Instructions

Print

Reset

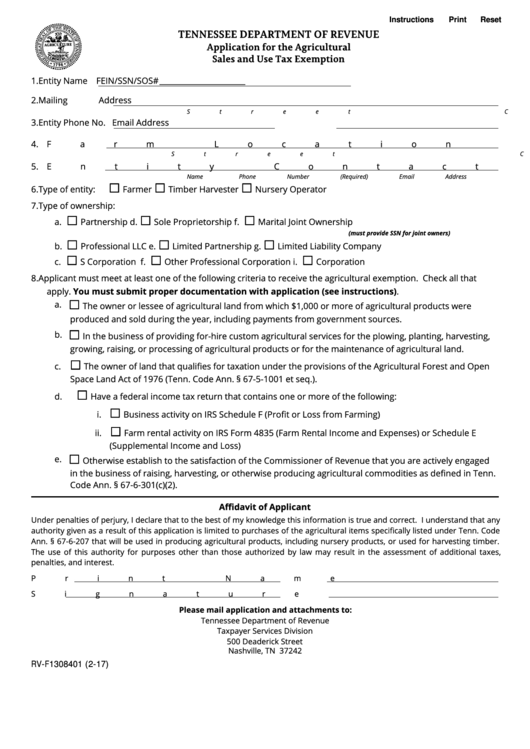

TENNESSEE DEPARTMENT OF REVENUE

Application for the Agricultural

Sales and Use Tax Exemption

1. Entity Name

FEIN/SSN/SOS#

___________________________

2. Mailing Address

Street

City

State

ZIP Code

3. Entity Phone No.

Email Address

4. Farm Location

Street

City

County

5. Entity Contact

Name

Phone Number (Required)

Email Address

☐

☐

☐

6. Type of entity:

Farmer

Timber Harvester

Nursery Operator

7. Type of ownership:

☐

☐

☐

a.

Partnership

d.

Sole Proprietorship

f.

Marital Joint Ownership

(must provide SSN for joint owners)

☐

☐

☐

b.

Professional LLC

e.

Limited Partnership

g.

Limited Liability Company

☐

☐

☐

c.

S Corporation

f.

Other Professional Corporation

i.

Corporation

8. Applicant must meet at least one of the following criteria to receive the agricultural exemption. Check all that

apply. You must submit proper documentation with application (see instructions).

☐

a.

The owner or lessee of agricultural land from which $1,000 or more of agricultural products were

produced and sold during the year, including payments from government sources.

☐

b.

In the business of providing for-hire custom agricultural services for the plowing, planting, harvesting,

growing, raising, or processing of agricultural products or for the maintenance of agricultural land.

☐

c.

The owner of land that qualifies for taxation under the provisions of the Agricultural Forest and Open

Space Land Act of 1976 (Tenn. Code Ann. § 67-5-1001 et seq.).

☐

d.

Have a federal income tax return that contains one or more of the following:

☐

i.

Business activity on IRS Schedule F (Profit or Loss from Farming)

☐

ii.

Farm rental activity on IRS Form 4835 (Farm Rental Income and Expenses) or Schedule E

(Supplemental Income and Loss)

☐

e.

Otherwise establish to the satisfaction of the Commissioner of Revenue that you are actively engaged

in the business of raising, harvesting, or otherwise producing agricultural commodities as defined in Tenn.

Code Ann. § 67-6-301(c)(2).

Affidavit of Applicant

Under penalties of perjury, I declare that to the best of my knowledge this information is true and correct. I understand that any

authority given as a result of this application is limited to purchases of the agricultural items specifically listed under Tenn. Code

Ann. § 67-6-207 that will be used in producing agricultural products, including nursery products, or used for harvesting timber.

The use of this authority for purposes other than those authorized by law may result in the assessment of additional taxes,

penalties, and interest.

Print Name

Title

Signature

Date

Please mail application and attachments to:

Tennessee Department of Revenue

Taxpayer Services Division

500 Deaderick Street

Nashville, TN 37242

RV-F1308401 (2-17)

1

1 2

2