Save

Print

Clear

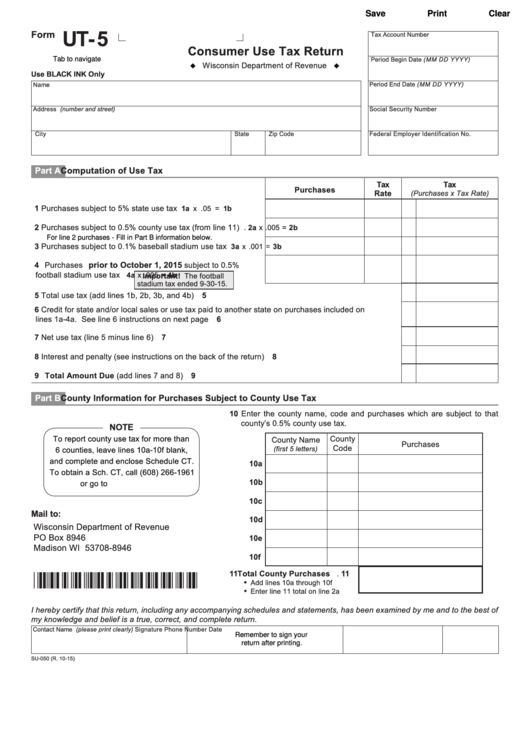

UT-5

Form

Tax Account Number

Consumer Use Tax Return

Period Begin Date (MM DD YYYY)

Tab to navigate

Wisconsin Department of Revenue

Use BLACK INK Only

Period End Date (MM DD YYYY)

Name

Address (number and street)

Social Security Number

City

State

Zip Code

Federal Employer Identification No .

Part A

Computation of Use Tax

Tax

Tax

Purchases

Rate

(Purchases x Tax Rate)

1 Purchases subject to 5% state use tax . . . . . . . . . . . . . . .

1a

x .05 = 1b

2 Purchases subject to 0 .5% county use tax (from line 11) .

2a

x .005 = 2b

For line 2 purchases - Fill in Part B information below.

3 Purchases subject to 0 . 1 % baseball stadium use tax . . . .

3a

x .001 = 3b

prior to October 1, 2015 subject to 0 .5%

4 Purchases

football stadium use tax

4a

x .005 = 4b

Important! The football

stadium tax ended 9-30-15 .

5 Total use tax (add lines 1b, 2b, 3b, and 4b) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Credit for state and/or local sales or use tax paid to another state on purchases included on

lines 1a-4a . See line 6 instructions on next page . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7 Net use tax (line 5 minus line 6) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 Interest and penalty (see instructions on the back of the return) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9 Total Amount Due (add lines 7 and 8) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

Part B

County Information for Purchases Subject to County Use Tax

10 Enter the county name, code and purchases which are subject to that

county’s 0 .5% county use tax .

NOTE

To report county use tax for more than

County

County Name

Purchases

Code

(first 5 letters)

6 counties, leave lines 10a-10f blank,

and complete and enclose Schedule CT .

10a

To obtain a Sch . CT, call (608) 266-1961

10b

or go to

revenue .wi .gov

10c

Mail to:

10d

Wisconsin Department of Revenue

PO Box 8946

10e

Madison WI 53708-8946

10f

11 Total County Purchases . 11

•

Add lines 10a through 10f

•

Enter line 11 total on line 2a

I hereby certify that this return, including any accompanying schedules and statements, has been examined by me and to the best of

my knowledge and belief is a true, correct, and complete return.

Contact Name (please print clearly)

Signature

Phone Number

Date

Remember to sign your

return after printing.

SU-050 (R . 10-15)

1

1