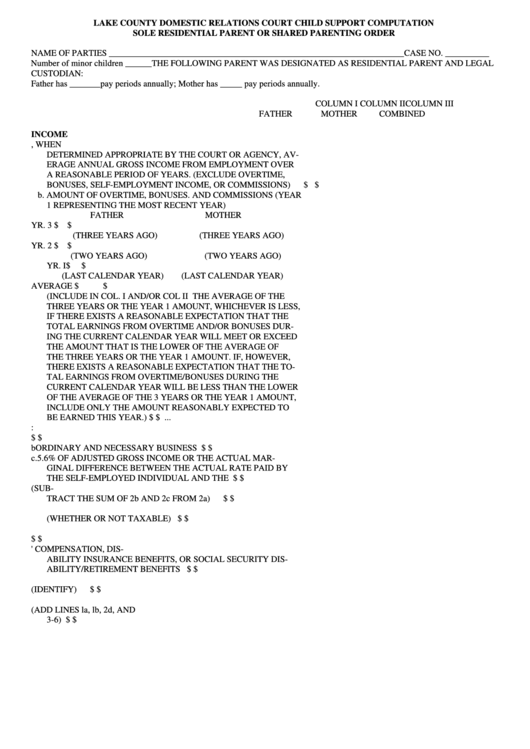

LAKE COUNTY DOMESTIC RELATIONS COURT CHILD SUPPORT COMPUTATION

SOLE RESIDENTIAL PARENT OR SHARED PARENTING ORDER

NAME OF PARTIES ___________________________________________________________________

CASE NO. __________

Number of minor children ______THE FOLLOWING PARENT WAS DESIGNATED AS RESIDENTIAL PARENT AND LEGAL

CUSTODIAN:......................................... MOTHER ............................................. FATHER..........................................SHARED

Father has _______pay periods annually; Mother has _____ pay periods annually.

COLUMN I

COLUMN II

COLUMN III

FATHER

MOTHER

COMBINED

INCOME

1.a. ANNUAL GROSS INCOME FROM EMPLOYMENT OR, WHEN

DETERMINED APPROPRIATE BY THE COURT OR AGENCY, AV-

ERAGE ANNUAL GROSS INCOME FROM EMPLOYMENT OVER

A REASONABLE PERIOD OF YEARS. (EXCLUDE OVERTIME,

BONUSES, SELF-EMPLOYMENT INCOME, OR COMMISSIONS)

$ ...................

$ ...................

b. AMOUNT OF OVERTIME, BONUSES. AND COMMISSIONS (YEAR

1 REPRESENTING THE MOST RECENT YEAR)

FATHER

MOTHER

YR. 3 $ ................................... YR. 3 $ ...................................

(THREE YEARS AGO)

(THREE YEARS AGO)

YR. 2 $ ................................... YR. 2 $ ...................................

(TWO YEARS AGO)

(TWO YEARS AGO)

YR. I$ ................................... YR. 1 $ ...................................

(LAST CALENDAR YEAR)

(LAST CALENDAR YEAR)

AVERAGE $

.........................$..............................................

(INCLUDE IN COL. I AND/OR COL II THE AVERAGE OF THE

THREE YEARS OR THE YEAR 1 AMOUNT, WHICHEVER IS LESS,

IF THERE EXISTS A REASONABLE EXPECTATION THAT THE

TOTAL EARNINGS FROM OVERTIME AND/OR BONUSES DUR-

ING THE CURRENT CALENDAR YEAR WILL MEET OR EXCEED

THE AMOUNT THAT IS THE LOWER OF THE AVERAGE OF

THE THREE YEARS OR THE YEAR 1 AMOUNT. IF, HOWEVER,

THERE EXISTS A REASONABLE EXPECTATION THAT THE TO-

TAL EARNINGS FROM OVERTIME/BONUSES DURING THE

CURRENT CALENDAR YEAR WILL BE LESS THAN THE LOWER

OF THE AVERAGE OF THE 3 YEARS OR THE YEAR 1 AMOUNT,

INCLUDE ONLY THE AMOUNT REASONABLY EXPECTED TO

BE EARNED THIS YEAR.)....................................................................

$...................

$ ...................

2. FOR SELF-EMPLOYMENT INCOME:

a.

GROSS RECEIPTS FROM BUSINESS ................................................

$...................

$ ...................

b

ORDINARY AND NECESSARY BUSINESS EXPENSES...................... $...................

$ ...................

c.

5.6% OF ADJUSTED GROSS INCOME OR THE ACTUAL MAR-

GINAL DIFFERENCE BETWEEN THE ACTUAL RATE PAID BY

THE SELF-EMPLOYED INDIVIDUAL AND THE F.I.CA RATE.

$...................

$ ...................

d. ADJUSTED GROSS INCOME FROM SELF-EMPLOYMENT (SUB-

TRACT THE SUM OF 2b AND 2c FROM 2a)

...................................... $...................

$ ...................

3. ANNUAL INCOME FROM INTEREST AND DIVIDENDS

(WHETHER OR NOT TAXABLE) ........................................................... $...................

$ ...................

4. ANNUAL INCOME FROM UNEMPLOYMENT COMPENSATION

$...................

$ ....................

5. ANNUAL INCOME FROM WORKERS' COMPENSATION, DIS-

ABILITY INSURANCE BENEFITS, OR SOCIAL SECURITY DIS-

ABILITY/RETIREMENT BENEFITS ...................................................... $...................

$ ...................

6. OTHER ANNUAL INCOME (IDENTIFY)

............................................ $...................

$ ...................

7. TOTAL ANNUAL GROSS INCOME (ADD LINES la, lb, 2d, AND

3-6) .............................................................................................................. $...................

$ ...................

1

1 2

2 3

3