Clear Form

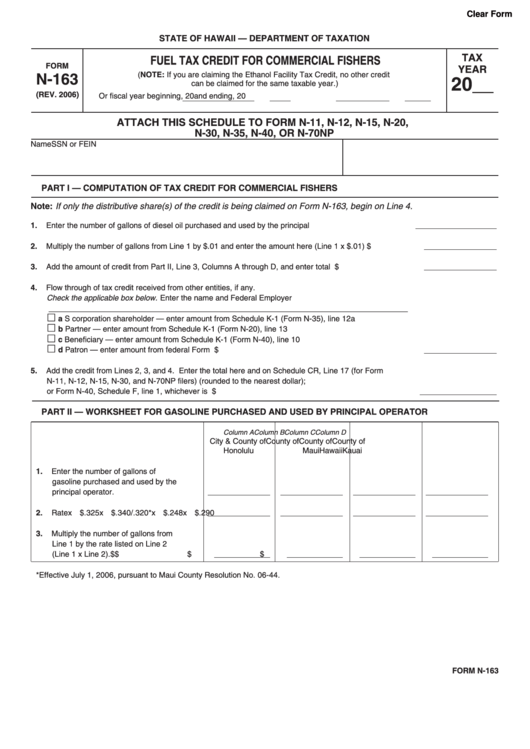

STATE OF HAWAII — DEPARTMENT OF TAXATION

TAX

FUEL TAX CREDIT FOR COMMERCIAL FISHERS

FORM

YEAR

(NOTE: If you are claiming the Ethanol Facility Tax Credit, no other credit

N-163

20__

can be claimed for the same taxable year.)

(REV. 2006)

Or fiscal year beginning

, 20

and ending

, 20

ATTACH THIS SCHEDULE TO FORM N-11, N-12, N-15, N-20,

N-30, N-35, N-40, OR N-70NP

Name

SSN or FEIN

PART I — COMPUTATION OF TAX CREDIT FOR COMMERCIAL FISHERS

Note: If only the distributive share(s) of the credit is being claimed on Form N-163, begin on Line 4.

1.

Enter the number of gallons of diesel oil purchased and used by the principal operator.............................

2.

Multiply the number of gallons from Line 1 by $.01 and enter the amount here (Line 1 x $.01). .................

$

3.

Add the amount of credit from Part II, Line 3, Columns A through D, and enter total here..........................

$

4.

Flow through of tax credit received from other entities, if any.

Check the applicable box below. Enter the name and Federal Employer I.D. No. of entity

__________________________________________________________________________________

£

a S corporation shareholder — enter amount from Schedule K-1 (Form N-35), line 12a

£

b Partner — enter amount from Schedule K-1 (Form N-20), line 13

£

c Beneficiary — enter amount from Schedule K-1 (Form N-40), line 10

£

d Patron — enter amount from federal Form 1099-PATR .....................................................................

$

5.

Add the credit from Lines 2, 3, and 4. Enter the total here and on Schedule CR, Line 17 (for Form

N-11, N-12, N-15, N-30, and N-70NP filers) (rounded to the nearest dollar);

or Form N-40, Schedule F, line 1, whichever is applicable.. .......................................................................

$

PART II — WORKSHEET FOR GASOLINE PURCHASED AND USED BY PRINCIPAL OPERATOR

Column A

Column B

Column C

Column D

City & County of

County of

County of

County of

Honolulu

Maui

Hawaii

Kauai

1.

Enter the number of gallons of

gasoline purchased and used by the

principal operator.

2.

Rate

x $.325

x $.340/.320*

x $.248

x $.290

3.

Multiply the number of gallons from

Line 1 by the rate listed on Line 2

(Line 1 x Line 2).

$

$

$

$

*Effective July 1, 2006, pursuant to Maui County Resolution No. 06-44.

FORM N-163

1

1