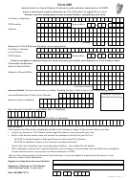

Form De1 - Application To Have Deposit Interest Paid Without Deduction Of Dirt Where Applicant And/or Spouse Or Civil Partner Is Aged 65 Or Over - 2017 Page 2

ADVERTISEMENT

Please read the explanatory notes below before completing this form

You should complete this form if you wish to apply to have your deposit interest, on funds of which you are

the beneficial owner, paid to you without deduction of Deposit Interest Retention Tax (DIRT).

You can claim an exemption if you (or your spouse or civil partner) satisfy both of these criteria:

●

You (or your spouse or civil partner) are aged 65 or over during the year 2017

●

Your (and your spouse or civil partner’s) total income (this is your gross income from all sources, such

as the State Pension and deposit interest) for the year 2017 does not exceed the following amounts:

Single Person, Widowed Person or Surviving Civil Partner

€18,000

Married Couple or Civil Partners (combined income)

€36,000

These exemption limits are increased by €575 for each of the first two dependent children and by €830 for each

subsequent dependent child. These amounts are liable to change and changes will be posted on our website

If a third party (such as a relative) has authority to operate your bank account on your behalf you will still be

entitled to the DIRT exemption, provided the beneficial ownership of your account is not affected.

To apply complete the form overleaf and return it to your financial institution manager (your bank, building

society, credit union or post office savings bank manager).

Complete a separate form for each account you (and your spouse or civil partner) hold.

Joint accounts qualify for the exemption, only where the two account holders are a married couple or civil partners.

If your circumstances change, and you no longer qualify to have your interest paid without deduction of DIRT,

you are obliged to notify the local manager of your bank, building society, credit union or post office savings bank.

This is a form authorised by the Revenue Commissioners. It may be subject to inspection by Revenue.

It is an offence to make a false declaration.

Single Euro Payments Area (SEPA)

Account numbers and sort codes have been replaced by International Bank Account Numbers (IBAN) and

Bank Identifier Codes (BIC). These numbers are generally available on your bank account statements. Further

information on SEPA can be found on

Further Information

More information is available on in the on-line explanatory leaflet ‘DE1’. If you require any

clarification or assistance, please contact your local Revenue office, the number of which can be found through

the Contact Locator on (or in the green pages of your local telephone directory).

Designed by the Revenue Printing Centre

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2