Ce Form 4a Disclosure Of Business Transaction, Relationship Or Interest

ADVERTISEMENT

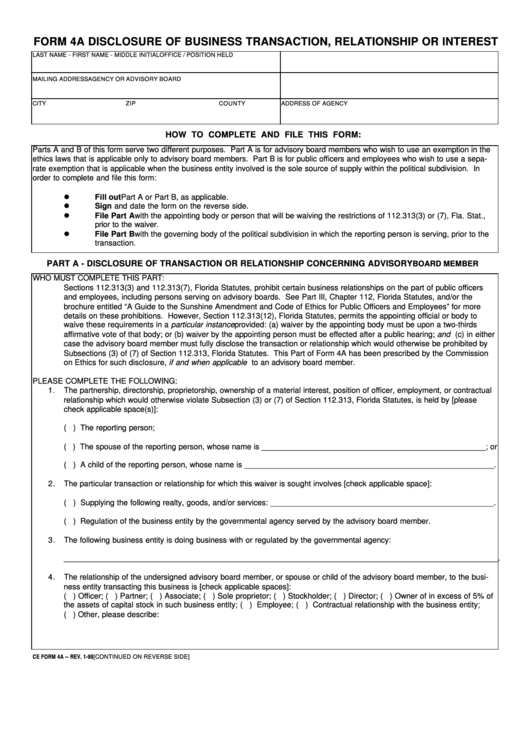

FORM 4A DISCLOSURE OF BUSINESS TRANSACTION, RELATIONSHIP OR INTEREST

LAST NAME - FIRST NAME - MIDDLE INITIAL

OFFICE / POSITION HELD

MAILING ADDRESS

AGENCY OR ADVISORY BOARD

CITY

ZIP

COUNTY

ADDRESS OF AGENCY

HOW TO COMPLETE AND FILE THIS FORM:

Parts A and B of this form serve two different purposes. Part A is for advisory board members who wish to use an exemption in the

ethics laws that is applicable only to advisory board members. Part B is for public officers and employees who wish to use a sepa-

rate exemption that is applicable when the business entity involved is the sole source of supply within the political subdivision. In

order to complete and file this form:

l

Fill out Part A or Part B, as applicable.

l

Sign and date the form on the reverse side.

l

File Part A with the appointing body or person that will be waiving the restrictions of 112.313(3) or (7), Fla. Stat.,

prior to the waiver.

l

File Part B with the governing body of the political subdivision in which the reporting person is serving, prior to the

transaction.

PART A - DISCLOSURE OF TRANSACTION OR RELATIONSHIP CONCERNING ADVISORY

BOARD MEMBER

WHO MUST COMPLETE THIS PART:

Sections 112.313(3) and 112.313(7), Florida Statutes, prohibit certain business relationships on the part of public officers

and employees, including persons serving on advisory boards. See Part III, Chapter 112, Florida Statutes, and/or the

brochure entitled “A Guide to the Sunshine Amendment and Code of Ethics for Public Officers and Employees” for more

details on these prohibitions. However, Section 112.313(12), Florida Statutes, permits the appointing official or body to

waive these requirements in a particular instance provided: (a) waiver by the appointing body must be upon a two-thirds

affirmative vote of that body; or (b) waiver by the appointing person must be effected after a public hearing; and (c) in either

case the advisory board member must fully disclose the transaction or relationship which would otherwise be prohibited by

Subsections (3) of (7) of Section 112.313, Florida Statutes. This Part of Form 4A has been prescribed by the Commission

on Ethics for such disclosure, if and when applicable to an advisory board member.

PLEASE COMPLETE THE FOLLOWING:

1.

The partnership, directorship, proprietorship, ownership of a material interest, position of officer, employment, or contractual

relationship which would otherwise violate Subsection (3) or (7) of Section 112.313, Florida Statutes, is held by [please

check applicable space(s)]:

( ) The reporting person;

( ) The spouse of the reporting person, whose name is ___________________________________________________; or

( ) A child of the reporting person, whose name is _________________________________________________________.

2.

The particular transaction or relationship for which this waiver is sought involves [check applicable space]:

( ) Supplying the following realty, goods, and/or services: ___________________________________________________.

( ) Regulation of the business entity by the governmental agency served by the advisory board member.

3.

The following business entity is doing business with or regulated by the governmental agency:

___________________________________________________________________________________________________.

4.

The relationship of the undersigned advisory board member, or spouse or child of the advisory board member, to the busi-

ness entity transacting this business is [check applicable spaces]:

( ) Officer; ( ) Partner; ( ) Associate; ( ) Sole proprietor; ( ) Stockholder; ( ) Director; ( ) Owner of in excess of 5% of

the assets of capital stock in such business entity; ( ) Employee; ( ) Contractual relationship with the business entity;

( ) Other, please describe:

CE FORM 4A -- REV. 1-98

[CONTINUED ON REVERSE SIDE]

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2