Employer Verification Of Earnings Page 3

ADVERTISEMENT

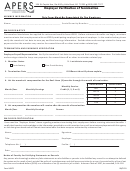

EMPLOYER VERIFICATION OF EARNINGS INSTRUCTIONS

F-10146A (07/08)

EMPLOYMENT VERIFICATION OF EARNINGS INSTRUCTIONS

We require employment and wage information concerning the employee named on the Employer Verification of

Earnings form. Please complete and return the form to the employee as soon as possible so that s/he can return it by

the date indicated.

•

Review the Federal Employment Identification Number (FEIN) number listed on the form. If it is incorrect or

missing please write correct number on the form, if known.

•

This form will be scanned. Please write clearly using blue or black ink.

•

Write additional comments in the comments section.

Although it is the employee’s responsibility to return this form to the local agency, in order to expedite this process,

you may return this form to the address or fax number listed. If you do, please inform the employee that you have

returned this form.

SECTION 1 - EMPLOYMENT STATUS

If the employee never worked for your company, check the "Never Employed" box. Sign, date and return the

form. If the employee listed on the form is no longer an employee of your company, check the "No" box. Write in

the date the employment ended. Write in the date of the employee’s last paycheck and gross amount (before any

deductions) of pay for his/her final month.

SECTION 2 - EMPLOYMENT INFORMATION

If the employee listed on the form is employed by your company, check the "Yes" box and complete Section 2.

Write in the date the employee started working for your company and the date of the employee's first check.

Employee Type – Check the temporary or permanent box if the employee is in a position that is defined as permanent

by your company.

Employee Title – Check the Manager box if the employee is a manager. Check the Other box if the employee is not

in a position of management as defined by your company.

Please provide your best estimate of gross wages (before any deductions) the employee will earn for the next 30 days.

Best estimate of Weekly Hours – Please provide the hours the employee is expected to work weekly.

Rate of Pay Per Hour - If the type of pay is regular, holiday, other shift, overtime, weekend or other type of pay,

indicate the rate of pay the employee earns per hour.

Regular Scheduled Hours – Indicate the employee’s regular scheduled hours and the days worked (i.e. 8:00 a.m. to

4:30 p.m. Monday, Tuesday, Wednesday and Saturday).

Gross Pay Per Pay Period - If the employee's type of pay is salary, bonus and commissions, cash and/or tips, write

in the gross amount (before any deductions) the employee earns per pay period.

Frequency of Pay - Indicate how often the employee is paid.

Weekly

Each week

Bi-weekly

Every other week (i.e. every other Thursday

st

th

Semi-monthly

Twice per month (i.e. the 1

and the 15

)

Monthly

Once each month

Irregular

On an irregular basis

Signature - This form must be completed, signed and dated by the employer or designee. Please provide the title of

the person completing the form. Also, provide a telephone number and fax number if available.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3