Form Ct-1041v - Connecticut Electronic Filing Payment Voucher - 2016

ADVERTISEMENT

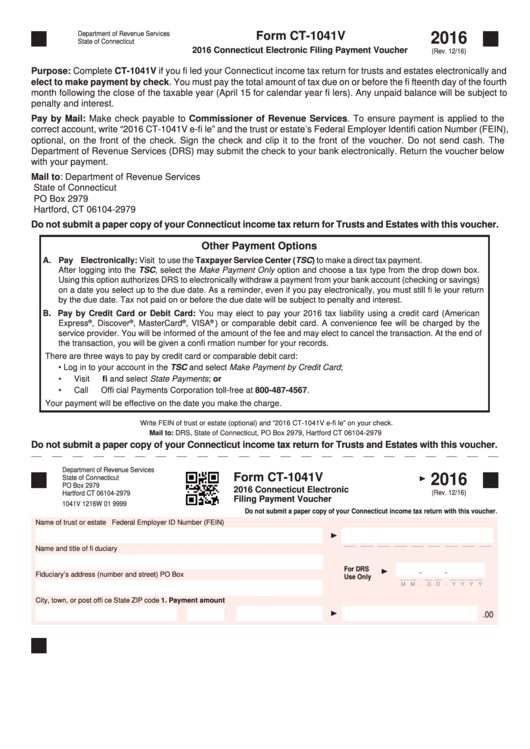

Department of Revenue Services

Form CT-1041V

2016

State of Connecticut

2016 Connecticut Electronic Filing Payment Voucher

(Rev. 12/16)

Purpose: Complete CT-1041V if you fi led your Connecticut income tax return for trusts and estates electronically and

elect to make payment by check. You must pay the total amount of tax due on or before the fi fteenth day of the fourth

month following the close of the taxable year (April 15 for calendar year fi lers). Any unpaid balance will be subject to

penalty and interest.

Pay by Mail: Make check payable to Commissioner of Revenue Services. To ensure payment is applied to the

correct account, write “2016 CT-1041V e-fi le” and the trust or estate’s Federal Employer Identifi cation Number (FEIN),

optional, on the front of the check. Sign the check and clip it to the front of the voucher. Do not send cash. The

Department of Revenue Services (DRS) may submit the check to your bank electronically. Return the voucher below

with your payment.

Mail to:

Department of Revenue Services

State of Connecticut

PO Box 2979

Hartford, CT 06104-2979

Do not submit a paper copy of your Connecticut income tax return for Trusts and Estates with this voucher.

Other Payment Options

A. Pay Electronically: Visit to use the Taxpayer Service Center (TSC) to make a direct tax payment.

After logging into the TSC, select the Make Payment Only option and choose a tax type from the drop down box.

Using this option authorizes DRS to electronically withdraw a payment from your bank account (checking or savings)

on a date you select up to the due date. As a reminder, even if you pay electronically, you must still fi le your return

by the due date. Tax not paid on or before the due date will be subject to penalty and interest.

B. Pay by Credit Card or Debit Card: You may elect to pay your 2016 tax liability using a credit card (American

Express

®

, Discover

®

, MasterCard

®

, VISA

®

) or comparable debit card. A convenience fee will be charged by the

service provider. You will be informed of the amount of the fee and may elect to cancel the transaction. At the end of

the transaction, you will be given a confi rmation number for your records.

There are three ways to pay by credit card or comparable debit card:

•

Log in to your account in the TSC and select Make Payment by Credit Card;

•

Visit and select State Payments; or

•

Call Offi cial Payments Corporation toll-free at 800-487-4567.

Your payment will be effective on the date you make the charge.

Write FEIN of trust or estate (optional) and “2016 CT-1041V e-fi le” on your check.

Mail to: DRS, State of Connecticut, PO Box 2979, Hartford CT 06104-2979

Do not submit a paper copy of your Connecticut income tax return for Trusts and Estates with this voucher.

Department of Revenue Services

Form CT-1041V

2016

State of Connecticut

PO Box 2979

2016 Connecticut Electronic

(Rev. 12/16)

Hartford CT 06104-2979

Filing Payment Voucher

1041V 1216W 01 9999

Do not submit a paper copy of your Connecticut income tax return with this voucher.

Name of trust or estate

Federal Employer ID Number (FEIN)

Name and title of fi duciary

For DRS

Fiduciary’s address (number and street)

PO Box

Use Only

M M - D D - Y Y Y Y

City, town, or post offi ce

State

ZIP code

1. Payment amount

.00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1