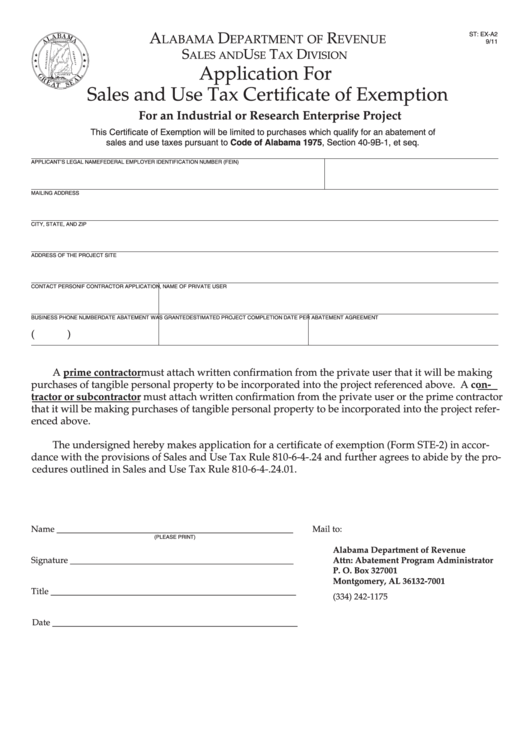

ST: EX-A2

A

D

R

LABAMA

EPARTMENT OF

EVENUE

9/11

S

U

T

D

ALES AND

SE

AX

IVISION

Reset

Application For

Sales and Use Tax Certificate of Exemption

For an Industrial or Research Enterprise Project

This Certificate of Exemption will be limited to purchases which qualify for an abatement of

sales and use taxes pursuant to Code of Alabama 1975, Section 40-9B-1, et seq.

APPLICANT’S LEGAL NAME

FEDERAL EMPLOYER IDENTIFICATION NUMBER (FEIN)

MAILING ADDRESS

CITY, STATE, AND ZIP

ADDRESS OF THE PROJECT SITE

CONTACT PERSON

IF CONTRACTOR APPLICATION, NAME OF PRIVATE USER

BUSINESS PHONE NUMBER

DATE ABATEMENT WAS GRANTED

ESTIMATED PROJECT COMPLETION DATE PER ABATEMENT AGREEMENT

(

)

A prime contractor must attach written confirmation from the private user that it will be making

purchases of tangible personal property to be incorporated into the project referenced above. A con-

tractor or subcontractor must attach written confirmation from the private user or the prime contractor

that it will be making purchases of tangible personal property to be incorporated into the project refer-

enced above.

The undersigned hereby makes application for a certificate of exemption (Form STE-2) in accor-

dance with the provisions of Sales and Use Tax Rule 810-6-4-.24 and further agrees to abide by the pro-

cedures outlined in Sales and Use Tax Rule 810-6-4-.24.01.

Name ______________________________________________________

Mail to:

(PLEASE PRINT)

Alabama Department of Revenue

Signature ___________________________________________________

Attn: Abatement Program Administrator

P. O. Box 327001

Montgomery, AL 36132-7001

Title ________________________________________________________

(334) 242-1175

Date ________________________________________________________

1

1