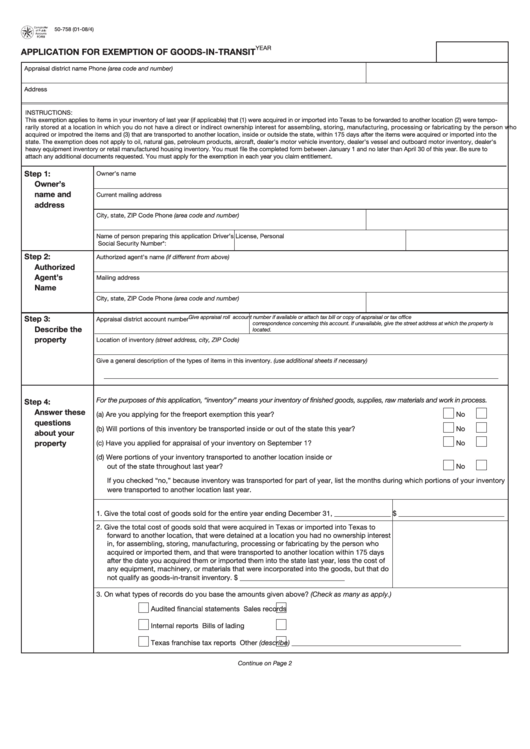

50-758 (01-08/4)

YEAR

APPLICATION FOR EXEMPTION OF GOODS-IN-TRANSIT

Appraisal district name

Phone (area code and number)

Address

INSTRUCTIONS:

This exemption applies to items in your inventory of last year (if applicable) that (1) were acquired in or imported into Texas to be forwarded to another location (2) were tempo-

rarily stored at a location in which you do not have a direct or indirect ownership interest for assembling, storing, manufacturing, processing or fabricating by the person who

acquired or impotred the items and (3) that are transported to another location, inside or outside the state, within 175 days after the items were acquired or imported into the

state. The exemption does not apply to oil, natural gas, petroleum products, aircraft, dealer’s motor vehicle inventory, dealer’s vessel and outboard motor inventory, dealer’s

heavy equipment inventory or retail manufactured housing inventory. You must file the completed form between January 1 and no later than April 30 of this year. Be sure to

attach any additional documents requested. You must apply for the exemption in each year you claim entitlement.

Step 1:

Owner’s name

Owner’s

name and

Current mailing address

address

City, state, ZIP Code

Phone (area code and number)

Name of person preparing this application

Driver’s License, Personal I.D. Certificate or

Title

Social Security Number*:

Step 2:

Authorized agent’s name (if different from above)

Authorized

Agent’s

Mailing address

Name

City, state, ZIP Code

Phone (area code and number)

Step 3:

Give appraisal roll account number if available or attach tax bill or copy of appraisal or tax office

Appraisal district account number

correspondence concerning this account. If unavailable, give the street address at which the property is

Describe the

located.

property

Location of inventory (street address, city, ZIP Code)

Give a general description of the types of items in this inventory. (use additional sheets if necessary)

For the purposes of this application, “inventory” means your inventory of finished goods, supplies, raw materials and work in process.

Step 4:

Answer these

(a) Are you applying for the freeport exemption this year? ............................................................................ Yes

No

questions

(b) Will portions of this inventory be transported inside or out of the state this year? ................................. Yes

No

about your

property

(c) Have you applied for appraisal of your inventory on September 1? ....................................................... Yes

No

(d) Were portions of your inventory transported to another location inside or

out of the state throughout last year? ...................................................................................................... Yes

No

If you checked “no,” because inventory was transported for part of year, list the months during which portions of your inventory

were transported to another location last year.

1. Give the total cost of goods sold for the entire year ending December 31, ________________ $ ______________________________

2. Give the total cost of goods sold that were acquired in Texas or imported into Texas to

forward to another location, that were detained at a location you had no ownership interest

in, for assembling, storing, manufacturing, processing or fabricating by the person who

acquired or imported them, and that were transported to another location within 175 days

after the date you acquired them or imported them into the state last year, less the cost of

any equipment, machinery, or materials that were incorporated into the goods, but that do

not qualify as goods-in-transit inventory.

$ ______________________________

3. On what types of records do you base the amounts given above? (Check as many as apply.)

Audited financial statements

Sales records

Internal reports

Bills of lading

Texas franchise tax reports

Other (describe) ________________________________________________

Continue on Page 2

1

1 2

2