checked box 33b, you must complete Form 6198

before going to Form 8582. In either case, enter the deductible loss here and on Schedule E,

line 40 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

33c

4835

For Paperwork Reduction Act Notice, see instructions on back.

Form

(2009)

Cat. No. 13117W

1

1 2

2