Texas State Sales/use Tax Exemption

ADVERTISEMENT

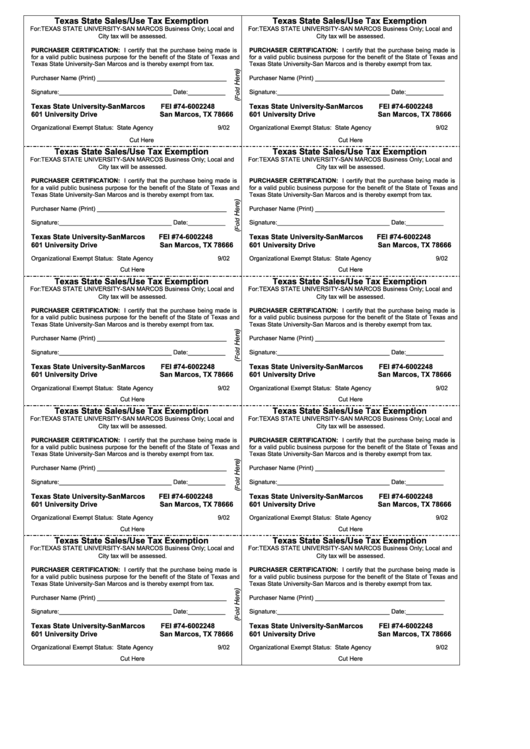

Texas State Sales/Use Tax Exemption

Texas State Sales/Use Tax Exemption

For: TEXAS STATE UNIVERSITY-SAN MARCOS Business Only; Local and

For: TEXAS STATE UNIVERSITY-SAN MARCOS Business Only; Local and

City tax will be assessed.

City tax will be assessed.

PURCHASER CERTIFICATION: I certify that the purchase being made is

PURCHASER CERTIFICATION: I certify that the purchase being made is

for a valid public business purpose for the benefit of the State of Texas and

for a valid public business purpose for the benefit of the State of Texas and

Texas State University-San Marcos and is thereby exempt from tax.

Texas State University-San Marcos and is thereby exempt from tax.

Purchaser Name (Print) ______________________________________

Purchaser Name (Print) ______________________________________

Signature:_________________________________ Date:___________

Signature:_________________________________ Date:___________

Texas State University-San Marcos

FEI #74-6002248

Texas State University-San Marcos

FEI #74-6002248

601 University Drive

San Marcos, TX 78666

601 University Drive

San Marcos, TX 78666

Organizational Exempt Status: State Agency

9/02

Organizational Exempt Status: State Agency

9/02

Cut Here

Cut Here

Texas State Sales/Use Tax Exemption

Texas State Sales/Use Tax Exemption

For: TEXAS STATE UNIVERSITY-SAN MARCOS Business Only; Local and

For: TEXAS STATE UNIVERSITY-SAN MARCOS Business Only; Local and

City tax will be assessed.

City tax will be assessed.

PURCHASER CERTIFICATION: I certify that the purchase being made is

PURCHASER CERTIFICATION: I certify that the purchase being made is

for a valid public business purpose for the benefit of the State of Texas and

for a valid public business purpose for the benefit of the State of Texas and

Texas State University-San Marcos and is thereby exempt from tax.

Texas State University-San Marcos and is thereby exempt from tax.

Purchaser Name (Print) ______________________________________

Purchaser Name (Print) ______________________________________

Signature:_________________________________ Date:___________

Signature:_________________________________ Date:___________

FEI #74-6002248

FEI #74-6002248

Texas State University-San Marcos

Texas State University-San Marcos

601 University Drive

San Marcos, TX 78666

601 University Drive

San Marcos, TX 78666

Organizational Exempt Status: State Agency

9/02

Organizational Exempt Status: State Agency

9/02

Cut Here

Cut Here

Texas State Sales/Use Tax Exemption

Texas State Sales/Use Tax Exemption

For: TEXAS STATE UNIVERSITY-SAN MARCOS Business Only; Local and

For: TEXAS STATE UNIVERSITY-SAN MARCOS Business Only; Local and

City tax will be assessed.

City tax will be assessed.

PURCHASER CERTIFICATION: I certify that the purchase being made is

PURCHASER CERTIFICATION: I certify that the purchase being made is

for a valid public business purpose for the benefit of the State of Texas and

for a valid public business purpose for the benefit of the State of Texas and

Texas State University-San Marcos and is thereby exempt from tax.

Texas State University-San Marcos and is thereby exempt from tax.

Purchaser Name (Print) ______________________________________

Purchaser Name (Print) ______________________________________

Signature:_________________________________ Date:___________

Signature:_________________________________ Date:___________

Texas State University-San Marcos

FEI #74-6002248

Texas State University-San Marcos

FEI #74-6002248

601 University Drive

San Marcos, TX 78666

601 University Drive

San Marcos, TX 78666

Organizational Exempt Status: State Agency

9/02

Organizational Exempt Status: State Agency

9/02

Cut Here

Cut Here

Texas State Sales/Use Tax Exemption

Texas State Sales/Use Tax Exemption

For: TEXAS STATE UNIVERSITY-SAN MARCOS Business Only; Local and

For: TEXAS STATE UNIVERSITY-SAN MARCOS Business Only; Local and

City tax will be assessed.

City tax will be assessed.

PURCHASER CERTIFICATION: I certify that the purchase being made is

PURCHASER CERTIFICATION: I certify that the purchase being made is

for a valid public business purpose for the benefit of the State of Texas and

for a valid public business purpose for the benefit of the State of Texas and

Texas State University-San Marcos and is thereby exempt from tax.

Texas State University-San Marcos and is thereby exempt from tax.

Purchaser Name (Print) ______________________________________

Purchaser Name (Print) ______________________________________

Signature:_________________________________ Date:___________

Signature:_________________________________ Date:___________

FEI #74-6002248

FEI #74-6002248

Texas State University-San Marcos

Texas State University-San Marcos

601 University Drive

San Marcos, TX 78666

601 University Drive

San Marcos, TX 78666

Organizational Exempt Status: State Agency

9/02

Organizational Exempt Status: State Agency

9/02

Cut Here

Cut Here

Texas State Sales/Use Tax Exemption

Texas State Sales/Use Tax Exemption

For: TEXAS STATE UNIVERSITY-SAN MARCOS Business Only; Local and

For: TEXAS STATE UNIVERSITY-SAN MARCOS Business Only; Local and

City tax will be assessed.

City tax will be assessed.

PURCHASER CERTIFICATION: I certify that the purchase being made is

PURCHASER CERTIFICATION: I certify that the purchase being made is

for a valid public business purpose for the benefit of the State of Texas and

for a valid public business purpose for the benefit of the State of Texas and

Texas State University-San Marcos and is thereby exempt from tax.

Texas State University-San Marcos and is thereby exempt from tax.

Purchaser Name (Print) ______________________________________

Purchaser Name (Print) ______________________________________

Signature:_________________________________ Date:___________

Signature:_________________________________ Date:___________

Texas State University-San Marcos

FEI #74-6002248

Texas State University-San Marcos

FEI #74-6002248

601 University Drive

San Marcos, TX 78666

601 University Drive

San Marcos, TX 78666

Organizational Exempt Status: State Agency

9/02

Organizational Exempt Status: State Agency

9/02

Cut Here

Cut Here

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1