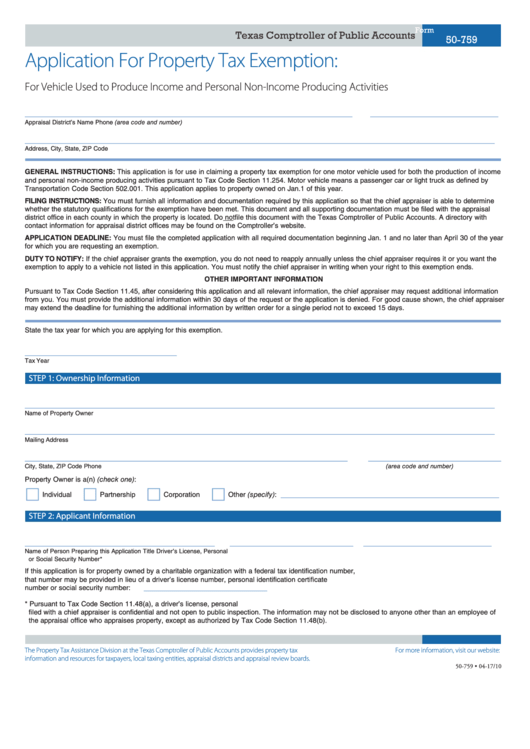

Form

Texas Comptroller of Public Accounts

50-759

Application For Property Tax Exemption:

For Vehicle Used to Produce Income and Personal Non-Income Producing Activities

_____________________________________________________________________

___________________________

Appraisal District’s Name

Phone (area code and number)

___________________________________________________________________________________________________

Address, City, State, ZIP Code

GENERAL INSTRUCTIONS: This application is for use in claiming a property tax exemption for one motor vehicle used for both the production of income

and personal non-income producing activities pursuant to Tax Code Section 11.254. Motor vehicle means a passenger car or light truck as defined by

Transportation Code Section 502.001. This application applies to property owned on Jan.1 of this year.

FILING INSTRUCTIONS: You must furnish all information and documentation required by this application so that the chief appraiser is able to determine

whether the statutory qualifications for the exemption have been met. This document and all supporting documentation must be filed with the appraisal

district office in each county in which the property is located. Do not file this document with the Texas Comptroller of Public Accounts. A directory with

contact information for appraisal district offices may be found on the Comptroller’s website.

APPLICATION DEADLINE: You must file the completed application with all required documentation beginning Jan. 1 and no later than April 30 of the year

for which you are requesting an exemption.

DUTY TO NOTIFY: If the chief appraiser grants the exemption, you do not need to reapply annually unless the chief appraiser requires it or you want the

exemption to apply to a vehicle not listed in this application. You must notify the chief appraiser in writing when your right to this exemption ends.

OTHER IMPORTANT INFORMATION

Pursuant to Tax Code Section 11.45, after considering this application and all relevant information, the chief appraiser may request additional information

from you. You must provide the additional information within 30 days of the request or the application is denied. For good cause shown, the chief appraiser

may extend the deadline for furnishing the additional information by written order for a single period not to exceed 15 days.

State the tax year for which you are applying for this exemption.

________________________________

Tax Year

STEP 1: Ownership Information

___________________________________________________________________________________________________

Name of Property Owner

___________________________________________________________________________________________________

Mailing Address

____________________________________________________________________

____________________________

City, State, ZIP Code

Phone

(area code and number)

Property Owner is a(n) (check one):

______________________________________________

Individual

Partnership

Corporation

Other (specify):

STEP 2: Applicant Information

________________________________________

__________________________

___________________________

Name of Person Preparing this Application

Title

Driver’s License, Personal I.D. Certificate

or Social Security Number*

If this application is for property owned by a charitable organization with a federal tax identification number,

that number may be provided in lieu of a driver’s license number, personal identification certificate

__________________________

number or social security number: . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

* Pursuant to Tax Code Section 11.48(a), a driver’s license, personal I.D. certificate or social security number provided in an application for an exemption

filed with a chief appraiser is confidential and not open to public inspection. The information may not be disclosed to anyone other than an employee of

the appraisal office who appraises property, except as authorized by Tax Code Section 11.48(b).

The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax

For more information, visit our website:

comptroller.texas.gov/taxes/property-tax

information and resources for taxpayers, local taxing entities, appraisal districts and appraisal review boards.

50-759 • 04-17/10

1

1 2

2