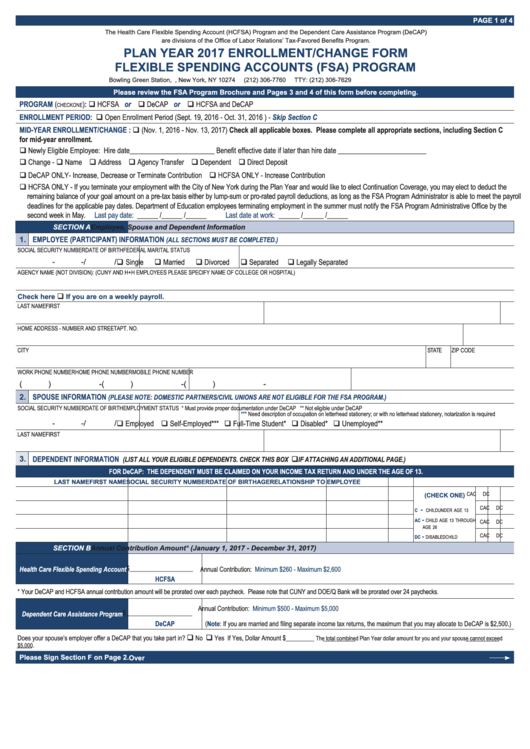

PAGE 1 of 4

The Health Care Flexible Spending Account (HCFSA) Program and the Dependent Care Assistance Program (DeCAP)

are divisions of the Office of Labor Relations’ Tax-Favored Benefits Program.

Reset Fields

PLAN YEAR 2017 ENROLLMENT/CHANGE FORM

FLEXIBLE SPENDING ACCOUNTS (FSA) PROGRAM

Print Form

Bowling Green Station, P.O. Box 707, New York, NY 10274

(212) 306-7760

TTY: (212) 306-7629

nyc.gov/fsa

Please review the FSA Program Brochure and Pages 3 and 4 of this form before completing.

PROGRAM

or

or

(

):

q HCFSA

q DeCAP

q HCFSA and DeCAP

check one

ENROLLMENT PERIOD:

q Open Enrollment Period (Sept. 19, 2016 - Oct. 31, 2016 ) -

Skip Section C

MID-YEAR ENROLLMENT/CHANGE :

q (Nov. 1, 2016 - Nov. 13, 2017) Check all applicable boxes. Please complete all appropriate sections, including Section C

for mid-year enrollment.

q Newly Eligible Employee: Hire date________________________ Benefit effective date if later than hire date _________________________

q Change - q Name q Address q Agency Transfer q Dependent q Direct Deposit

q DeCAP ONLY- Increase, Decrease or Terminate Contribution q HCFSA ONLY - Increase Contribution

q HCFSA ONLY - If you terminate your employment with the City of New York during the Plan Year and would like to elect Continuation Coverage, you may elect to deduct the

remaining balance of your goal amount on a pre-tax basis either by lump-sum or pro-rated payroll deductions, as long as the FSA Program Administrator is able to meet the payroll

deadlines for the applicable pay dates. Department of Education employees terminating employment in the summer must notify the FSA Program Administrative Office by the

second week in May.

Last pay date:

______ /______ /______

Last date at work:

______ /______ /______

SECTION A

Employee, Spouse and Dependent Information

1. EMPLOYEE (PARTICIPANT) INFORMATION

(ALL SECTIONS MUST BE COMPLETED.)

SOCIAL SECURITY NUMBER

DATE OF BIRTH

FEDERAL MARITAL STATUS

-

-

/

/

q Single

q Married

q Divorced

q Separated

q Legally Separated

AGENCY NAME (NOT DIVISION): (CUNY AND H+H EMPLOYEES PLEASE SPECIFY NAME OF COLLEGE OR HOSPITAL)

Check here

q

If you are on a weekly payroll.

LAST NAME

FIRST NAME

M.I.

HOME ADDRESS - NUMBER AND STREET

APT. NO.

CITY

STATE

ZIP CODE

WORK PHONE NUMBER

HOME PHONE NUMBER

MOBILE PHONE NUMBER

(

)

-

(

)

-

(

)

-

2. SPOUSE INFORMATION

(PLEASE NOTE: DOMESTIC PARTNERS/CIVIL UNIONS ARE NOT ELIGIBLE FOR THE FSA PROGRAM.)

SOCIAL SECURITY NUMBER

DATE OF BIRTH

EMPLOYMENT STATUS

*

Must provide proper documentation under DeCAP

**

Not eligible under DeCAP

***

Need description of occupation on letterhead stationery; or with no letterhead stationery, notarization is required

-

-

/

/

q Employed q Self-Employed*** q Full-Time Student* q Disabled* q Unemployed**

LAST NAME

FIRST NAME

M.I.

3. DEPENDENT INFORMATION

(LIST ALL YOUR ELIGIBLE DEPENDENTS. CHECK THIS BOX

IF ATTACHING AN ADDITIONAL PAGE.)

q

FOR DeCAP: THE DEPENDENT MUST BE CLAIMED ON YOUR INCOME TAX RETURN AND UNDER THE AGE OF 13.

LAST NAME

FIRST NAME

SOCIAL SECURITY NUMBER

DATE OF BIRTH

AGE

RELATIONSHIP TO EMPLOYEE

c

ac

dc

(CHECK ONE)

c

ac

dc

-

c

child under age 13

-

ac

child age 13 through

c

ac

dc

age 26

-

c

ac

dc

dc

disabled child

SECTION B

Annual Contribution

Amount*

(January 1, 2017 - December 31, 2017)

$____________________

Health Care Flexible Spending Account

Annual Contribution:

Minimum $260 - Maximum $2,600

HCFSA

*

Your DeCAP and HCFSA annual contribution amount will be prorated over each paycheck. Please note that CUNY and DOE/Q Bank will be prorated over 24 paychecks.

Annual Contribution:

Minimum $500 - Maximum $5,000

$_____________________

Dependent Care Assistance Program

DeCAP

(Note: If you are married and filing separate income tax returns, the maximum that you may allocate to DeCAP is $2,500.)

Does your spouse’s employer offer a DeCAP that you take part in?

No

Yes If Yes, Dollar Amount $_________

q

q

The total combined Plan Year dollar amount for you and your spouse cannot exceed

$5,000.

Please Sign Section F on Page 2.

Over

1

1 2

2 3

3 4

4