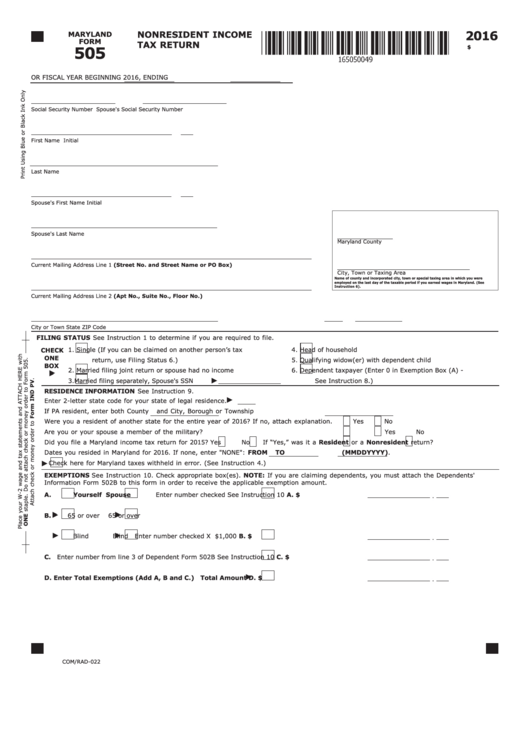

2016

NONRESIDENT INCOME

MARYLAND

FORM

TAX RETURN

505

$

OR FISCAL YEAR BEGINNING

2016, ENDING

Social Security Number

Spouse's Social Security Number

First Name

Initial

Last Name

Spouse's First Name

Initial

Spouse's Last Name

Maryland County

Current Mailing Address Line 1 (Street No. and Street Name or PO Box)

City, Town or Taxing Area

Name of county and incorporated city, town or special taxing area in which you were

employed on the last day of the taxable period if you earned wages in Maryland. (See

Instruction 6).

Current Mailing Address Line 2 (Apt No., Suite No., Floor No.)

City or Town

State

ZIP Code

FIlINg STATuS See Instruction 1 to determine if you are required to file.

1.

Single (If you can be claimed on another person’s tax

4.

Head of household

CHECK

ONE

return, use Filing Status 6.)

5.

Qualifying widow(er) with dependent child

BOX

2.

Married filing joint return or spouse had no income

6.

Dependent taxpayer (Enter 0 in Exemption Box (A) -

3.

Married filing separately, Spouse's SSN

See Instruction 8.)

RESIDENCE INFORMATION See Instruction 9.

Enter 2-letter state code for your state of legal residence.

If PA resident, enter both County

and City, Borough or Township

Were you a resident of another state for the entire year of 2016? If no, attach explanation.

Yes

No

Are you or your spouse a member of the military?

Yes

No

Did you file a Maryland income tax return for 2015?

Yes

No

If “Yes,” was it a

Resident or a

Nonresident return?

Dates you resided in Maryland for 2016. If none, enter "NONE": FROM

TO

(MMDDYYYY).

Check here for Maryland taxes withheld in error. (See Instruction 4.)

EXEMPTIONS See Instruction 10. Check appropriate box(es). NOTE: If you are claiming dependents, you must attach the Dependents'

Information Form 502B to this form in order to receive the applicable exemption amount.

A.

Yourself

Spouse

See Instruction 10 A. $

Enter number checked

B.

65 or over

65 or over

Blind

Blind

Enter number checked

X $1,000

B. $

C.

Enter number from line 3 of Dependent Form 502B

See Instruction 10 C. $

D. Enter Total Exemptions (Add A, B and C.)

Total Amount

D. $

COM/RAD-022

1

1 2

2 3

3