Form It-201-V (2010) Payment Voucher For E-Filed Income Tax Returns - New York State

ADVERTISEMENT

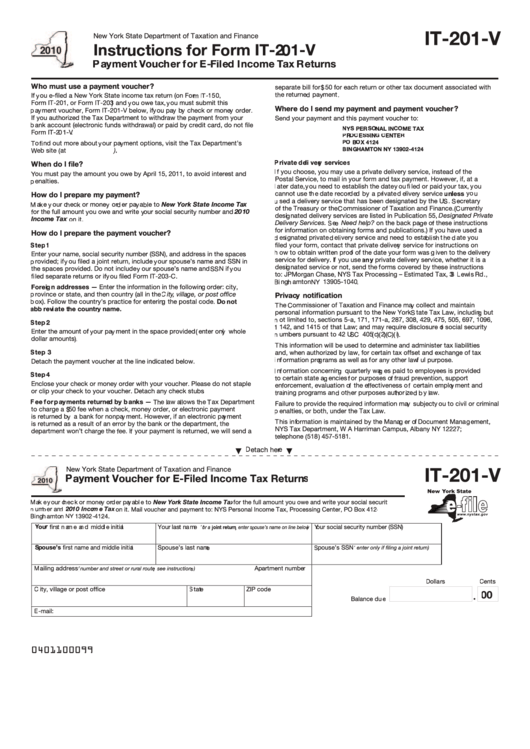

IT-201-V

New York State Department of Taxation and Finance

Instructions for Form IT-201-V

Payment Voucher for E-Filed Income Tax Returns

Who must use a payment voucher?

separate bill for $50 for each return or other tax document associated with

the returned payment.

If you e- led a New York State income tax return (on Form IT- T T 150,

Form IT-201, or Form IT-203) and you owe tax, you must submit this

Where do I send my payment and payment voucher?

payment voucher, Form IT-201-V below, if you pay by check or money order.

If you authorized the Tax Department to withdraw the payment from your

Send your payment and this payment voucher to:

bank account (electronic funds withdrawal) or paid by credit card, do not le

NYS PERSONAL INCOME TAX

Form IT-201-V.

PROCESSING CENTER

To nd out more about your payment options, visit the Tax Department’s

PO BOX 4124

BINGHAMTON NY 13902-4124

Web site (at )

Private delivery services

When do I file?

If you choose, you may use a private delivery service, instead of the U.S.

You must pay the amount you owe by April 15, 2011, to avoid interest and

Postal Service, to mail in your form and tax payment. However, if, at a

penalties.

later date, you need to establish the date you led or paid your tax, you

cannot use the date recorded by a private delivery service unless you

How do I prepare my payment?

used a delivery service that has been designated by the U.S. Secretary

Make your check or money order payable to New York State Income Tax

of the Treasury or the Commissioner of Taxation and Finance. (Currently

for the full amount you owe and write your social security number and 2010

designated delivery services are listed in Publication 55, Designated Private

Income Tax on it.

x

Delivery Services. See Need help? on the back page of these instructions

for information on obtaining forms and publications.) If you have used a

How do I prepare the payment voucher?

designated private delivery service and need to establish the date you

Step 1

led your form, contact that private delivery service for instructions on

how to obtain written proof of the date your form was given to the delivery

Enter your name, social security number (SSN), and address in the spaces

service for delivery. If you use any private delivery service, whether it is a

provided; if you led a joint return, include your spouse’s name and SSN in

designated service or not, send the forms covered by these instructions

the spaces provided. Do not include your spouse’s name and SSN if you

to: JPMorgan Chase, NYS Tax Processing – Estimated Tax, 33 Lewis Rd.,

led separate returns or if you led Form IT-203-C.

Binghamton NY 13905-1040.

Foreign addresses — Enter the information in the following order: city,

province or state, and then country (all in the City, village, or post office

Privacy notification

box). Follow the country’s practice for entering the postal code. Do not

The Commissioner of Taxation and Finance may collect and maintain

abbreviate the country name.

personal information pursuant to the New York State Tax Law, including but

not limited to, sections 5-a, 171, 171-a, 287, 308, 429, 475, 505, 697, 1096,

Step 2

1142, and 1415 of that Law; and may require disclosure of social security

Enter the amount of your payment in the space provided (enter only whole

numbers pursuant to 42 USC 405(c)(2)(C)(i).

dollar amounts).

This information will be used to determine and administer tax liabilities

Step 3

and, when authorized by law, for certain tax offset and exchange of tax

information programs as well as for any other lawful purpose.

Detach the payment voucher at the line indicated below.

Information concerning quarterly wages paid to employees is provided

Step 4

to certain state agencies for purposes of fraud prevention, support

Enclose your check or money order with your voucher. Please do not staple

enforcement, evaluation of the effectiveness of certain employment and

or clip your check to your voucher. Detach any check stubs.

training programs and other purposes authorized by law.

Fee for payments returned by banks — The law allows the Tax Department

Failure to provide the required information may subject you to civil or criminal

to charge a $50 fee when a check, money order, or electronic payment

penalties, or both, under the Tax Law.

is returned by a bank for nonpayment. However, if an electronic payment

This information is maintained by the Manager of Document Management,

is returned as a result of an error by the bank or the department, the

NYS Tax Department, W A Harriman Campus, Albany NY 12227;

department won’t charge the fee. If your payment is returned, we will send a

telephone (518) 457-5181.

Detach here

New York State Department of Taxation and Finance

IT-201-V

Payment Voucher for E-Filed Income Tax Returns

Make your check or money order payable to New York State Income Tax for the full amount you owe and write your social security

x

number and 2010 Income Tax on it. Mail voucher and payment to: NYS Personal Income Tax, Processing Center, PO Box 4124,

x

Binghamton NY 13902-4124.

Your rst name and middle initial

Your last name

Your social security number (SSN)

( for a joint return, enter spouse’s name on line below )

Spouse’s rst name and middle initial

Spouse’s last name

Spouse’s SSN

(enter only if filing a joint return)

Mailing address

Apartment number

( number and street or rural route; see instructions )

Dollars

Cents

City, village or post of ce

State

ZIP code

00

Balance due

E-mail:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1