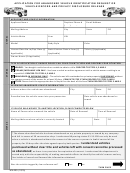

GENERAL INFORMATION

• A Certificate of Exemption is non-transferable.

• A Farm Vehicle is defined as “a truck or truck tractor determined by the Department of Transportation to be used exclusively for agricultural purposes.”

• List name and address as printed on current Pennsylvania Certificate of Title or as listed on accompanying application for Pennsylvania Certificate of Title

in Section A and complete all other applicable sections of the application. Tax and fees are payable at the time of application for Pennsylvania Certificate

of Title and registration.

• A copy of your last current income tax return filing which demonstrates you are engaged commercially in farming, must be attached. The copy of the income

tax return filing attached to Form MV-77A must show the business activity code or business activity description. Specific income information filed in the

original return may be blacked out. If you are:

- An individual - A copy of your PA Income Tax Form, Schedule F must be attached.

- A partnership - A copy of your Federal Income Tax Form 1165 or 1165B or a copy of the Schedule F filed with the 1065 or 1065B must be attached.

- A corporation - A copy of your Federal Income Tax Form 1120 or 1120A (Schedule K of the 1120 return or Part II of the 1120A return) must be attached.

- A Subchapter S Corporation - A copy of your Federal Income Tax Form 1120S (Schedule B) must be attached.

• Mail completed application and fees to the address listed on the front of the application. Make check or money order payable to the “Commonwealth of

Pennsylvania.” NOTE: If this application is submitted as an attachment to application for Pennsylvania Certificate of Title on Forms MV-1 or MV-4ST, mail

all documents to the address printed in the upper right margin of Forms MV-1 or MV-4ST.

NOTE: A farm vehicle must be used exclusively for agricultural purposes and may not be used in other operations such as commercial trucking, logging,

landscaping and transporting show horses. Agricultural purposes include produce, dairy, livestock and poultry farming, hay and field crop farming

and orchard and nursery operations.

INSTRUCTIONS FOR FARM VEHICLE 2-YEAR CERTIFICATE OF EXEMPTION

1. Sections A, C, D and F must be completed in full.

2. Sections A through D and F must be completed in full. Section E need only be completed when applying for a replacement certificate of exemption,

registration card or renewal sticker. NOTE: Complete Section G only if the “never received” block is checked in Section E. No fee is required if original

certificate of exemption was lost in the mail and application is made within 90 days of original issuance.

3. Type A: Used exclusively:

a.

Upon farm(s) owned/operated by the vehicle owner on highways only between parts of a farm;

b.

Between such farms located within 50 miles of each other;

c.

Between a farm or farms and place of business within a 50 mile radius of the farm or farms for the purpose of buying/selling agricultural

commodities/supplies, or

d.

Between a farm or farms and a place of business within a 50 mile radius of the farm or farms for repairing or servicing the farm vehicle or trailer

or semi-trailer being towed or hauled by the farm vehicle.

Type B: Used exclusively:

a.

Upon farm(s) owned/operated by the vehicle owner on highways only between parts of a farm;

b.

Between such farms located within 25 miles of each other;

c.

Between a farm or farms and place of business within a 25 mile radius of the farm or farms for the purpose of buying/selling agricultural

commodities/supplies, or

d.

Between a farm or farms and a place of business within a 50 mile radius of the farm or farms for repairing or servicing the farm vehicle or trailer

or semitrailer being towed or hauled by the farm vehicle.

Type C: Used exclusively:

a.

Upon farm(s) owned/operated by the vehicle owner on highways only between parts of a farm;

b.

Between such farms located within 10 miles of each other;

c.

Between a farm or farms and place of business within a 10 mile radius of the farm or farms for the purpose of buying/selling agricultural

commodities/supplies, or

d.

Between a farm or farms and a place of business within a 25 mile radius of the farm or farms for repairing or servicing the farm vehicle or trailer

or semitrailer being towed or hauled by the farm vehicle.

Type D: Used exclusively:

a.

Upon farm(s) owned/operated by the vehicle owner on highways only between parts of a farm;

b.

Between such farms located within 50 miles of each other;

c.

Between a farm or farms and place of business within a 50 mile radius of the farm or farms for the purpose of buying/selling agricultural

commodities/supplies, or

d.

Between a farm or farms and a place of business within a 50 mile radius of the farm or farms for repairing or servicing the farm vehicle or

trailer or semitrailer being towed or hauled by the farm vehicle.

4. Farm vehicles being operated with a certificate of exemption cannot be used beyond the mileage or time restrictions listed in Section D on front of

this application.

5. The owner of the farm vehicle must maintain the minimum levels of liability insurance coverage on the vehicle. This can be by a vehicle insurance policy

or under farm liability insurance coverage maintained generally by the owner.

Visit us at or call us at:

In state: 1-800-932-4600 u TDD: 1-800-228-0676 u Out-of-State: 1-717-412-5300 u TDD Out-of-State: 1-717-412-5380

1

1 2

2