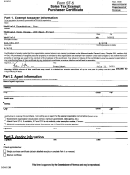

Mfi Form St-5 - Medfield Foundation Page 2

ADVERTISEMENT

ee-o<JOO12

Description of property purchased

Part 4.

General information

on purchases

exem pt from sales tax

An exempt

501 (c)(3) organization

must have

obtained a Certificate of ~

emption (Fcnn ST-2) from !he Commissioner

of ReYeBJe certifying that

It is entitled to exemption under G.L. c.64H, ~e).

The 501 (c)(3) organi-

zation must submit to the vendor a properly

completed

Sales

Tax ~mpt

Purchaser Certificate

(Form ST-5) signed

by the 501 (c)(3) organization

with a copy

of its

Form

ST-2

attached.

Any person, group or organization purchasing as an agent on behalf of a

501 (c)(3) organization must certify that It is doing so by presenting to the

vendor a properly completed Form 81.0 signed by the 501 (c)(3) organi-

zation. It must also present a copy of the 501(0)(3) organization's Form

ST-2. The agent of the exempt 501(0)(3) organization must complete

Part 2 cI Form ST-5.

Any government organization is encouraged to obtain a Certificate of Ex-

emption (Form ST-2) from the Commissioner of Revenue, certifying that

It is entitled to exemption under GL c.64, §6(d). The exempt govem-

ment organization is encouraged to submit to the yendor a properly com-

pleted Sales Tax Exempt Purchaser Certificate (Foon ST-5) with a copy

of its Form

ST-2

attached. If the government organization doas not pre-

sent Form 81-5, the vendor must maintain adequate documentation

(generally, a copy of the government check) verifying that the purchaser

Is an eJC8I11pt

government agency.

Any person, group or organization purchasing on behalf of exempt g0v-

ernment organizations must certify that they are doing so by presenting

to the

vendor a properly executed Form

ST-5

when making sud1 pur-

chases. Part 1 of Form ST-5 should be filled out by the exempt govern-

2V2420

1.000

ment organization. If PII't 1 is not completed by the exempt government

organization, the agent must enter the name, address, and, if available,

the exemptIon number of the government organization on whose behalf

the purchases are being made.. Also enter a description of the property

purchased Into Part 4. The agent

must

complete Part

2 when acting on

behalf of the exempt government organization. The purchaser must at-

tach to the Form ST-5 a copy of the exempt government organization's

Form

ST-2

If available. If it is not available, the purchaser must enter the

exemption number of the exempt government organization.

Other information for vendors

Vendors

should verify the validity of the certificate presented to them by

checking the expiration date on the certificate. Vendors must not honor a

Certificate of Exemption that has eJCpired.

Government organization maintain

Form ST-2

Certificates of Exemption

that have

an

expiration

date

of "None. .

Vendors

should call the Bureau of Desk Audit at (617) 887-6970 if they

have any questions regarding a Certificate of Exemption which is pre-

sented to them.

If you have any questions about completing this certificate, please contact:

Massachu..tts

Department of Revenue

Bureau of Desk Audit

Exempt Organization Unit

200 Arlington Street

Chelsea, MA 02150

(617) 887-6970

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2