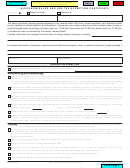

June 2007 S-211 Wisconsin Sales And Use Tax Exemption Certificate Page 3

ADVERTISEMENT

INSTRUCTIONS

This certificate may be used to claim exemption from

A resale exemption may be granted if the purchaser is

Wisconsin state, county, baseball and football stadium,

unable to ascertain at the time of purchase whether the

local exposition, and premier resort sales or use taxes and

property will be sold or will be used for some other pur-

replaces all sales and use tax exemption certificates,

pose. If the items are used in a taxable manner, then sales

except for the following: Certificate of Exemption for Rental

or use tax is due on the purchase of the items.

Vehicles (Form RV-207), Construction Contract Entered

Into Before the Effective Date of County Tax (Form

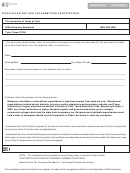

MANUFACTURING: “Manufacturing” is defined as “the

S-207CT-1), and a Wisconsin Direct Pay Permit. (Note:

production by machinery of a new article with a different

Form S-211 may be used by a purchaser claiming the direct

form, use and name from existing materials by a process

pay exemption, if the purchaser checks the “other

popularly regarded as manufacturing.”

purchases exempt by law” line and enters all the required

direct pay information.)

FARMING: This certificate may not be used by farmers to

claim exemption for the purchase of motor vehicles or trail-

Under the sales and use tax law, all receipts from sales of

ers for highway use, lawn or garden tractors, snowmobiles,

tangible personal property or taxable services are subject

or for items used for the personal convenience of the

to the tax until the contrary is established. However, a seller

farmer. When claiming an exemption for an ATV which is

who accepts in “good faith” a valid exemption certificate is

also registered for public use, a written description includ-

relieved of any responsibility for collection or payment of

ing the percentages of time for personal and farm use,

the tax upon transactions covered by the certificate. A valid

must be submitted with the ATV Registration Application.

certificate is one which is completely filled in and discloses

a specific exemption claim appropriate to the business or

Gross receipts from the sale of electricity, natural gas, and

activity being conducted by the purchaser. The seller should

other fuels for use in farming are exempt all 12 months of

be familiar with the various exemption requirements and

the year. Farmers claiming this exemption should check

the instructions for using this certificate.

the box for electricity and fuel located in the “Other” sec-

tion.

RESALE: A purchaser using the resale exemption is at-

testing that the tangible personal property or taxable

This certificate cannot be used as an exemption for pay-

services being purchased will be resold, leased, or rented.

ing Wisconsin motor vehicle fuel tax.

However, in the event any such property is used for any

purpose other than retention, demonstration, or display

FEDERAL AND WISCONSIN GOVERNMENTAL UNITS:

while holding it for sale, lease, or rental in the regular course

This exemption may only be accepted from federal and

of business, the purchaser is required to report and pay

Wisconsin governmental units and replaces the require-

the tax on the purchase of the property.

ment for having a purchase order from the governmental

unit or recording on invoices the Certificate of Exempt Sta-

The following purchasers may make purchases for resale

tus (CES) number of the governmental unit. Governmental

even though they do not hold a Wisconsin seller’s permit

units of other countries and states may not use this ex-

or use tax certificate: (a) A wholesaler who only sells to

emption certificate. The governmental unit should check

other sellers for resale may insert “Wholesale only” in the

the box that best describes their unit of government.

space for the seller’s permit number; (b) A person who

only sells or repairs exempt property, such as to a manu-

OTHER:

facturer or farmer, may insert “Exempt sales only”; (c) A

nonprofit organization may insert “Exempt sales only” if its

Containers: This exemption applies regardless of whether

subsequent sales of the tangible personal property or tax-

or not the containers are returnable. Containers used by

able services are exempt as occasional sales; or (d) A

the purchaser only for storage or to transfer merchandise

person registered as a seller in another state who makes

owned by the purchaser from one location to another do

no taxable retail sales in Wisconsin may insert the name

not qualify for the exemption.

of the state in which registered and that state’s seller’s

permit or use tax certificate number. However, a supplier

Common or contract carriers: The exemption available

may not accept the resale exemption from a business not

to common or contract carriers for certain vehicles and

holding a Wisconsin seller’s permit or use tax certificate, if

repairs listed on this certificate applies only to those units

the sale involves the supplier’s delivery of goods to a con-

used “exclusively” in such common or contract carriage.

sumer in Wisconsin (i.e., drop shipment).

The fact that a carrier holds a LC or IC number is not in

itself a reason for exemption.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4