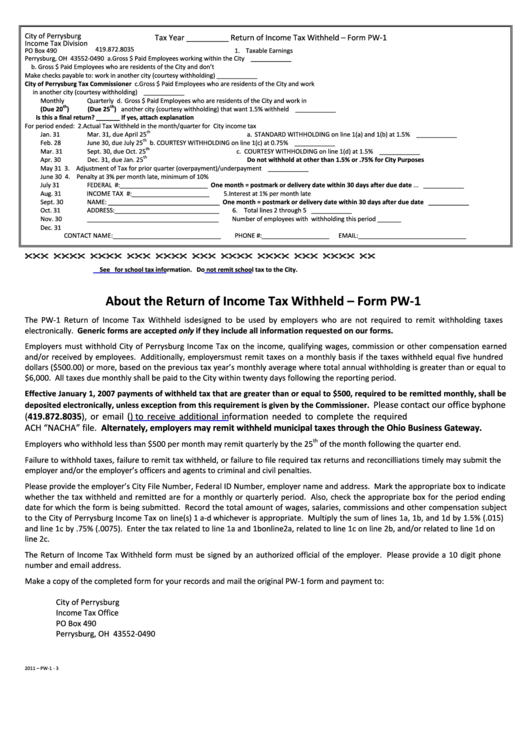

City of Perrysburg

Tax Year __________ Return of Income Tax Withheld – Form PW-1

Income Tax Division

419.872.8035

PO Box 490

1. Taxable Earnings

Perrysburg, OH 43552-0490

a. Gross $ Paid Employees working within the City ....................................

____________

b. Gross $ Paid Employees who are residents of the City and don’t

Make checks payable to:

work in another city (courtesy withholding) ..........................................

____________

City of Perrysburg Tax Commissioner

c. Gross $ Paid Employees who are residents of the City and work

in another city (courtesy withholding) ...................................................

____________

Monthly

Quarterly

d. Gross $ Paid Employees who are residents of the City and work in

th

th

(Due 20

)

(Due 25

)

another city (courtesy withholding) that want 1.5% withheld ...............

____________

Is this a final return? _______ If yes, attach explanation

For period ended:

2. Actual Tax Withheld in the month/quarter for City income tax

th

Jan. 31

Mar. 31, due April 25

a. STANDARD WITHHOLDING on line 1(a) and 1(b) at 1.5% .......................

____________

th

Feb. 28

June 30, due July 25

b. COURTESY WITHHOLDING on line 1(c) at 0.75% ....................................

____________

th

Mar. 31

Sept. 30, due Oct. 25

c. COURTESY WITHHOLDING on line 1(d) at 1.5% ......................................

____________

th

Apr. 30

Dec. 31, due Jan. 25

Do not withhold at other than 1.5% or .75% for City Purposes

May 31

3. Adjustment of Tax for prior quarter (overpayment)/underpayment ..........

____________

June 30

4. Penalty at 3% per month late, minimum of 10%

One month = postmark or delivery date within 30 days after due date ...

July 31

FEDERAL I.D. #:__________________________

____________

Aug. 31

INCOME TAX I.D. #:_______________________

5. Interest at 1% per month late

Sept. 30

NAME: _________________________________

One month = postmark or delivery date within 30 days after due date ...... ____________

Oct. 31

ADDRESS:_______________________________

6. Total lines 2 through 5 ................................................................................... ____________

Nov. 30

_______________________________________

Number of employees with withholding this period _______

Dec. 31

CONTACT NAME:________________________________

PHONE #:____________________

EMAIL:________________________________

See

for school tax information. Do not remit school tax to the City.

About the Return of Income Tax Withheld – Form PW-1

The PW-1 Return of Income Tax Withheld is designed to be used by employers who are not required to remit withholding taxes

electronically. Generic forms are accepted only if they include all information requested on our forms.

Employers must withhold City of Perrysburg Income Tax on the income, qualifying wages, commission or other compensation earned

and/or received by employees. Additionally, employers must remit taxes on a monthly basis if the taxes withheld equal five hundred

dollars ($500.00) or more, based on the previous tax year’s monthly average where total annual withholding is greater than or equal to

$6,000. All taxes due monthly shall be paid to the City within twenty days following the reporting period.

Effective January 1, 2007 payments of withheld tax that are greater than or equal to $500, required to be remitted monthly, shall be

Please contact our office by phone

deposited electronically, unless exception from this requirement is given by the Commissioner.

(419.872.8035), or email (Itax@ci.perrysburg.oh.us) to receive additional information needed to complete the required

ACH “NACHA” file. Alternately, employers may remit withheld municipal taxes through the Ohio Business Gateway.

th

Employers who withhold less than $500 per month may remit quarterly by the 25

of the month following the quarter end.

Failure to withhold taxes, failure to remit tax withheld, or failure to file required tax returns and reconcilliations timely may submit the

employer and/or the employer’s officers and agents to criminal and civil penalties.

Please provide the employer’s City File Number, Federal ID Number, employer name and address. Mark the appropriate box to indicate

whether the tax withheld and remitted are for a monthly or quarterly period. Also, check the appropriate box for the period ending

date for which the form is being submitted. Record the total amount of wages, salaries, commissions and other compensation subject

to the City of Perrysburg Income Tax on line(s) 1 a-d whichever is appropriate. Multiply the sum of lines 1a, 1b, and 1d by 1.5% (.015)

and line 1c by .75% (.0075). Enter the tax related to line 1a and 1b on line 2a, related to line 1c on line 2b, and/or related to line 1d on

line 2c.

The Return of Income Tax Withheld form must be signed by an authorized official of the employer. Please provide a 10 digit phone

number and email address.

Make a copy of the completed form for your records and mail the original PW-1 form and payment to:

City of Perrysburg

Income Tax Office

PO Box 490

Perrysburg, OH 43552-0490

2011 – PW-1 - 3

1

1