Form It-201-D - Resident Itemized Deduction Schedule - New York

ADVERTISEMENT

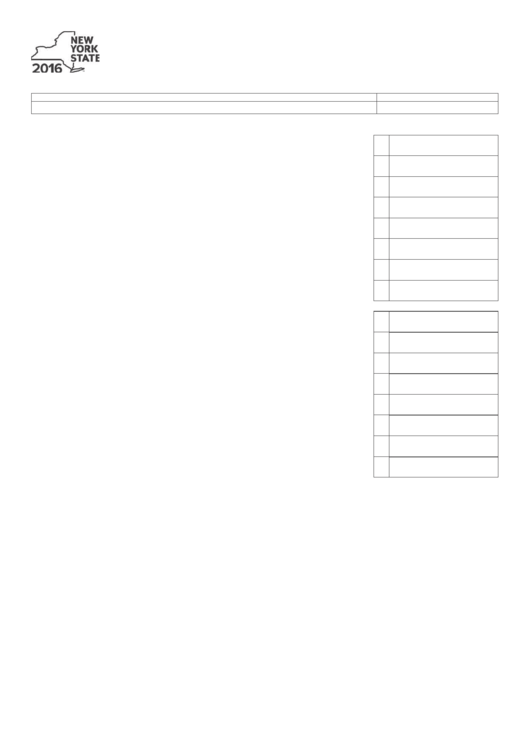

IT-201-D

Department of Taxation and Finance

Resident Itemized Deduction Schedule

Submit this form with Form IT-201.

See instructions for completing Form IT-201-D in the instructions for Form IT-201.

Name(s) as shown on your Form IT-201

Your social security number

Whole dollars only

.

1

1

Medical and dental expenses

..............................................................

(federal Schedule A, line 4)

00

.

2

2

Taxes you paid

.....................................................................................

(federal Schedule A, line 9)

00

.

3

3

Interest you paid

.................................................................................

(federal Schedule A, line 15)

00

.

4

4

Gifts to charity

....................................................................................

(federal Schedule A, line 19)

00

.

5

5

Casualty and theft losses

...................................................................

(federal Schedule A, line 20)

00

.

6

6

Job expenses / miscellaneous deductions

..........................................

(federal Schedule A, line 27)

00

.

7

7

Other miscellaneous deductions

........................................................

(federal Schedule A, line 28)

00

.

8

from federal Schedule A, line 29

8

Enter amount

.......................................................................

00

9

income

State, local, and foreign

taxes

(or general sales tax, if applicable)

.

9

and other subtraction adjustments

.................................................................

(see instructions)

00

.

10

10

Subtract line 9 from line 8 ............................................................................................................

00

.

11

11

Addition adjustments

..........................................................................................

(see instructions)

00

.

12

12

Add lines 10 and 11 .....................................................................................................................

00

.

13

13

Itemized deduction adjustment

..........................................................................

(see instructions)

00

.

14

14

Subtract line 13 from line 12 ........................................................................................................

00

.

15

15

College tuition itemized deduction

....................................................................

(see Form IT-272)

00

.

16 New York State itemized deduction

16

...............

(add lines 14 and 15; enter on Form IT-201, line 34)

00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1