Tiaa-Cref Application For Medicare Part B Premium Reimbursement Page 2

ADVERTISEMENT

INSTRUCTIONS

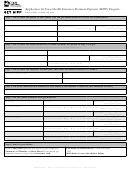

Application for Medicare Part B Premium Reimbursement

(Members of TIAA-CREF Pension System)

A. ELIGIBILITY

During those months for which a reimbursement is requested, the retiree must have been:

1. Receiving a monthly Lifetime Income Annuity from TIAA-CREF to satisfy standard health care premium deductions

(Interest Only, Minimum Distribution and Transfer Pay Out Annuity are not considered settlement options used to satisfy

your health care premium deductions); and

2. Enrolled in and paying premiums for a New York City Health Benefits Plan as the contract holder (premiums must be

deducted from your monthly TIAA-CREF pension check); and

3. Enrolled in and paying premiums for Medicare Medical Insurance (Part B), and

4.

.

Your primary residence is within the United States

B. SPOUSE/DOMESTIC PARTNER OR DISABLED CHILDREN OF RETIREE

If a spouse/domestic partner or a disabled dependent is enrolled in Medicare Part B and is covered under an eligible retiree’s New

York City health plan, Medicare premiums may be reimbursed to the retiree. An application for reimbursement must be completed

when adding a spouse/domestic partner and/or disabled child.

C. HEALTH INSURANCE COVERAGE FOR DISABLED DEPENDENT CHILDREN

Unmarried children age 26 and older who cannot support themselves because of a disability, including mental illness,

developmental disability, mental retardation or physical handicap are eligible for coverage if the disability occurred before the age

at which the dependent coverage would otherwise terminate. You must provide medical evidence of the disability.

D. SURVIVORS OF RETIREES

Unless a survivor is retired from The City University or a New York City agency, and is eligible for and enrolls in the New York

City Health Insurance Program as the contract holder, he/she is not eligible for reimbursement for any month beyond the period of

the deceased retiree’s eligibility. As a reminder, health insurance benefits for survivors of retirees ceases with the death of the

retiree, however, survivor dependents may be eligible for continuation of coverage under COBRA. Also, refer to the PSC-CUNY

Welfare Fund website

for information on continuation of coverage under COBRA for supplemental

benefits.

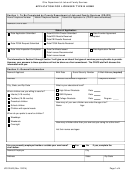

E. GENERAL INFORMATION

The City of New York Office of Labor Relations (OLR) – Health Benefits Program processes Medicare Part B

reimbursements annually, usually in August, for the previous year at the standard monthly rate. The first payment year

will be the year after your retirement date, provided you are Medicare-eligible; or the year after you become Medicare-

eligible. You do not need to apply annually for this benefit.

IRMAA – If you and eligible dependents pay more than the standard monthly rate, you must apply annually directly

through OLR to obtain full reimbursement of Medicare Part B premiums. Claims must be submitted to OLR following

receipt of the standard monthly premium reimbursement. Forms and information regarding IRMAA can be found at:

Your Medicare Reimbursement check will be mailed to the address that appears on your application. Please notify this

office of your change in address by completing a Change of Address form. Forms can be obtained by contacting

University Benefits Office at 646.664.3350. You do not need to apply for reimbursement each year, however, periodically

we will mail out a recertification form requesting you review and update your personal information.

Medicare does not pay for hospital or other medical expenses outside the U.S. If you plan to travel abroad, consider

obtaining additional insurance. Currently, the Health Benefits Program does not process reimbursement for retirees

residing outside the US territory.

The University Benefits Office should be notified of any changes due to death of the retiree, spouse/domestic partner or

dependent, changes in marital status or any other change which may impact payment of reimbursement for premiums of

Medicare Part B.

A beneficiary is a person, other than yourself, who has been designated by you, to be the administrator or executor of your

estate. This beneficiary will be notified of any final Medicare Part B Premium reimbursement upon your death. However,

if your spouse/domestic partner is covered as a dependent under your New York City health plan, final payments will be

paid to your spouse/domestic partner. To obtain any final payments your beneficiary or surviving spouse/domestic partner

must complete and submit a notarized Affidavit, along with a copy of the death certificate and a copy of the will or court

document indicating who is the sole beneficiary, the executor/executrix or the administrator/administratix of your Estate.

The City University of New York – University Employee Benefits Office

th

th

555 West 57

Street, 11

Floor, New York, NY 10019

\forms\medicare part B applic instruct / Rev5/15

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2