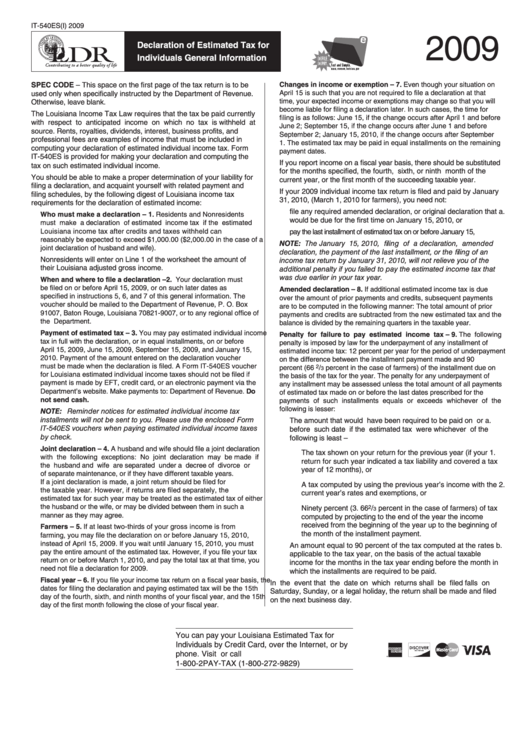

Form It-540es(I) - Declaration Of Estimated Tax For Individuals General Information - 2009

ADVERTISEMENT

IT-540ES(I) 2009

2009

Declaration of Estimated Tax for

Individuals General Information

SPEC CODE – This space on the first page of the tax return is to be

7.

Changes in income or exemption –

Even though your situation on

April 15 is such that you are not required to file a declaration at that

used only when specifically instructed by the Department of Revenue.

time, your expected income or exemptions may change so that you will

Otherwise, leave blank.

become liable for filing a declaration later. In such cases, the time for

The Louisiana Income Tax Law requires that the tax be paid currently

filing is as follows: June 15, if the change occurs after April 1 and before

with respect to anticipated income on which no tax is withheld at

June 2; September 15, if the change occurs after June 1 and before

source. Rents, royalties, dividends, interest, business profits, and

September 2; January 15, 2010, if the change occurs after September

professional fees are examples of income that must be included in

1. The estimated tax may be paid in equal installments on the remaining

computing your declaration of estimated individual income tax. Form

payment dates.

IT-540ES is provided for making your declaration and computing the

If you report income on a fiscal year basis, there should be substituted

tax on such estimated individual income.

for the months specified, the fourth, sixth, or ninth month of the

You should be able to make a proper determination of your liability for

current year, or the first month of the succeeding taxable year.

filing a declaration, and acquaint yourself with related payment and

If your 2009 individual income tax return is filed and paid by January

filing schedules, by the following digest of Louisiana income tax

31, 2010, (March 1, 2010 for farmers), you need not:

requirements for the declaration of estimated income:

a.

file any required amended declaration, or original declaration that

1.

Who must make a declaration –

Residents and Nonresidents

would be due for the first time on January 15, 2010, or

must make a declaration of estimated income tax if the estimated

Louisiana income tax after credits and taxes withheld can

b.

pay the last installment of estimated tax on or before January 15, 2010.

reasonably be expected to exceed $1,000.00 ($2,000.00 in the case of a

NOTE: The January 15, 2010, filing of a declaration, amended

joint declaration of husband and wife).

declaration, the payment of the last installment, or the filing of an

Nonresidents will enter on Line 1 of the worksheet the amount of

income tax return by January 31, 2010, will not relieve you of the

their Louisiana adjusted gross income.

additional penalty if you failed to pay the estimated income tax that

was due earlier in your tax year.

2.

When and where to file a declaration –

Your declaration must

be filed on or before April 15, 2009, or on such later dates as

8.

Amended declaration –

If additional estimated income tax is due

specified in instructions 5, 6, and 7 of this general information. The

over the amount of prior payments and credits, subsequent payments

voucher should be mailed to the Department of Revenue, P. O. Box

are to be computed in the following manner: The total amount of prior

91007, Baton Rouge, Louisiana 70821-9007, or to any regional office of

payments and credits are subtracted from the new estimated tax and the

the Department.

balance is divided by the remaining quarters in the taxable year.

3.

Payment of estimated tax –

You may pay estimated individual income

9.

Penalty for failure to pay estimated income tax –

The following

tax in full with the declaration, or in equal installments, on or before

penalty is imposed by law for the underpayment of any installment of

April 15, 2009, June 15, 2009, September 15, 2009, and January 15,

estimated income tax: 12 percent per year for the period of underpayment

2010. Payment of the amount entered on the declaration voucher

on the difference between the installment payment made and 90

must be made when the declaration is filed. A Form IT-540ES voucher

2

percent (66

/

percent in the case of farmers) of the installment due on

3

for Louisiana estimated individual income taxes should not be filed if

the basis of the tax for the year. The penalty for any underpayment of

payment is made by EFT, credit card, or an electronic payment via the

any installment may be assessed unless the total amount of all payments

Department’s website. Make payments to: Department of Revenue. Do

of estimated tax made on or before the last dates prescribed for the

not send cash.

payments of such installments equals or exceeds whichever of the

following is lesser:

NOTE: Reminder notices for estimated individual income tax

installments will not be sent to you. Please use the enclosed Form

a.

The amount that would have been required to be paid on or

IT-540ES vouchers when paying estimated individual income taxes

before such date if the estimated tax were whichever of the

by check.

following is least –

4.

Joint declaration –

A husband and wife should file a joint declaration

1.

The tax shown on your return for the previous year (if your

with the following exceptions: No joint declaration may be made if

return for such year indicated a tax liability and covered a tax

the husband and wife are separated under a decree of divorce or

year of 12 months), or

of separate maintenance, or if they have different taxable years.

If a joint declaration is made, a joint return should be filed for

2.

A tax computed by using the previous year’s income with the

the taxable year. However, if returns are filed separately, the

current year’s rates and exemptions, or

estimated tax for such year may be treated as the estimated tax of either

the husband or the wife, or may be divided between them in such a

3.

Ninety percent (

66

2

/

percent in the case of farmers) of tax

3

manner as they may agree.

computed by projecting to the end of the year the income

received from the beginning of the year up to the beginning of

5.

Farmers –

If at least two-thirds of your gross income is from

the month of the installment payment.

farming, you may file the declaration on or before January 15, 2010,

instead of April 15, 2009. If you wait until January 15, 2010, you must

b.

An amount equal to 90 percent of the tax computed at the rates

pay the entire amount of the estimated tax. However, if you file your tax

applicable to the tax year, on the basis of the actual taxable

return on or before March 1, 2010, and pay the total tax at that time, you

income for the months in the tax year ending before the month in

need not file a declaration for 2009.

which the installments are required to be paid.

6.

Fiscal year –

If you file your income tax return on a fiscal year basis, the

In the event that the date on which returns shall be filed falls on

dates for filing the declaration and paying estimated tax will be the 15th

Saturday, Sunday, or a legal holiday, the return shall be made and filed

day of the fourth, sixth, and ninth months of your fiscal year, and the 15th

on the next business day.

day of the first month following the close of your fiscal year.

You can pay your Louisiana Estimated Tax for

Individuals by Credit Card, over the Internet, or by

phone. Visit or call

1-800-2PAY-TAX (1-800-272-9829)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2