Form N-163 - Fuel Tax Credit

Download a blank fillable Form N-163 - Fuel Tax Credit in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form N-163 - Fuel Tax Credit with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

Clear Form

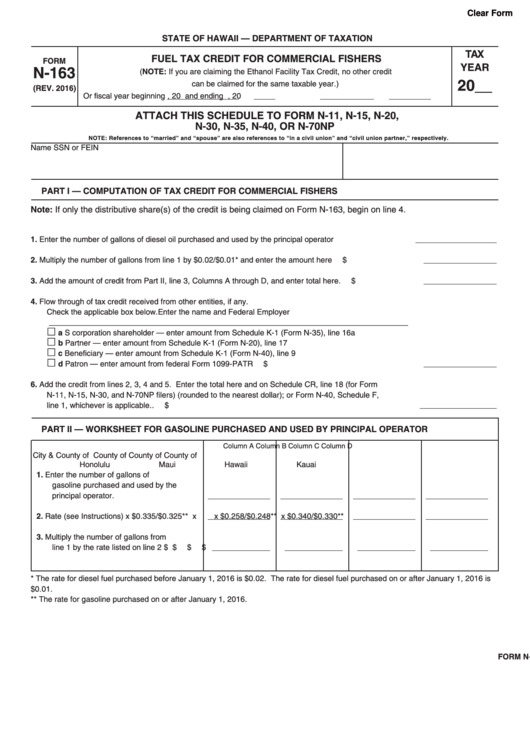

STATE OF HAWAII — DEPARTMENT OF TAXATION

FUEL TAX CREDIT FOR COMMERCIAL FISHERS

TAX

FORM

N-163

YEAR

(NOTE: If you are claiming the Ethanol Facility Tax Credit, no other credit

20__

can be claimed for the same taxable year.)

(REV. 2016)

Or fiscal year beginning

, 20

and ending

, 20

ATTACH THIS SCHEDULE TO FORM N-11, N-15, N-20,

N-30, N-35, N-40, OR N-70NP

NOTE: References to “married” and “spouse” are also references to “in a civil union” and “civil union partner,” respectively.

Name

SSN or FEIN

PART I — COMPUTATION OF TAX CREDIT FOR COMMERCIAL FISHERS

Note: If only the distributive share(s) of the credit is being claimed on Form N-163, begin on line 4.

1.

Enter the number of gallons of diesel oil purchased and used by the principal operator ............................

2.

Multiply the number of gallons from line 1 by $0.02/$0.01* and enter the amount here .............................

$

3.

Add the amount of credit from Part II, line 3, Columns A through D, and enter total here. ..........................

$

4.

Flow through of tax credit received from other entities, if any.

Check the applicable box below. Enter the name and Federal Employer I.D. No. of entity

__________________________________________________________________________________

a S corporation shareholder — enter amount from Schedule K-1 (Form N-35), line 16a

b Partner — enter amount from Schedule K-1 (Form N-20), line 17

c Beneficiary — enter amount from Schedule K-1 (Form N-40), line 9

d Patron — enter amount from federal Form 1099-PATR ......................................................................

$

6.

Add the credit from lines 2, 3, 4 and 5. Enter the total here and on Schedule CR, line 18 (for Form

N-11, N-15, N-30, and N-70NP filers) (rounded to the nearest dollar); or Form N-40, Schedule F,

line 1, whichever is applicable.. ...................................................................................................................

$

PART II — WORKSHEET FOR GASOLINE PURCHASED AND USED BY PRINCIPAL OPERATOR

Column A

Column B

Column C

Column D

City & County of

County of

County of

County of

Honolulu

Maui

Hawaii

Kauai

1.

Enter the number of gallons of

gasoline purchased and used by the

principal operator.

2.

Rate (see Instructions)

x $0.335/$0.325**

x

x $0.258/$0.248**

x $0.340/$0.330**

3.

Multiply the number of gallons from

line 1 by the rate listed on line 2

$

$

$

$

* The rate for diesel fuel purchased before January 1, 2016 is $0.02. The rate for diesel fuel purchased on or after January 1, 2016 is

$0.01.

** The rate for gasoline purchased on or after January 1, 2016.

FORM N-163

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2