State Income Tax Withholding Election Notice For Qualified Pension And Annuity Payments

ADVERTISEMENT

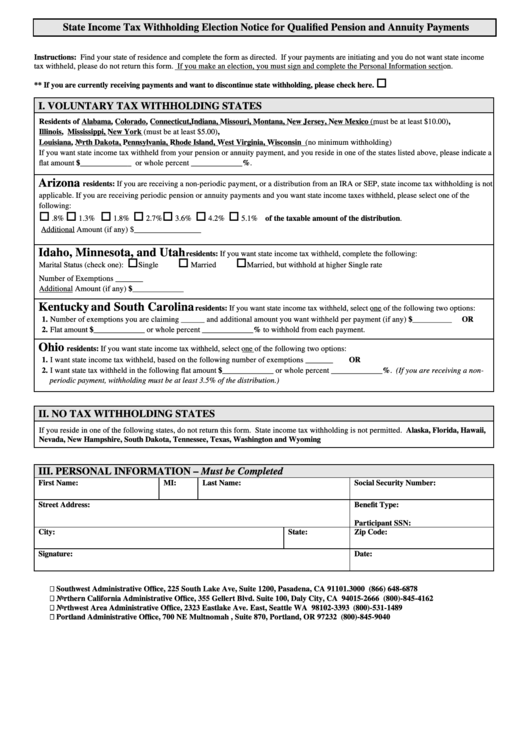

State Income Tax Withholding Election Notice for Qualified Pension and Annuity Payments

Instructions: Find your state of residence and complete the form as directed. If your payments are initiating and you do not want state income

tax withheld, please do not return this form. If you make an election, you must sign and complete the Personal Information section.

** If you are currently receiving payments and want to discontinue state withholding, please check here.

I. VOLUNTARY TAX WITHHOLDING STATES

Residents of Alabama, Colorado, Connecticut, Indiana, Missouri, Montana, New Jersey, New Mexico (must be at least $10.00),

Illinois, Mississippi, New York (must be at least $5.00),

Louisiana, North Dakota, Pennsylvania, Rhode Island, West Virginia, Wisconsin (no minimum withholding)

If you want state income tax withheld from your pension or annuity payment, and you reside in one of the states listed above, please indicate a

flat amount $_____________ or whole percent _____________%.

Arizona

residents: If you are receiving a non-periodic payment, or a distribution from an IRA or SEP, state income tax withholding is not

applicable. If you are receiving periodic pension or annuity payments and you want state income taxes withheld, please select one of the

following:

.8%

1.3%

1.8%

2.7%

3.6%

4.2%

5.1% of the taxable amount of the distribution.

Additional Amount (if any) $_________________

Idaho, Minnesota, and Utah

residents: If you want state income tax withheld, complete the following:

Marital Status (check one):

Single

Married

Married, but withhold at higher Single rate

Number of Exemptions _______

Additional Amount (if any) $_____________

Kentucky and South Carolina

residents: If you want state income tax withheld, select one of the following two options:

1. Number of exemptions you are claiming ______ and additional amount you want withheld per payment (if any) $ __________

OR

2. Flat amount $_____________ or whole percent _____________% to withhold from each payment.

Ohio

residents: If you want state income tax withheld, select one of the following two options:

1. I want state income tax withheld, based on the following number of exemptions _______

OR

2. I want state tax withheld in the following flat amount $_____________ or whole percent _____________%. (If you are receiving a non-

periodic payment, withholding must be at least 3.5% of the distribution.)

II. NO TAX WITHHOLDING STATES

If you reside in one of the following states, do not return this form. State income tax withholding is not permitted. Alaska, Florida, Hawaii,

Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming

III. PERSONAL INFORMATION – Must be Completed

First Name:

MI:

Last Name:

Social Security Number:

Street Address:

Benefit Type:

Participant SSN:

City:

State:

Zip Code:

Signature:

Date:

Southwest Administrative Office, 225 South Lake Ave, Suite 1200, Pasadena, CA 91101.3000 (866) 648-6878

Northern California Administrative Office, 355 Gellert Blvd. Suite 100, Daly City, CA 94015-2666 (800)-845-4162

Northwest Area Administrative Office, 2323 Eastlake Ave. East, Seattle WA 98102-3393 (800)-531-1489

Portland Administrative Office, 700 NE Multnomah , Suite 870, Portland, OR 97232 (800)-845-9040

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1