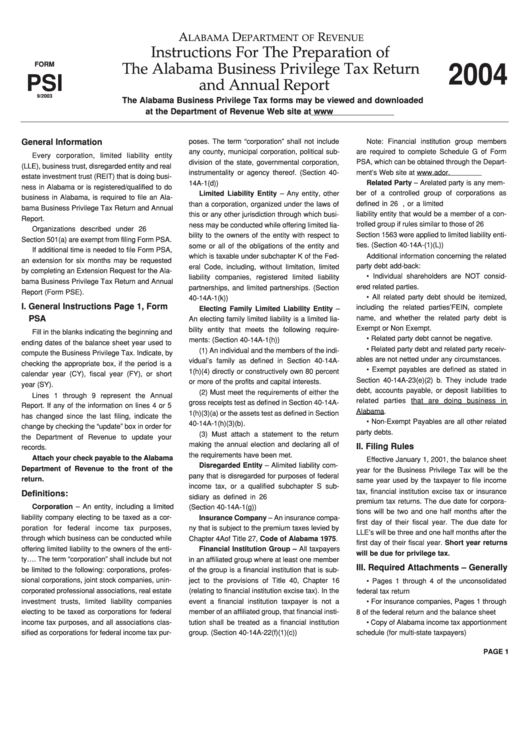

Form Psi - Instructions For The Preparation Of The Alabama Business Privilege Tax Return And Annual Report - 2004

ADVERTISEMENT

A

D

R

LABAMA

EPARTMENT OF

EVENUE

Instructions For The Preparation of

2004

FORM

The Alabama Business Privilege Tax Return

PSI

and Annual Report

9/2003

The Alabama Business Privilege Tax forms may be viewed and downloaded

at the Department of Revenue Web site at

General Information

poses. The term “corporation” shall not include

Note: Financial institution group members

any county, municipal corporation, political sub-

are required to complete Schedule G of Form

Every corporation, limited liability entity

division of the state, governmental corporation,

PSA, which can be obtained through the Depart-

(LLE), business trust, disregarded entity and real

instrumentality or agency thereof. (Section 40-

ment’s Web site at

estate investment trust (REIT) that is doing busi-

14A-1(d))

Related Party – A related party is any mem-

ness in Alabama or is registered/qualified to do

ber of a controlled group of corporations as

Limited Liability Entity – Any entity, other

business in Alabama, is required to file an Ala-

defined in 26 U.S.C. Section 1563, or a limited

than a corporation, organized under the laws of

bama Business Privilege Tax Return and Annual

liability entity that would be a member of a con-

this or any other jurisdiction through which busi-

Report.

trolled group if rules similar to those of 26 U.S.C.

ness may be conducted while offering limited lia-

Organizations described under 26 U.S.C.

Section 1563 were applied to limited liability enti-

bility to the owners of the entity with respect to

Section 501(a) are exempt from filing Form PSA.

ties. (Section 40-14A-(1)(L))

some or all of the obligations of the entity and

If additional time is needed to file Form PSA,

Additional information concerning the related

which is taxable under subchapter K of the Fed-

an extension for six months may be requested

party debt add-back:

eral Code, including, without limitation, limited

by completing an Extension Request for the Ala-

• Individual shareholders are NOT consid-

liability companies, registered limited liability

bama Business Privilege Tax Return and Annual

ered related parties.

partnerships, and limited partnerships. (Section

Report (Form PSE).

• All related party debt should be itemized,

40-14A-1(k))

I. General Instructions Page 1, Form

including the related parties’ FEIN, complete

Electing Family Limited Liability Entity –

PSA

name, and whether the related party debt is

An electing family limited liability is a limited lia-

Exempt or Non Exempt.

bility entity that meets the following require-

Fill in the blanks indicating the beginning and

• Related party debt cannot be negative.

ments: (Section 40-14A-1(h))

ending dates of the balance sheet year used to

• Related party debt and related party receiv-

(1) An individual and the members of the indi-

compute the Business Privilege Tax. Indicate, by

ables are not netted under any circumstances.

vidual’s family as defined in Section 40-14A-

checking the appropriate box, if the period is a

• Exempt payables are defined as stated in

1(h)(4) directly or constructively own 80 percent

calendar year (CY), fiscal year (FY), or short

Section 40-14A-23(e)(2) b. They include trade

or more of the profits and capital interests.

year (SY).

debt, accounts payable, or deposit liabilities to

(2) Must meet the requirements of either the

Lines 1 through 9 represent the Annual

related parties that are doing business in

gross receipts test as defined in Section 40-14A-

Report. If any of the information on lines 4 or 5

Alabama.

1(h)(3)(a) or the assets test as defined in Section

has changed since the last filing, indicate the

• Non-Exempt Payables are all other related

40-14A-1(h)(3)(b).

change by checking the “update” box in order for

party debts.

(3) Must attach a statement to the return

the Department of Revenue to update your

making the annual election and declaring all of

II. Filing Rules

records.

the requirements have been met.

Attach your check payable to the Alabama

Effective January 1, 2001, the balance sheet

Disregarded Entity – A limited liability com-

Department of Revenue to the front of the

year for the Business Privilege Tax will be the

pany that is disregarded for purposes of federal

return.

same year used by the taxpayer to file income

income tax, or a qualified subchapter S sub-

tax, financial institution excise tax or insurance

Definitions:

sidiary as defined in 26 U.S.C. Section 1361.

premium tax returns. The due date for corpora-

Corporation – An entity, including a limited

(Section 40-14A-1(g))

tions will be two and one half months after the

liability company electing to be taxed as a cor-

Insurance Company – An insurance compa-

first day of their fiscal year. The due date for

poration for federal income tax purposes,

ny that is subject to the premium taxes levied by

LLE’s will be three and one half months after the

through which business can be conducted while

Chapter 4A of Title 27, Code of Alabama 1975.

first day of their fiscal year. Short year returns

offering limited liability to the owners of the enti-

Financial Institution Group – All taxpayers

will be due for privilege tax.

ty…. The term “corporation” shall include but not

in an affiliated group where at least one member

III. Required Attachments – Generally

be limited to the following: corporations, profes-

of the group is a financial institution that is sub-

sional corporations, joint stock companies, unin-

ject to the provisions of Title 40, Chapter 16

• Pages 1 through 4 of the unconsolidated

corporated professional associations, real estate

(relating to financial institution excise tax). In the

federal tax return

investment trusts, limited liability companies

event a financial institution taxpayer is not a

• For insurance companies, Pages 1 through

electing to be taxed as corporations for federal

member of an affiliated group, that financial insti-

8 of the federal return and the balance sheet

income tax purposes, and all associations clas-

tution shall be treated as a financial institution

• Copy of Alabama income tax apportionment

sified as corporations for federal income tax pur-

group. (Section 40-14A-22(f)(1)(c))

schedule (for multi-state taxpayers)

PAGE 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4