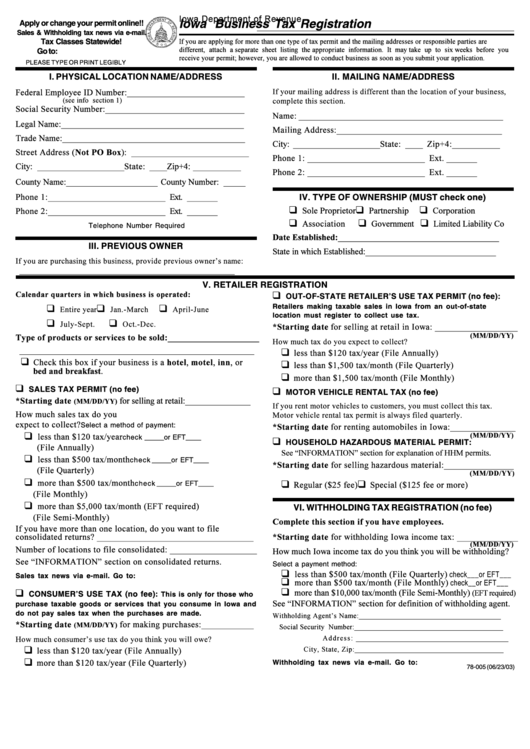

Iowa Business Tax Registration

ADVERTISEMENT

Iowa Department of Revenue

Iowa Business Tax Registration

Apply or change your permit online!!

Sales & Withholding tax news via e-mail.

Tax Classes Statewide!

If you are applying for more than one type of tax permit and the mailing addresses or responsible parties are

different, attach a separate sheet listing the appropriate information. It may take up to six weeks before you

Go to:

receive your permit; however, you are allowed to conduct business as soon as you submit your application.

PLEASE TYPE OR PRINT LEGIBLY

I. PHYSICAL LOCATION NAME/ADDRESS

II. MAILING NAME/ADDRESS

If your mailing address is different than the location of your business,

(see info section 1)

complete this section.

Not PO Box

IV. TYPE OF OWNERSHIP (MUST check one)

q

q

q

q

q

q

Telephone Number Required

Date Established: _____________________________________

III. PREVIOUS OWNER

If you are purchasing this business, provide previous owner’s name:

________________________________________________________

V. RETAILER REGISTRATION

q

Calendar quarters in which business is operated:

OUT-OF-STATE RETAILER’S USE TAX PERMIT (no fee):

q

q

q

Retailers making taxable sales in Iowa from an out-of-state

Entire year

Jan.-March

April-June

location must register to collect use tax.

q

q

July-Sept.

Oct.-Dec.

*Starting date

(MM/DD/YY)

Type of products or services to be sold: _____________________

How much tax do you expect to collect?

q

q

hotel motel inn

q

bed and breakfast

q

q

SALES TAX PERMIT (no fee)

q

MOTOR VEHICLE RENTAL TAX (no fee)

*Starting date

(MM/DD/YY)

If you rent motor vehicles to customers, you must collect this tax.

Motor vehicle rental tax permit is always filed quarterly.

Select a method of payment:

*Starting date

q

(MM/DD/YY)

check _____ or EFT ____

q

HOUSEHOLD HAZARDOUS MATERIAL PERMIT:

q

check _____ or EFT ____

*Starting date

(MM/DD/YY)

q

q

q

check _____ or EFT ____

q

VI. WITHHOLDING TAX REGISTRATION (no fee)

Complete this section if you have employees.

*Starting date

(MM/DD/YY)

Select a payment method:

q

check ___ or EFT ___

Sales tax news via e-mail. Go to:

q

check __ or EFT ___

q

q

(EFT required)

CONSUMER’S USE TAX (no fee):

This is only for those who

purchase taxable goods or services that you consume in Iowa and

do not pay sales tax when the purchases are made.

Withholding Agent’s Name: _________________________________________

*Starting date

(MM/DD/YY)

Social Security Number: ___________________________________________

A d d r e s s : ____________________________________________

How much consumer’s use tax do you think you will owe?

q

City, State, Zip: ___________________________________________

q

Withholding tax news via e-mail. Go to:

78-005 (06/23/03)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2