Customs Power Of Attorney Form

Download a blank fillable Customs Power Of Attorney Form in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Customs Power Of Attorney Form with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

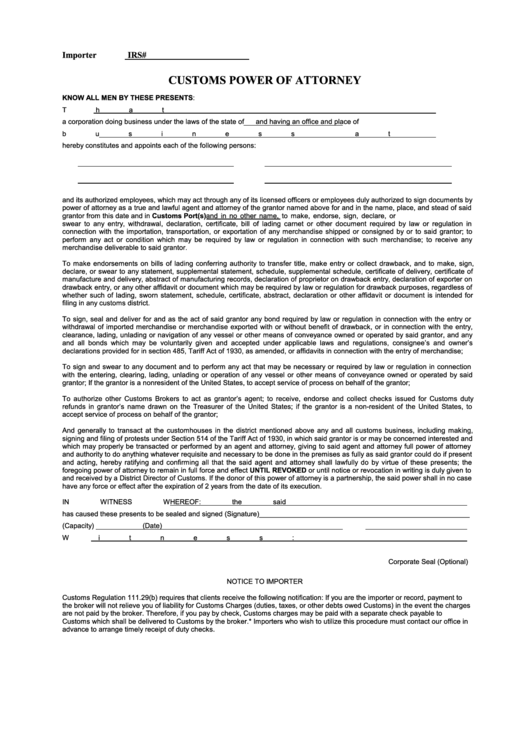

Importer IRS#

CUSTOMS POWER OF ATTORNEY

KNOW ALL MEN BY THESE PRESENTS:

That

,

a corporation doing business under the laws of the state of

and having an office and place of

business at

hereby constitutes and appoints each of the following persons:

and its authorized employees, which may act through any of its licensed officers or employees duly authorized to sign documents by

power of attorney as a true and lawful agent and attorney of the grantor named above for and in the name, place, and stead of said

grantor from this date and in Customs Port(s)

and in no other name, to make, endorse, sign, declare, or

swear to any entry, withdrawal, declaration, certificate, bill of lading carnet or other document required by law or regulation in

connection with the importation, transportation, or exportation of any merchandise shipped or consigned by or to said grantor; to

perform any act or condition which may be required by law or regulation in connection with such merchandise; to receive any

merchandise deliverable to said grantor.

To make endorsements on bills of lading conferring authority to transfer title, make entry or collect drawback, and to make, sign,

declare, or swear to any statement, supplemental statement, schedule, supplemental schedule, certificate of delivery, certificate of

manufacture and delivery, abstract of manufacturing records, declaration of proprietor on drawback entry, declaration of exporter on

drawback entry, or any other affidavit or document which may be required by law or regulation for drawback purposes, regardless of

whether such of lading, sworn statement, schedule, certificate, abstract, declaration or other affidavit or document is intended for

filing in any customs district.

To sign, seal and deliver for and as the act of said grantor any bond required by law or regulation in connection with the entry or

withdrawal of imported merchandise or merchandise exported with or without benefit of drawback, or in connection with the entry,

clearance, lading, unlading or navigation of any vessel or other means of conveyance owned or operated by said grantor, and any

and all bonds which may be voluntarily given and accepted under applicable laws and regulations, consignee’s and owner’s

declarations provided for in section 485, Tariff Act of 1930, as amended, or affidavits in connection with the entry of merchandise;

To sign and swear to any document and to perform any act that may be necessary or required by law or regulation in connection

with the entering, clearing, lading, unlading or operation of any vessel or other means of conveyance owned or operated by said

grantor; If the grantor is a nonresident of the United States, to accept service of process on behalf of the grantor;

To authorize other Customs Brokers to act as grantor’s agent; to receive, endorse and collect checks issued for Customs duty

refunds in grantor’s name drawn on the Treasurer of the United States; if the grantor is a non-resident of the United States, to

accept service of process on behalf of the grantor;

And generally to transact at the customhouses in the district mentioned above any and all customs business, including making,

signing and filing of protests under Section 514 of the Tariff Act of 1930, in which said grantor is or may be concerned interested and

which may properly be transacted or performed by an agent and attorney, giving to said agent and attorney full power of attorney

and authority to do anything whatever requisite and necessary to be done in the premises as fully as said grantor could do if present

and acting, hereby ratifying and confirming all that the said agent and attorney shall lawfully do by virtue of these presents; the

foregoing power of attorney to remain in full force and effect UNTIL REVOKED or until notice or revocation in writing is duly given to

and received by a District Director of Customs. If the donor of this power of attorney is a partnership, the said power shall in no case

have any force or effect after the expiration of 2 years from the date of its execution.

IN WITNESS WHEREOF: the said

has caused these presents to be sealed and signed (Signature)______________________________________________________

(Capacity)

(Date)

Witness:

Corporate Seal (Optional)

NOTICE TO IMPORTER

Customs Regulation 111.29(b) requires that clients receive the following notification: If you are the importer or record, payment to

the broker will not relieve you of liability for Customs Charges (duties, taxes, or other debts owed Customs) in the event the charges

are not paid by the broker. Therefore, if you pay by check, Customs charges may be paid with a separate check payable to U.S.

Customs which shall be delivered to Customs by the broker.* Importers who wish to utilize this procedure must contact our office in

advance to arrange timely receipt of duty checks.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1