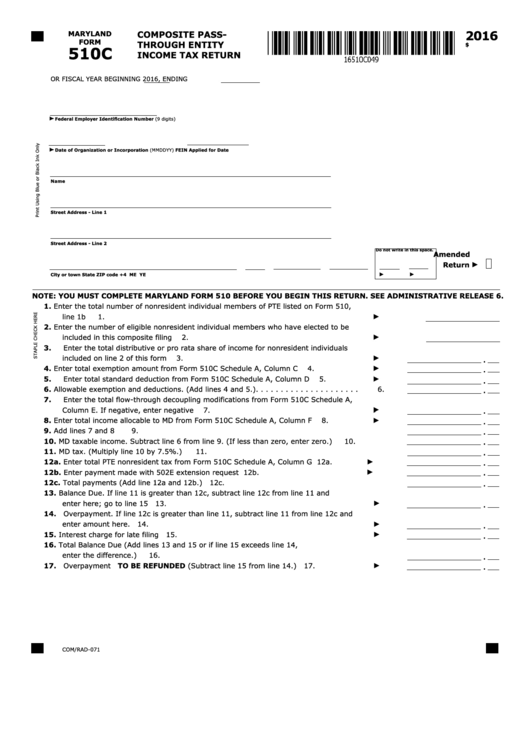

2016

COMPOSITE PASS-

MARYLAND

FORM

THROUGH ENTITY

$

510C

INCOME TAX RETURN

OR FISCAL YEAR BEGINNING

2016, ENDING

Federal Employer Identification Number (9 digits)

Date of Organization or Incorporation (MMDDYY)

FEIN Applied for Date

Name

Street Address - Line 1

Street Address - Line 2

Do not write in this space.

Amended

Return

City or town

State

ZIP code

+4

ME

YE

NOTE: YOU MUST COMPLETE MARYLAND FORM 510 BEFORE YOU BEGIN THIS RETURN. SEE ADMINISTRATIVE RELEASE 6.

1.

Enter the total number of nonresident individual members of PTE listed on Form 510,

line 1b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1.

2.

Enter the number of eligible nonresident individual members who have elected to be

included in this composite filing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.

3.

Enter the total distributive or pro rata share of income for nonresident individuals

included on line 2 of this form . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.

.

.

4.

Enter total exemption amount from Form 510C Schedule A, Column C . . . . . . . . . . . .

4.

5.

Enter total standard deduction from Form 510C Schedule A, Column D . . . . . . . . . . . .

5.

.

.

6.

Allowable exemption and deductions. (Add lines 4 and 5.). . . . . . . . . . . . . . . . . . . . .

6.

7.

Enter the total flow-through decoupling modifications from Form 510C Schedule A,

.

Column E. If negative, enter negative . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7.

8.

Enter total income allocable to MD from Form 510C Schedule A, Column F . . . . . . . . .

8.

.

9.

.

Add lines 7 and 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9.

.

10. MD taxable income. Subtract line 6 from line 9. (If less than zero, enter zero.) . . . . . .

10.

.

11. MD tax. (Multiply line 10 by 7.5%.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11.

.

12a. Enter total PTE nonresident tax from Form 510C Schedule A, Column G . . . . . . . . . . .

12a.

.

12b. Enter payment made with 502E extension request . . . . . . . . . . . . . . . . . . . . . . . . . .

12b.

.

12c. Total payments (Add line 12a and 12b.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12c.

13. Balance Due. If line 11 is greater than 12c, subtract line 12c from line 11 and

enter here; go to line 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13.

.

14. Overpayment. If line 12c is greater than line 11, subtract line 11 from line 12c and

enter amount here. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14.

.

15. Interest charge for late filing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

15.

16. Total Balance Due (Add lines 13 and 15 or if line 15 exceeds line 14,

enter the difference.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16.

.

17. Overpayment TO BE REFUNDED (Subtract line 15 from line 14.) . . . . . . . . . . . . . . .

.

17.

COM/RAD-071

1

1 2

2 3

3 4

4