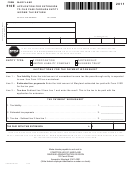

2016

COMPOSITE PASS-

MARYLAND

FORM

THROUGH ENTITY

page 2

510C

INCOME TAX RETURN

NAME

FEIN

DIRECT DEPOSIT OF REFUND (See Instructions.) Be sure the account information is correct.

If this refund will go to an account outside of the United States, then to comply with banking rules, place a "Y" in this box

and see instructions.

For the direct deposit option, complete the following information clearly and legibly.

18a. Type of account: . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18a.

Checking

Savings

18b. Routing Number (9-digits): . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18b.

18c. Account number: . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18c.

SIGNATURE AND VERIFICATION

Check here

if you authorize your preparer to discuss this return with us.

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements and to

the best of my knowledge and belief it is true, correct and complete. If prepared by a person other than taxpayer, the declaration is

based on all information of which the preparer has any knowledge.

Signature of general partner, officer or member

Date

Preparer's Name

Preparer's Signature

Title

Preparer's address and telephone number

Preparer’s PTIN (required by law)

Make checks payable to and mail to:

Comptroller Of Maryland

Revenue Administration Division

110 Carroll Street

Annapolis, Maryland 21411-0001

(Write Your Federal Employer Identification Number On Check

Using Blue Or Black Ink.)

CODE NUMBERS (3 digits per line)

COM/RAD-071

1

1 2

2 3

3 4

4