Beneficiary Change E-Form

Download a blank fillable Beneficiary Change E-Form in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Beneficiary Change E-Form with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

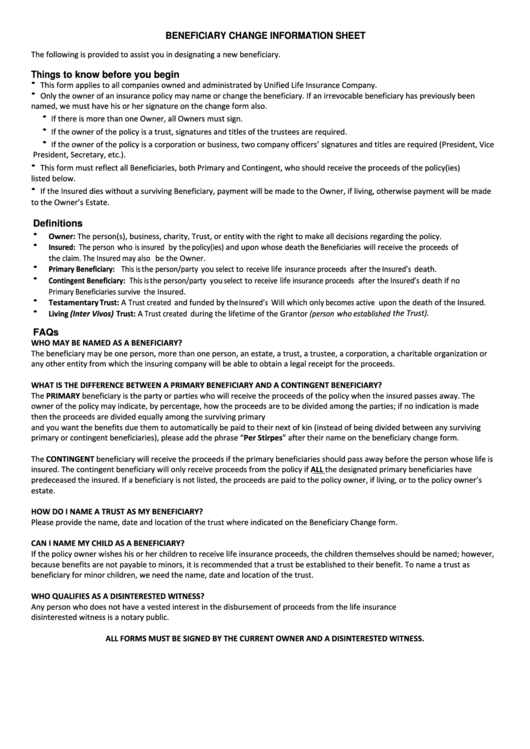

BENEFICIARY CHANGE INFORMATION SHEET

The following is provided to assist you in designating a new beneficiary.

Things to know before you begin

• This form applies to all companies owned and administrated by Unified Life Insurance Company.

• Only the owner of an insurance policy may name or change the beneficiary. If an irrevocable beneficiary has previously been

named, we must have his or her signature on the change form also.

• If there is more than one Owner, all Owners must sign.

• If the owner of the policy is a trust, signatures and titles of the trustees are required.

• If the owner of the policy is a corporation or business, two company officers’ signatures and titles are required (President, Vice

President, Secretary, etc.).

• This form must reflect all Beneficiaries, both Primary and Contingent, who should receive the proceeds of the policy(ies)

listed below.

• If the Insured dies without a surviving Beneficiary, payment will be made to the Owner, if living, otherwise payment will be made

to the Owner’s Estate.

Definitions

•

Owner: The person(s), business, charity, Trust, or entity with the right to make all decisions regarding the policy.

•

Insured: The person who is insured by the policy(ies) and upon whose death the Beneficiaries will receive the proceeds of

the claim. The Insured may also be the Owner.

•

Primary Beneficiary: This is the person/party you select to receive life insurance proceeds after the Insured’s death.

•

Contingent Beneficiary: This is the person/party you select to receive life insurance proceeds after the Insured’s death if no

Primary Beneficiaries survive the Insured.

•

Testamentary Trust: A Trust created and funded by the Insured’s Will which only becomes active upon the death of the Insured.

•

Living (Inter Vivos) Trust: A Trust created during the lifetime of the Grantor (person who established the Trust).

FAQs

WHO MAY BE NAMED AS A BENEFICIARY?

The beneficiary may be one person, more than one person, an estate, a trust, a trustee, a corporation, a charitable organization or

any other entity from which the insuring company will be able to obtain a legal receipt for the proceeds.

WHAT IS THE DIFFERENCE BETWEEN A PRIMARY BENEFICIARY AND A CONTINGENT BENEFICIARY?

The PRIMARY beneficiary is the party or parties who will receive the proceeds of the policy when the insured passes away. The

owner of the policy may indicate, by percentage, how the proceeds are to be divided among the parties; if no indication is made

then the proceeds are divided equally among the surviving primary beneficiaries. In the event a beneficiary dies before the insured

and you want the benefits due them to automatically be paid to their next of kin (instead of being divided between any surviving

primary or contingent beneficiaries), please add the phrase “Per Stirpes” after their name on the beneficiary change form.

The CONTINGENT beneficiary will receive the proceeds if the primary beneficiaries should pass away before the person whose life is

insured. The contingent beneficiary will only receive proceeds from the policy if ALL the designated primary beneficiaries have

predeceased the insured. If a beneficiary is not listed, the proceeds are paid to the policy owner, if living, or to the policy owner’s

estate.

HOW DO I NAME A TRUST AS MY BENEFICIARY?

Please provide the name, date and location of the trust where indicated on the Beneficiary Change form.

CAN I NAME MY CHILD AS A BENEFICIARY?

If the policy owner wishes his or her children to receive life insurance proceeds, the children themselves should be named; however,

because benefits are not payable to minors, it is recommended that a trust be established to their benefit. To name a trust as

beneficiary for minor children, we need the name, date and location of the trust.

WHO QUALIFIES AS A DISINTERESTED WITNESS?

Any person who does not have a vested interest in the disbursement of proceeds from the life insurance policy. The best

disinterested witness is a notary public.

ALL FORMS MUST BE SIGNED BY THE CURRENT OWNER AND A DISINTERESTED WITNESS.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3