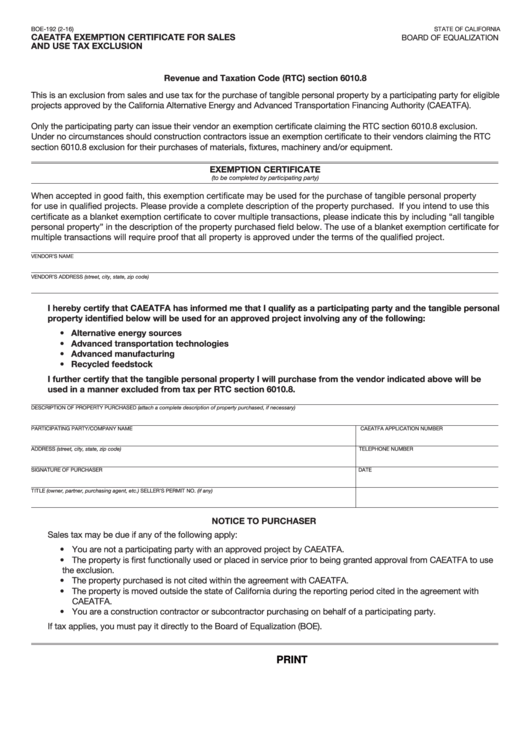

BOE-192 (2-16)

STATE OF CALIFORNIA

CAEATFA EXEMPTION CERTIFICATE FOR SALES

BOARD OF EQUALIZATION

AND USE TAX EXCLUSION

Revenue and Taxation Code (RTC) section 6010.8

This is an exclusion from sales and use tax for the purchase of tangible personal property by a participating party for eligible

projects approved by the California Alternative Energy and Advanced Transportation Financing Authority (CAEATFA).

Only the participating party can issue their vendor an exemption certificate claiming the RTC section 6010.8 exclusion.

Under no circumstances should construction contractors issue an exemption certificate to their vendors claiming the RTC

section 6010.8 exclusion for their purchases of materials, fixtures, machinery and/or equipment.

EXEMPTION CERTIFICATE

(to be completed by participating party)

When accepted in good faith, this exemption certificate may be used for the purchase of tangible personal property

for use in qualified projects. Please provide a complete description of the property purchased. If you intend to use this

certificate as a blanket exemption certificate to cover multiple transactions, please indicate this by including “all tangible

personal property” in the description of the property purchased field below. The use of a blanket exemption certificate for

multiple transactions will require proof that all property is approved under the terms of the qualified project.

VENDOR’S NAME

VENDOR’S ADDRESS (street, city, state, zip code)

I hereby certify that CAEATFA has informed me that I qualify as a participating party and the tangible personal

property identified below will be used for an approved project involving any of the following:

• Alternative energy sources

• Advanced transportation technologies

• Advanced manufacturing

• Recycled feedstock

I further certify that the tangible personal property I will purchase from the vendor indicated above will be

used in a manner excluded from tax per RTC section 6010.8.

DESCRIPTION OF PROPERTY PURCHASED (attach a complete description of property purchased, if necessary)

PARTICIPATING PARTY/COMPANY NAME

CAEATFA APPLICATION NUMBER

ADDRESS (street, city, state, zip code)

TELEPHONE NUMBER

SIGNATURE OF PURCHASER

DATE

TITLE (owner, partner, purchasing agent, etc.)

SELLER’S PERMIT NO. (if any)

NOTICE TO PURCHASER

Sales tax may be due if any of the following apply:

• You are not a participating party with an approved project by CAEATFA.

• The property is first functionally used or placed in service prior to being granted approval from CAEATFA to use

the exclusion.

• The property purchased is not cited within the agreement with CAEATFA.

• The property is moved outside the state of California during the reporting period cited in the agreement with

CAEATFA.

• You are a construction contractor or subcontractor purchasing on behalf of a participating party.

If tax applies, you must pay it directly to the Board of Equalization (BOE).

CLEAR

PRINT

1

1