Verification Worksheet - 2017-2018

ADVERTISEMENT

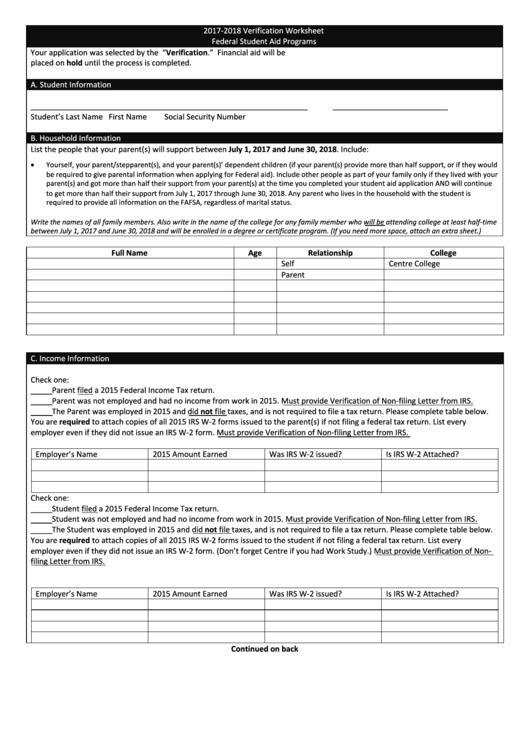

2017-2018 Verification Worksheet

Federal Student Aid Programs

Your application was selected by the U.S. Department of Education for review in a process called “Verification.” Financial aid will be

placed on hold until the process is completed.

A. Student Information

_________________________________________________________________

___________________________

Student’s Last Name

First Name

M.I.

Social Security Number

B. Household Information

List the people that your parent(s) will support between July 1, 2017 and June 30, 2018. Include:

Yourself, your parent/stepparent(s), and your parent(s)’ dependent children (if your parent(s) provide more than half support, or if they would

be required to give parental information when applying for Federal aid). Include other people as part of your family only if they lived with your

parent(s) and got more than half their support from your parent(s) at the time you completed your student aid application AND will continue

to get more than half their support from July 1, 2017 through June 30, 2018. Any parent who lives in the household with the student is

required to provide all information on the FAFSA, regardless of marital status.

Write the names of all family members. Also write in the name of the college for any family member who will be attending college at least half-time

between July 1, 2017 and June 30, 2018 and will be enrolled in a degree or certificate program. (If you need more space, attach an extra sheet.)

Full Name

Age

Relationship

College

Self

Centre College

Parent

C. Income Information

Check one:

_____Parent filed a 2015 Federal Income Tax return.

_____Parent was not employed and had no income from work in 2015. Must provide Verification of Non-filing Letter from IRS.

_____The Parent was employed in 2015 and did not file taxes, and is not required to file a tax return. Please complete table below.

You are required to attach copies of all 2015 IRS W-2 forms issued to the parent(s) if not filing a federal tax return. List every

employer even if they did not issue an IRS W-2 form. Must provide Verification of Non-filing Letter from IRS.

Employer’s Name

2015 Amount Earned

Was IRS W-2 issued?

Is IRS W-2 Attached?

Check one:

_____Student filed a 2015 Federal Income Tax return.

_____Student was not employed and had no income from work in 2015. Must provide Verification of Non-filing Letter from IRS.

_____The Student was employed in 2015 and did not file taxes, and is not required to file a tax return. Please complete table below.

You are required to attach copies of all 2015 IRS W-2 forms issued to the student if not filing a federal tax return. List every

employer even if they did not issue an IRS W-2 form. (Don’t forget Centre if you had Work Study.) Must provide Verification of Non-

filing Letter from IRS.

Employer’s Name

2015 Amount Earned

Was IRS W-2 issued?

Is IRS W-2 Attached?

Continued on back

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2