Form D-4a Certificate Of Nonresidence In The District Of Columbia

ADVERTISEMENT

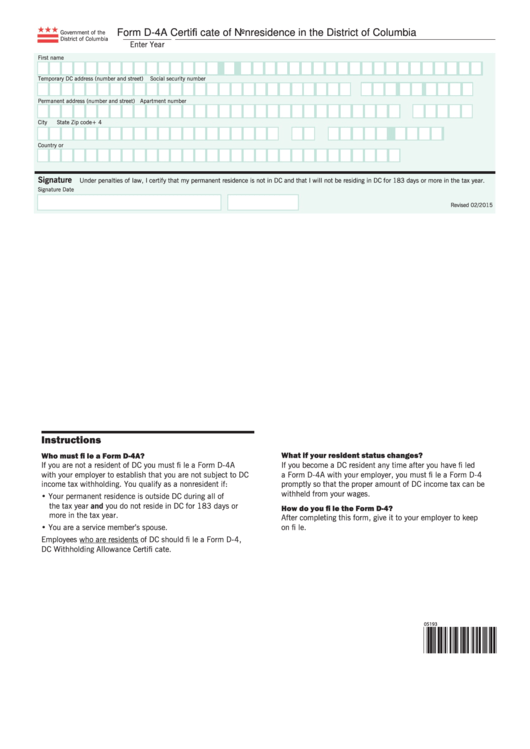

Form D-4A Certi cate of Nonresidence in the District of Columbia

Government of the

District of Columbia

Enter Year

First name

M.I. Last name

Temporary DC address (number and street)

Social security number

Permanent address (number and street)

Apartment number

City

State

Zip code + 4

Country or U.S. commonwealth

Signature

Under penalties of law, I certify that my permanent residence is not in DC and that I will not be residing in DC for 183 days or more in the tax year.

Signature

Date

Revised 02/2015

Instructions

Who must le a Form D-4A?

What if your resident status changes?

If you are not a resident of DC you must fi le a Form D-4A

If you become a DC resident any time after you have fi led

with your employer to establish that you are not subject to DC

a Form D-4A with your employer, you must fi le a Form D-4

income tax withholding. You qualify as a nonresident if:

promptly so that the proper amount of DC income tax can be

withheld from your wages.

• Your permanent residence is outside DC during all of

the tax year and you do not reside in DC for 183 days or

How do you le the Form D-4?

more in the tax year.

After completing this form, give it to your employer to keep

• You are a service member’s spouse.

on fi le.

Employees who are residents of DC should fi le a Form D-4,

DC Withholding Allowance Certifi cate.

05193

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1