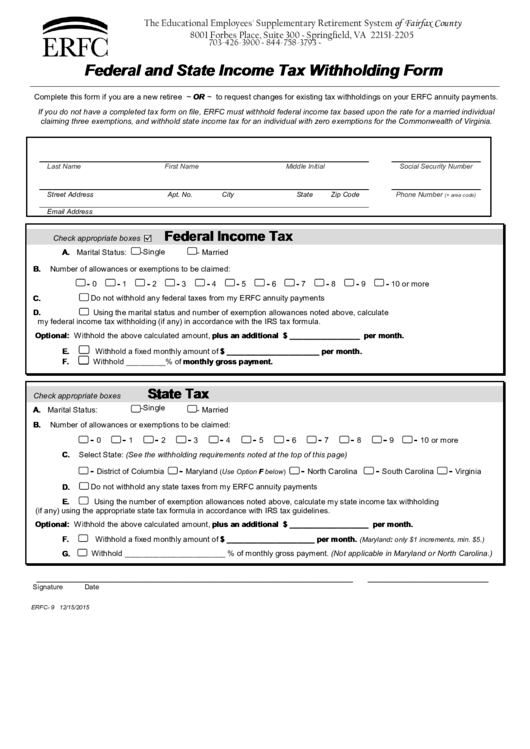

The Educational Employees' Supplementary Retirement System

of Fairfax County

8001 Forbes Place, Suite 300 ~ Springfield, VA 22151-2205

703-426-3900 ~ 844-758-3793 ~

Federal and State Income Tax Withholding Form

Complete this form if you are a new retiree ~ OR ~ to request changes for existing tax withholdings on your ERFC annuity payments.

If you do not have a completed tax form on file, ERFC must withhold federal income tax based upon the rate for a married individual

claiming three exemptions, and withhold state income tax for an individual with zero exemptions for the Commonwealth of Virginia.

Last Name

First Name

Middle Initial

Social Security Number

Street Address

Apt. No.

City

State

Zip Code

Phone Number

(+ area code)

Email Address

Federal Income Tax

Check appropriate boxes

A. Marital Status:

-Single

- Married

B.

Number of allowances or exemptions to be claimed:

- 0

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10 or more

C.

Do not withhold any federal taxes from my ERFC annuity payments

D.

Using the marital status and number of exemption allowances noted above, calculate

my federal income tax withholding (if any) in accordance with the IRS tax formula.

Optional: Withhold the above calculated amount, plus an additional $ ________________ per month.

E.

Withhold a fixed monthly amount of $ _____________________ per month.

F.

Withhold _________% of monthly gross payment.

State Tax

Check appropriate boxes

A. Marital Status:

-Single

- Married

B.

Number of allowances or exemptions to be claimed:

-

-

-

-

-

-

-

-

-

-

-

0

1

2

3

4

5

6

7

8

9

10 or more

C.

Select State:

(See the withholding requirements noted at the top of this page)

-

-

-

-

-

District of Columbia

Maryland

North Carolina

South Carolina

Virginia

(Use Option F below)

D.

Do not withhold any state taxes from my ERFC annuity payments

E.

Using the number of exemption allowances noted above, calculate my state income tax withholding

(if any) using the appropriate state tax formula in accordance with IRS tax guidelines.

Optional: Withhold the above calculated amount, plus an additional $ __________________ per month.

F.

Withhold a fixed monthly amount of $ ____________________ per month.

(Maryland: only $1 increments, min. $5.)

G.

Withhold _______________________ % of monthly gross payment. (Not applicable in Maryland or North Carolina.)

_______________________________________________________

_____________________

Signature

Date

ERFC- 9 12/15/2015

1

1