Form Bd Uniform Application For Broker-Dealer Registration Page 10

ADVERTISEMENT

Schedule A of FORM BD

OFFICIAL USE

DIRECT OWNERS AND

Applicant Name:_____________________________________________

EXECUTIVE OFFICERS

Date:____________________

Firm CRD No.: _______________

(Answer for Form BD Item 3)

1. Use Schedule A only in new applications to provide information on the direct owners and executive officers of the applicant. Use Schedule

B in new applications to provide information on indirect owners. File all amendments on Schedule C. Complete each column.

2. List below the names of:

(a) each Chief Executive Officer, Chief Financial Officer, Chief Operations Officer, Chief Legal Officer, Chief Compliance Officer, Director,

and individuals with similar status or functions;

(b) in the case of an applicant that is a corporation, each shareholder that directly owns 5% or more of a class of a voting security of the

applicant, unless the applicant is a public reporting company (a company subject to Sections 12 or 15(d) of the Securities Exchange

Act of 1934);

Direct owners include any person that owns, beneficially owns, has the right to vote, or has the power to sell or direct the sale of, 5%

or more of a class of a voting security of the applicant. For purposes of this Schedule, a person beneficially owns any securities (i)

owned by his/her child, stepchild, grandchild, parent, stepparent, grandparent, spouse, sibling, mother-in-law, father-in-law, son-in

law, daughter-in-law, brother-in-law, or sister-in-law, sharing the same residence; or (ii) that he/she has the right to acquire, within

60 days, through the exercise of any option, warrant or right to purchase the security.

(c) in the case of an applicant that is a partnership, all general partners and those limited and special partners that have the right to receive

upon dissolution, or have contributed, 5% or more of the partnership’s capital; and

(d) in the case of a trust that directly owns 5% or more of a class of a voting security of the applicant, or that has the right to receive upon

dissolution, or has contributed, 5% or more of the applicant’s capital, the trust and each trustee.

(e) in the case of an applicant that is a Limited Liability Company (“LLC”), (i) those members that have the right to receive upon

dissolution, or have contributed, 5% or more of the LLC’s capital, and (ii) if managed by elected managers, all elected managers.

3. Are there any indirect owners of the applicant required to be reported on Schedule B?

Yes

No

4. In the “DE/FE/I” column, enter “DE” if the owner is a domestic entity, or enter “FE” if owner is an entity incorporated or domiciled in a foreign

country, or enter “I” if the owner is an individual.

5. Complete the “Title or Status” column by entering board/management titles; status as partner, trustee, sole proprietor, or shareholder;

and for shareholders, the class of securities owned (if more than one is issued).

6. Ownership codes are:

NA - less than 5%

B - 10% but less than 25%

D - 50% but less than 75%

A - 5% but less than 10%

C - 25% but less than 50%

E - 75% or more

7. (a) In the “Control Person” column, enter “Yes” if person has “control” as defined in the instructions to this form, and enter “No” if the

person does not have control. Note that under this definition most executive officers and all 25% owners, general partners, and

trustees would be “control persons”.

(b) In the “PR” column, enter “PR” if the owner is a public reporting company under Sections 12 or 15(d) of the Securities Exchange Act

of 1934.

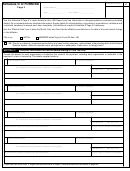

Date Title or

Control

CRD No. If None:

Official

FULL LEGAL NAME

DE/FE/I

Title or Status

Status Acquired

Ownership

Person

S.S. No., IRS Tax No.

Use

(Individuals: Last Name, First Name, Middle Name)

Code

or Employer ID.

Only

MM YYYY

PR

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28