June 2007 S-211 Wisconsin Sales And Use Tax Exemption Certificate

ADVERTISEMENT

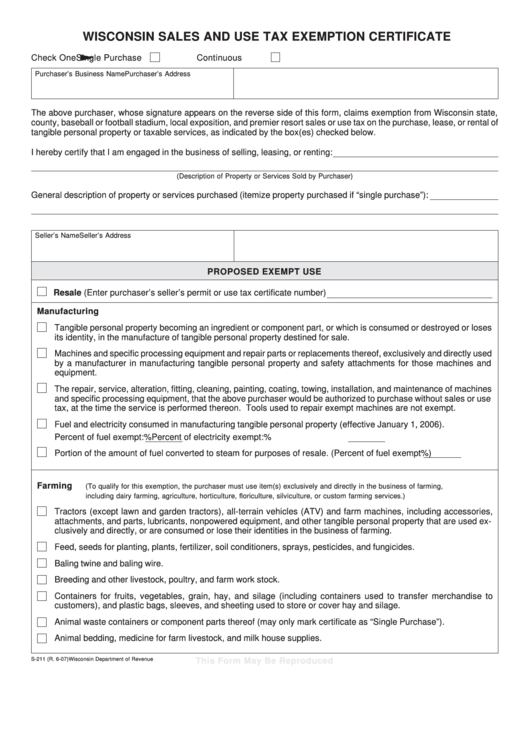

WISCONSIN SALES AND USE TAX EXEMPTION CERTIFICATE

Check One

Single Purchase

Continuous

Purchaser’s Business Name

Purchaser’s Address

The above purchaser, whose signature appears on the reverse side of this form, claims exemption from Wisconsin state,

county, baseball or football stadium, local exposition, and premier resort sales or use tax on the purchase, lease, or rental of

tangible personal property or taxable services, as indicated by the box(es) checked below.

I hereby certify that I am engaged in the business of selling, leasing, or renting:

(Description of Property or Services Sold by Purchaser)

General description of property or services purchased (itemize property purchased if “single purchase”):

Seller’s Name

Seller’s Address

PROPOSED EXEMPT USE

Resale (Enter purchaser’s seller’s permit or use tax certificate number)

Manufacturing

Tangible personal property becoming an ingredient or component part, or which is consumed or destroyed or loses

its identity, in the manufacture of tangible personal property destined for sale.

Machines and specific processing equipment and repair parts or replacements thereof, exclusively and directly used

by a manufacturer in manufacturing tangible personal property and safety attachments for those machines and

equipment.

The repair, service, alteration, fitting, cleaning, painting, coating, towing, installation, and maintenance of machines

and specific processing equipment, that the above purchaser would be authorized to purchase without sales or use

tax, at the time the service is performed thereon. Tools used to repair exempt machines are not exempt.

Fuel and electricity consumed in manufacturing tangible personal property (effective January 1, 2006).

Percent of fuel exempt:

%

Percent of electricity exempt:

%

Portion of the amount of fuel converted to steam for purposes of resale. (Percent of fuel exempt

%)

Farming

(To qualify for this exemption, the purchaser must use item(s) exclusively and directly in the business of farming,

including dairy farming, agriculture, horticulture, floriculture, silviculture, or custom farming services.)

Tractors (except lawn and garden tractors), all-terrain vehicles (ATV) and farm machines, including accessories,

attachments, and parts, lubricants, nonpowered equipment, and other tangible personal property that are used ex-

clusively and directly, or are consumed or lose their identities in the business of farming.

Feed, seeds for planting, plants, fertilizer, soil conditioners, sprays, pesticides, and fungicides.

Baling twine and baling wire.

Breeding and other livestock, poultry, and farm work stock.

Containers for fruits, vegetables, grain, hay, and silage (including containers used to transfer merchandise to

customers), and plastic bags, sleeves, and sheeting used to store or cover hay and silage.

Animal waste containers or component parts thereof (may only mark certificate as “Single Purchase”).

Animal bedding, medicine for farm livestock, and milk house supplies.

S-211 (R. 6-07)

This Form May Be Reproduced

Wisconsin Department of Revenue

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4