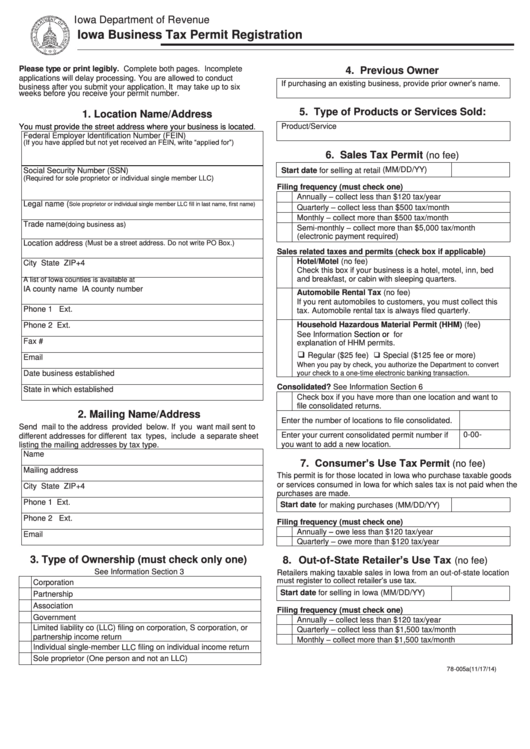

Iowa Business Tax Permit Registration

ADVERTISEMENT

Iowa Department of Revenue

Iowa Business Tax Permit Registration

Please type or print legibly. Complete both pages. Incomplete

4. Previous Owner

applications will delay processing. You are allowed to conduct

If purchasing an existing business, provide prior owner’s name.

business after you submit your application. It may take up to six

weeks before you receive your permit number.

5. Type of Products or Services Sold:

1. Location Name/Address

Product/Service

You must provide the street address where your business is located.

Federal Employer Identification Number (FEIN)

(If you have applied but not yet received an FEIN, write “applied for”)

6. Sales Tax Permit

(no fee)

Start date for selling at retail (MM/DD/YY)

Social Security Number (SSN)

(Required for sole proprietor or individual single member LLC)

Filing frequency (must check one)

Annually – collect less than $120 tax/year

Legal name (

Quarterly – collect less than $500 tax/month

Sole proprietor or individual single member LLC fill in last name, first name)

Monthly – collect more than $500 tax/month

Trade name

(doing business as)

Semi-monthly – collect more than $5,000 tax/month

(electronic payment required)

Location address

( Must be a street address. Do not write PO Box.)

Sales related taxes and permits (check box if applicable)

Hotel/Motel (no fee)

City

State

ZIP+4

Check this box if your business is a hotel, motel, inn, bed

and breakfast, or cabin with sleeping quarters.

A list of Iowa counties is available at

IA county name

IA county number

Automobile Rental Tax (no fee)

If you rent automobiles to customers, you must collect this

Phone 1

Ext.

tax. Automobile rental tax is always filed quarterly.

)

Phone 2

Ext.

Household Hazardous Material Permit (HHM) (fee

See Information

Section or

for

Fax #

explanation of HHM permits.

❑

Regular ($25 fee) ❑ Special ($125 fee or more)

Email

When you pay by check, you authorize the Department to convert

.

Date business established

your check to a one-time electronic banking transaction

Consolidated? See Information Section 6

State in which established

Check box if you have more than one location and want to

file consolidated returns.

2. Mailing Name/Address

Enter the number of locations to file consolidated.

Send mail to the address provided below. If you want mail sent to

0-00-

Enter your current consolidated permit number if

different addresses for different tax types, include a separate sheet

you want to add a new location.

listing the mailing addresses by tax type.

Name

7. Consumer’s Use Tax

Permit (no fee)

Mailing address

This permit is for those located in Iowa who purchase taxable goods

or services consumed in Iowa for which sales tax is not paid when the

City

State

ZIP+4

purchases are made.

Phone 1

Ext.

Start date for making purchases (MM/DD/YY)

Phone 2

Ext.

Filing frequency (must check one)

Annually – owe less than $120 tax/year

Email

Quarterly – owe more than $120 tax/year

8. Out-of-State Retailer’s Use Tax

3. Type of Ownership (must check only one)

(no fee)

See Information Section 3

Retailers making taxable sales in Iowa from an out-of-state location

must register to collect retailer’s use tax.

Corporation

Start date for selling in Iowa (MM/DD/YY)

Partnership

Association

Filing frequency (must check one)

Government

Annually – collect less than $120 tax/year

Limited liability co (LLC) filing on corporation, S corporation, or

Quarterly – collect less than $1,500 tax/month

partnership income return

Monthly – collect more than $1,500 tax/month

Individual single-member LLC filing on individual income return

Sole proprietor (One person and not an LLC)

78-005a(11/17/14)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2