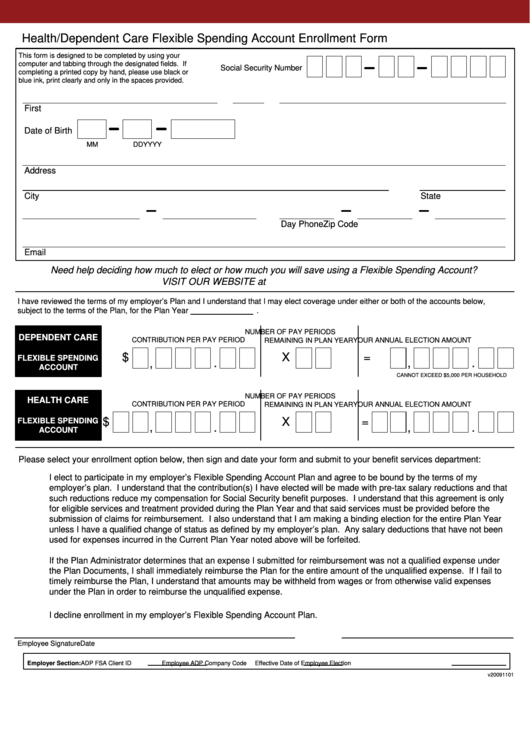

Health/Dependent Care Flexible Spending Account Enrollment Form

This form is designed to be completed by using your

computer and tabbing through the designated fields. If

Social Security Number

completing a printed copy by hand, please use black or

blue ink, print clearly and only in the spaces provided.

First Name

M.I.

Last Name

Date of Birth

MM

DD

YYYY

Address

City

State

Zip Code

Day Phone

Email

Need help deciding how much to elect or how much you will save using a Flexible Spending Account?

VISIT OUR WEBSITE at

I have reviewed the terms of my employer’s Plan and I understand that I may elect coverage under either or both of the accounts below,

subject to the terms of the Plan, for the Plan Year

.

NUMBER OF PAY PERIODS

DEPENDENT CARE

CONTRIBUTION PER PAY PERIOD

YOUR ANNUAL ELECTION AMOUNT

REMAINING IN PLAN YEAR

$

X

=

FLEXIBLE SPENDING

,

.

,

.

ACCOUNT

CANNOT EXCEED $5,000 PER HOUSEHOLD

NUMBER OF PAY PERIODS

HEALTH CARE

CONTRIBUTION PER PAY PERIOD

REMAINING IN PLAN YEAR

YOUR ANNUAL ELECTION AMOUNT

$

X

=

FLEXIBLE SPENDING

,

.

,

.

ACCOUNT

Please select your enrollment option below, then sign and date your form and submit to your benefit services department:

I elect to participate in my employer’s Flexible Spending Account Plan and agree to be bound by the terms of my

employer’s plan. I understand that the contribution(s) I have elected will be made with pre-tax salary reductions and that

such reductions reduce my compensation for Social Security benefit purposes. I understand that this agreement is only

for eligible services and treatment provided during the Plan Year and that said services must be provided before the

submission of claims for reimbursement. I also understand that I am making a binding election for the entire Plan Year

unless I have a qualified change of status as defined by my employer’s plan. Any salary deductions that have not been

used for expenses incurred in the Current Plan Year noted above will be forfeited.

If the Plan Administrator determines that an expense I submitted for reimbursement was not a qualified expense under

the Plan Documents, I shall immediately reimburse the Plan for the entire amount of the unqualified expense. If I fail to

timely reimburse the Plan, I understand that amounts may be withheld from wages or from otherwise valid expenses

under the Plan in order to reimburse the unqualified expense.

I decline enrollment in my employer’s Flexible Spending Account Plan.

Employee Signature

Date

Employer Section:

ADP FSA Client ID

Employee ADP Company Code

Effective Date of Employee Election

v20091101

1

1