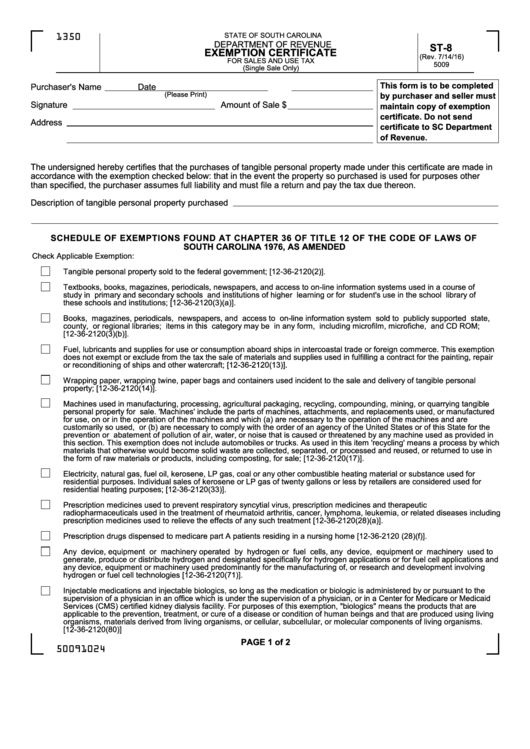

Form St-8 - Exemption Certificate For Sales And Use Tax - Department Of Revenue

ADVERTISEMENT

STATE OF SOUTH CAROLINA

1350

DEPARTMENT OF REVENUE

ST-8

EXEMPTION CERTIFICATE

(Rev. 7/14/16)

FOR SALES AND USE TAX

5009

(Single Sale Only)

This form is to be completed

Purchaser's Name

Date

by purchaser and seller must

(Please Print)

Signature

Amount of Sale $

maintain copy of exemption

certificate.

Do

not

send

Address

certificate to SC Department

of Revenue.

The undersigned hereby certifies that the purchases of tangible personal property made under this certificate are made in

accordance with the exemption checked below: that in the event the property so purchased is used for purposes other

than specified, the purchaser assumes full liability and must file a return and pay the tax due thereon.

Description of tangible personal property purchased

SCHEDULE OF EXEMPTIONS FOUND AT CHAPTER 36 OF TITLE 12 OF THE CODE OF LAWS OF

SOUTH CAROLINA 1976, AS AMENDED

Check Applicable Exemption:

Tangible personal property sold to the federal government; [12-36-2120(2)].

Textbooks, books, magazines, periodicals, newspapers, and access to on-line information systems used in a course of

study in primary and secondary schools and institutions of higher learning or for student's use in the school library of

these schools and institutions; [12-36-2120(3)(a)].

Books, magazines, periodicals, newspapers, and access to on-line information system sold to publicly supported state,

county, or regional libraries; items in this category may be in any form, including microfilm, microfiche, and CD ROM;

[12-36-2120(3)(b)].

Fuel, lubricants and supplies for use or consumption aboard ships in intercoastal trade or foreign commerce. This exemption

does not exempt or exclude from the tax the sale of materials and supplies used in fulfilling a contract for the painting, repair

or reconditioning of ships and other watercraft; [12-36-2120(13)].

Wrapping paper, wrapping twine, paper bags and containers used incident to the sale and delivery of tangible personal

property; [12-36-2120(14)].

Machines used in manufacturing, processing, agricultural packaging, recycling, compounding, mining, or quarrying tangible

personal property for sale. 'Machines' include the parts of machines, attachments, and replacements used, or manufactured

for use, on or in the operation of the machines and which (a) are necessary to the operation of the machines and are

customarily so used, or (b) are necessary to comply with the order of an agency of the United States or of this State for the

prevention or abatement of pollution of air, water, or noise that is caused or threatened by any machine used as provided in

this section. This exemption does not include automobiles or trucks. As used in this item 'recycling' means a process by which

materials that otherwise would become solid waste are collected, separated, or processed and reused, or returned to use in

the form of raw materials or products, including composting, for sale; [12-36-2120(17)].

Electricity, natural gas, fuel oil, kerosene, LP gas, coal or any other combustible heating material or substance used for

residential purposes. Individual sales of kerosene or LP gas of twenty gallons or less by retailers are considered used for

residential heating purposes; [12-36-2120(33)].

Prescription

medicines

used

to

prevent

respiratory

syncytial

virus,

prescription

medicines

and

therapeutic

radiopharmaceuticals used in the treatment of rheumatoid arthritis, cancer, lymphoma, leukemia, or related diseases including

prescription medicines used to relieve the effects of any such treatment [12-36-2120(28)(a)].

Prescription drugs dispensed to medicare part A patients residing in a nursing home [12-36-2120 (28)(f)].

Any device, equipment or machinery operated by hydrogen or fuel cells, any device, equipment or machinery used to

generate, produce or distribute hydrogen and designated specifically for hydrogen applications or for fuel cell applications and

any device, equipment or machinery used predominantly for the manufacturing of, or research and development involving

hydrogen or fuel cell technologies [12-36-2120(71)].

Injectable medications and injectable biologics, so long as the medication or biologic is administered by or pursuant to the

supervision of a physician in an office which is under the supervision of a physician, or in a Center for Medicare or Medicaid

Services (CMS) certified kidney dialysis facility. For purposes of this exemption, "biologics" means the products that are

applicable to the prevention, treatment, or cure of a disease or condition of human beings and that are produced using living

organisms, materials derived from living organisms, or cellular, subcellular, or molecular components of living organisms.

[12-36-2120(80)]

PAGE 1 of 2

50091024

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2