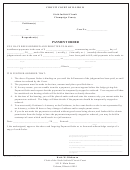

Agreement For Judgment And For Payment Order Page 2

ADVERTISEMENT

INCOME AND PROPERTY

THAT ARE

EXEMPT FROM PAYMENT ORDERS

(This list of exempt income and property is not comprehensive. It is provided to assist the court

in avoiding the issuance of orders that would require payment from exempt sources. When

requesting a payment order, the creditor bears the burden of proving that the debtor has sufficient

non-exempt income or property with which to satisfy the judgment. See G.L. c. 224, § 16.)

1. INCOME FROM THE FOLLOWING SOURCES is exempt by law from payment orders:

•

Unemployment Benefits (G.L. c. 151A, § 36)

•

Workers Compensation Benefits (G.L. c. 152, § 47)

•

Social Security Benefits (42 U.S.C. § 401)

•

Federal Old-Age, Survivors & Disability Insurance Benefits (42 U.S.C. § 407)

•

Supplementary Security Income (SSI) for Aged, Blind & Disabled (42 U.S.C. § 1383[d][1])

•

Other Disability Insurance Benefits up to $400 weekly (G.L. c. 175, § 110A)

•

Emergency Aid for Elderly & Disabled (G.L. c. 117A)

•

Veterans Benefits

•

Federal Veterans Benefits (38 U.S.C. § 5301[a])

•

Special Benefits for Certain WW II Veterans (42 U.S.C. § 1001)

•

Medal of Honor Veterans Benefits (38 U.S.C. § 1562)

•

State Veterans Benefits (G.L. c. 115, § 5)

•

Transitional Aid to Families with Dependent Children (AFDC) Benefits (G.L. c. 118, § 10)

•

Maternal Child Health Services Block Grant Benefits (42 U.S.C. § 701)

•

Other public assistance benefits (G.L. c. 235, § 34, cl. fifteenth)

•

Payouts from certain Massachusetts employee pension plans (G.L. c. 32, § 19)

2. Certain PERSONAL AND REAL PROPERTY is also exempt from payment orders,

including:

•

$2,500 in cash or savings or other deposits in a banking or investment institution (G.L. c. 235,

§ 34, cl. fifteenth)

•

Automobile or vehicle up to exemption limit (G.L. c. 235, § 34, cl. sixteenth)

•

Other specific types of personal property are exempt under other clauses of G.L. c. 235, § 34

•

Real estate subject to automatic or declared homestead exemption (G.L. c. 188) and, in lieu

thereof, the amount of money necessary for rent, up to $2,500 per month (G.L. c. 235, § 34, cl.

fourteenth)

•

There are also exemptions for “aggregate” amounts, up to maximum limits, of certain unused

exemptions (G.L. c. 235, § 34, cl. seventeenth)

3. In addition, A PORTION OF WAGES AND CONTRIBUTIONS TO EMPLOYMENT-

BASED RETIREMENT PLANS is exempt by law from payment orders.

Massachusetts law exempts the greater of 85% of the debtor’s gross earnings or 50 times the

greater of the Federal minimum wage ($7.25 as of 7/24/09) or the Massachusetts minimum wage

($10/hr. until 12/31/16 per G.L. c. 151, § 1; and $11/hr. as of 1/1/17) for each week or portion

thereof. (G.L. c. 224, § 16 & c. 235, § 34, cl. fifteenth). The amount exempt under federal law (15

U.S.C. § §1671-1677) may exceed the Massachusetts exemption. If so, the federal exemption

applies.

See Worksheet for Computing Amount of Wages Exempt From Attachment, Execution and

Payment Orders.

exemption-worksheet.pdf

Rev. 03/16

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2