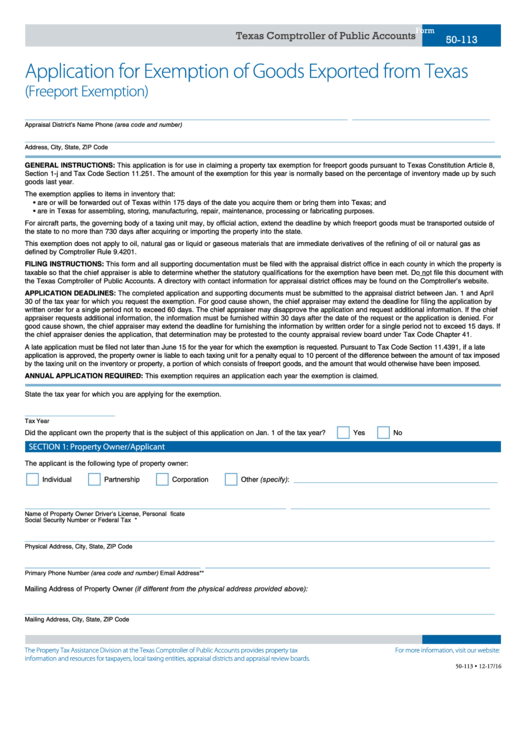

Form

Texas Comptroller of Public Accounts

50-113

Application for Exemption of Goods Exported from Texas

(Freeport Exemption)

____________________________________________________________________

_____________________________

Appraisal District’s Name

Phone (area code and number)

___________________________________________________________________________________________________

Address, City, State, ZIP Code

GENERAL INSTRUCTIONS: This application is for use in claiming a property tax exemption for freeport goods pursuant to Texas Constitution Article 8,

Section 1-j and Tax Code Section 11.251. The amount of the exemption for this year is normally based on the percentage of inventory made up by such

goods last year.

The exemption applies to items in inventory that:

•

are or will be forwarded out of Texas within 175 days of the date you acquire them or bring them into Texas; and

•

are in Texas for assembling, storing, manufacturing, repair, maintenance, processing or fabricating purposes.

For aircraft parts, the governing body of a taxing unit may, by official action, extend the deadline by which freeport goods must be transported outside of

the state to no more than 730 days after acquiring or importing the property into the state.

This exemption does not apply to oil, natural gas or liquid or gaseous materials that are immediate derivatives of the refining of oil or natural gas as

defined by Comptroller Rule 9.4201.

FILING INSTRUCTIONS: This form and all supporting documentation must be filed with the appraisal district office in each county in which the property is

taxable so that the chief appraiser is able to determine whether the statutory qualifications for the exemption have been met. Do not file this document with

the Texas Comptroller of Public Accounts. A directory with contact information for appraisal district offices may be found on the Comptroller’s website.

APPLICATION DEADLINES: The completed application and supporting documents must be submitted to the appraisal district between Jan. 1 and April

30 of the tax year for which you request the exemption. For good cause shown, the chief appraiser may extend the deadline for filing the application by

written order for a single period not to exceed 60 days. The chief appraiser may disapprove the application and request additional information. If the chief

appraiser requests additional information, the information must be furnished within 30 days after the date of the request or the application is denied. For

good cause shown, the chief appraiser may extend the deadline for furnishing the information by written order for a single period not to exceed 15 days. If

the chief appraiser denies the application, that determination may be protested to the county appraisal review board under Tax Code Chapter 41.

A late application must be filed not later than June 15 for the year for which the exemption is requested. Pursuant to Tax Code Section 11.4391, if a late

application is approved, the property owner is liable to each taxing unit for a penalty equal to 10 percent of the difference between the amount of tax imposed

by the taxing unit on the inventory or property, a portion of which consists of freeport goods, and the amount that would otherwise have been imposed.

ANNUAL APPLICATION REQUIRED: This exemption requires an application each year the exemption is claimed.

State the tax year for which you are applying for the exemption.

___________________

Tax Year

Did the applicant own the property that is the subject of this application on Jan. 1 of the tax year? . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

SECTION 1: Property Owner/Applicant

The applicant is the following type of property owner:

___________________________________________

Individual

Partnership

Corporation

Other (specify):

_______________________________________________________

__________________________________________

Name of Property Owner

Driver’s License, Personal I.D. Certificate

Social Security Number or Federal Tax I.D. Number*

___________________________________________________________________________________________________

Physical Address, City, State, ZIP Code

_____________________________________

____________________________________________________________

Primary Phone Number (area code and number)

Email Address**

Mailing Address of Property Owner (if different from the physical address provided above):

___________________________________________________________________________________________________

Mailing Address, City, State, ZIP Code

The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax

For more information, visit our website:

comptroller.texas.gov/taxes/property-tax

information and resources for taxpayers, local taxing entities, appraisal districts and appraisal review boards.

50-113 • 12-17/16

1

1 2

2 3

3