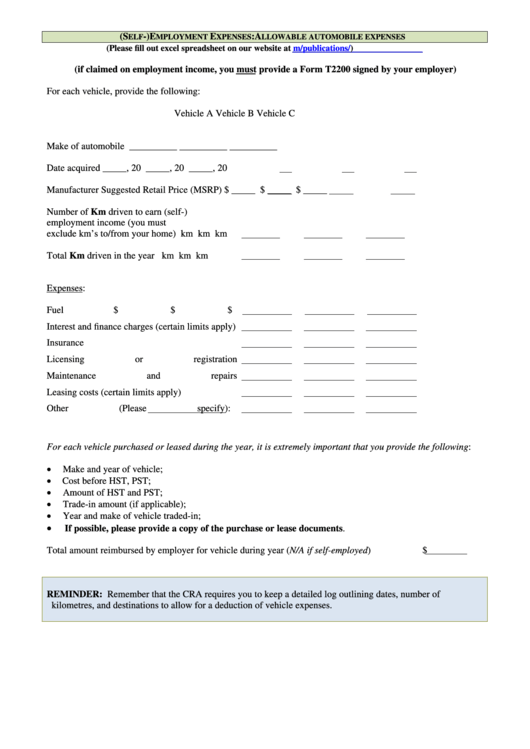

(Self-) Employment Expenses: Allowable Automobile Expenses

ADVERTISEMENT

(S

-) E

E

: A

ELF

MPLOYMENT

XPENSES

LLOWABLE AUTOMOBILE EXPENSES

(Please fill out excel spreadsheet on our website at )

(if claimed on employment income, you must provide a Form T2200 signed by your employer)

For each vehicle, provide the following:

Vehicle A

Vehicle B

Vehicle C

Make of automobile

__________

__________

__________

Date acquired

_____, 20

_____, 20

_____, 20

Manufacturer Suggested Retail Price (MSRP)

$ _____

$ _____

$ _____

Number of Km driven to earn (self-)

employment income (you must

exclude km’s to/from your home)

km

km

km

Total Km driven in the year

km

km

km

Expenses:

Fuel

$

$

$

Interest and finance charges (certain limits apply)

Insurance

Licensing or registration

Maintenance and repairs

Leasing costs (certain limits apply)

Other (Please specify):

For each vehicle purchased or leased during the year, it is extremely important that you provide the following:

Make and year of vehicle;

Cost before HST, PST;

Amount of HST and PST;

Trade-in amount (if applicable);

Year and make of vehicle traded-in;

If possible, please provide a copy of the purchase or lease documents.

Total amount reimbursed by employer for vehicle during year (N/A if self-employed)

$

REMINDER: Remember that the CRA requires you to keep a detailed log outlining dates, number of

kilometres, and destinations to allow for a deduction of vehicle expenses.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1