Annexure I - Declaration Form

ADVERTISEMENT

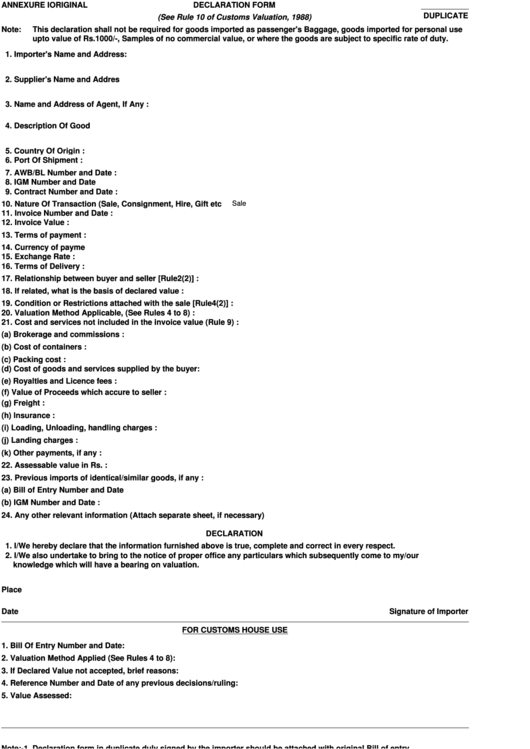

ANNEXURE I

DECLARATION FORM

ORIGINAL

DUPLICATE

(See Rule 10 of Customs Valuation, 1988)

Note:

This declaration shall not be required for goods imported as passenger's Baggage, goods imported for personal use

upto value of Rs.1000/-, Samples of no commercial value, or where the goods are subject to specific rate of duty.

1. Importer's Name and Address:

2. Supplier's Name and Addres

3. Name and Address of Agent, If Any :

4. Description Of Good

5. Country Of Origin :

6. Port Of Shipment :

7. AWB/BL Number and Date :

8. IGM Number and Date

9. Contract Number and Date :

10. Nature Of Transaction (Sale, Consignment, Hire, Gift etc

Sale

11. Invoice Number and Date :

12. Invoice Value :

13. Terms of payment :

14. Currency of payme

15. Exchange Rate :

16. Terms of Delivery :

17. Relationship between buyer and seller [Rule2(2)] :

18. If related, what is the basis of declared value :

19. Condition or Restrictions attached with the sale [Rule4(2)] :

20. Valuation Method Applicable, (See Rules 4 to 8) :

21. Cost and services not included in the invoice value (Rule 9) :

(a) Brokerage and commissions :

(b) Cost of containers :

(c) Packing cost :

(d) Cost of goods and services supplied by the buyer:

(e) Royalties and Licence fees :

(f) Value of Proceeds which accure to seller :

(g) Freight :

(h) Insurance :

(i) Loading, Unloading, handling charges :

(j) Landing charges :

(k) Other payments, if any :

22. Assessable value in Rs. :

23. Previous imports of identical/similar goods, if any :

(a) Bill of Entry Number and Date

(b) IGM Number and Date :

24. Any other relevant information (Attach separate sheet, if necessary)

DECLARATION

1. I/We hereby declare that the information furnished above is true, complete and correct in every respect.

2. I/We also undertake to bring to the notice of proper office any particulars which subsequently come to my/our

knowledge which will have a bearing on valuation.

Place

Date

Signature of Importer

FOR CUSTOMS HOUSE USE

1. Bill Of Entry Number and Date:

2. Valuation Method Applied (See Rules 4 to 8):

3. If Declared Value not accepted, brief reasons:

4. Reference Number and Date of any previous decisions/ruling:

5. Value Assessed:

A.O. Asistant Collector

Note:- 1. Declaration form in duplicate duly signed by the importer should be attached with original Bill of entry.

2

In case Order-in-Original (Speaking Order) is required, Importer/CHA are requested to apply within 30 days. No

request on this account will be considered after 30 days.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1