Quick Preparation Reference For Ty 2017 Alabama Business Privilege Tax Forms

ADVERTISEMENT

A

D

R

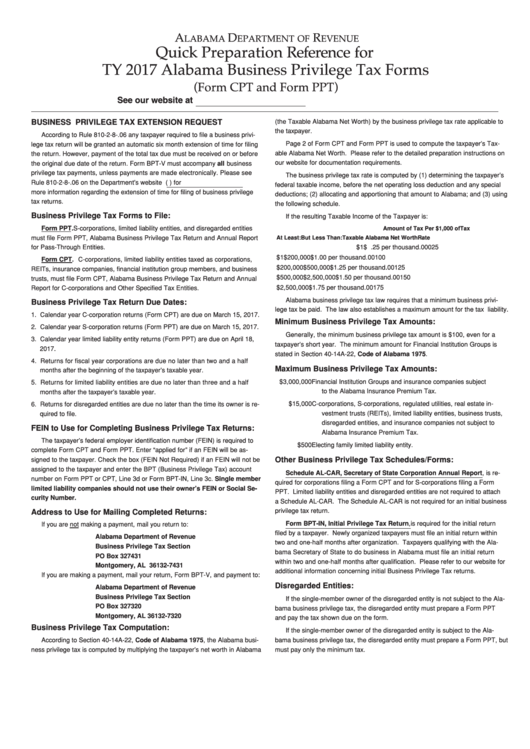

Quick Preparation Reference for

LABAMA

EPARTMENT OF

EVENUE

TY 2017 Alabama Business Privilege Tax Forms

(Form CPT and Form PPT)

See our website at for additional information

BUSINESS PRIVILEGE TAX EXTENSION REQUEST

(the Taxable Alabama Net Worth) by the business privilege tax rate applicable to

the taxpayer.

According to Rule 810-2-8-.06 any taxpayer required to file a business privi-

Page 2 of Form CPT and Form PPT is used to compute the taxpayer’s Tax-

lege tax return will be granted an automatic six month extension of time for filing

able Alabama Net Worth. Please refer to the detailed preparation instructions on

the return. However, payment of the total tax due must be received on or before

our website for documentation requirements.

the original due date of the return. Form BPT-V must accompany all business

privilege tax payments, unless payments are made electronically. Please see

The business privilege tax rate is computed by (1) determining the taxpayer’s

Rule 810-2-8-.06 on the Department’s website ( ) for

federal taxable income, before the net operating loss deduction and any special

more information regarding the extension of time for filing of business privilege

deductions; (2) allocating and apportioning that amount to Alabama; and (3) using

tax returns.

the following schedule.

Business Privilege Tax Forms to File:

If the resulting Taxable Income of the Taxpayer is:

Form PPT. S-corporations, limited liability entities, and disregarded entities

Amount of Tax Per $1,000 of

Tax

must file Form PPT, Alabama Business Privilege Tax Return and Annual Report

At Least:

But Less Than:

Taxable Alabama Net Worth

Rate

for Pass-Through Entities.

$1

$ .25 per thousand

.00025

$1

$200,000

$1.00 per thousand

.00100

Form CPT. C-corporations, limited liability entities taxed as corporations,

$200,000

$500,000

$1.25 per thousand

.00125

REITs, insurance companies, financial institution group members, and business

$500,000

$2,500,000

$1.50 per thousand

.00150

trusts, must file Form CPT, Alabama Business Privilege Tax Return and Annual

$2,500,000

$1.75 per thousand

.00175

Report for C-corporations and Other Specified Tax Entities.

Alabama business privilege tax law requires that a minimum business privi-

Business Privilege Tax Return Due Dates:

lege tax be paid. The law also establishes a maximum amount for the tax liability.

1. Calendar year C-corporation returns (Form CPT) are due on March 15, 2017.

Minimum Business Privilege Tax Amounts:

2. Calendar year S-corporation returns (Form PPT) are due on March 15, 2017.

Generally, the minimum business privilege tax amount is $100, even for a

3. Calendar year limited liability entity returns (Form PPT) are due on April 18,

taxpayer’s short year. The minimum amount for Financial Institution Groups is

2017.

stated in Section 40-14A-22, Code of Alabama 1975.

4. Returns for fiscal year corporations are due no later than two and a half

Maximum Business Privilege Tax Amounts:

months after the beginning of the taxpayer’s taxable year.

$3,000,000

Financial Institution Groups and insurance companies subject

5. Returns for limited liability entities are due no later than three and a half

to the Alabama Insurance Premium Tax.

months after the taxpayer’s taxable year.

6. Returns for disregarded entities are due no later than the time its owner is re-

$15,000

C-corporations, S-corporations, regulated utilities, real estate in-

vestment trusts (REITs), limited liability entities, business trusts,

quired to file.

disregarded entities, and insurance companies not subject to

FEIN to Use for Completing Business Privilege Tax Returns:

Alabama Insurance Premium Tax.

The taxpayer’s federal employer identification number (FEIN) is required to

$500

Electing family limited liability entity.

complete Form CPT and Form PPT. Enter “applied for” if an FEIN will be as-

Other Business Privilege Tax Schedules/Forms:

signed to the taxpayer. Check the box (FEIN Not Required) if an FEIN will not be

assigned to the taxpayer and enter the BPT (Business Privilege Tax) account

Schedule AL-CAR, Secretary of State Corporation Annual Report, is re-

number on Form PPT or CPT, Line 3d or Form BPT-IN, Line 3c. Single member

quired for corporations filing a Form CPT and for S-corporations filing a Form

limited liability companies should not use their owner’s FEIN or Social Se-

PPT. Limited liability entities and disregarded entities are not required to attach

curity Number.

a Schedule AL-CAR. The Schedule AL-CAR is not required for an initial business

privilege tax return.

Address to Use for Mailing Completed Returns:

Form BPT-IN, Initial Privilege Tax Return, is required for the initial return

If you are not making a payment, mail you return to:

filed by a taxpayer. Newly organized taxpayers must file an initial return within

Alabama Department of Revenue

two and one-half months after organization. Taxpayers qualifying with the Ala-

Business Privilege Tax Section

bama Secretary of State to do business in Alabama must file an initial return

PO Box 327431

within two and one-half months after qualification. Please refer to our website for

Montgomery, AL 36132-7431

additional information concerning initial Business Privilege Tax returns.

If you are making a payment, mail your return, Form BPT-V, and payment to:

Disregarded Entities:

Alabama Department of Revenue

Business Privilege Tax Section

If the single-member owner of the disregarded entity is not subject to the Ala-

PO Box 327320

bama business privilege tax, the disregarded entity must prepare a Form PPT

Montgomery, AL 36132-7320

and pay the tax shown due on the form.

Business Privilege Tax Computation:

If the single-member owner of the disregarded entity is subject to the Ala-

According to Section 40-14A-22, Code of Alabama 1975, the Alabama busi-

bama business privilege tax, the disregarded entity must prepare a Form PPT, but

ness privilege tax is computed by multiplying the taxpayer’s net worth in Alabama

must pay only the minimum tax.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2