Uniform Residential Loan Application Form

ADVERTISEMENT

Dimond Mortgage Inc, NMLS# 190187

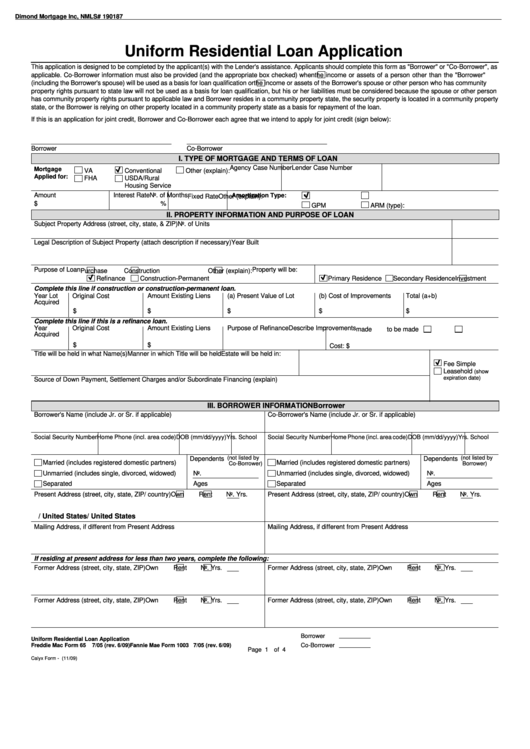

Uniform Residential Loan Application

This application is designed to be completed by the applicant(s) with the Lender's assistance. Applicants should complete this form as "Borrower" or "Co-Borrower", as

applicable. Co-Borrower information must also be provided (and the appropriate box checked) when

the income or assets of a person other than the "Borrower"

(including the Borrower's spouse) will be used as a basis for loan qualification or

the income or assets of the Borrower's spouse or other person who has community

property rights pursuant to state law will not be used as a basis for loan qualification, but his or her liabilities must be considered because the spouse or other person

has community property rights pursuant to applicable law and Borrower resides in a community property state, the security property is located in a community property

state, or the Borrower is relying on other property located in a community property state as a basis for repayment of the loan.

If this is an application for joint credit, Borrower and Co-Borrower each agree that we intend to apply for joint credit (sign below):

Borrower

Co-Borrower

I. TYPE OF MORTGAGE AND TERMS OF LOAN

Agency Case Number

Lender Case Number

Mortgage

VA

Conventional

Other (explain):

Applied for:

FHA

USDA/Rural

Housing Service

Amount

Interest Rate

No. of Months

Amortization Type:

Fixed Rate

Other (explain):

$

%

GPM

ARM (type):

II. PROPERTY INFORMATION AND PURPOSE OF LOAN

Subject Property Address (street, city, state, & ZIP)

No. of Units

Legal Description of Subject Property (attach description if necessary)

Year Built

Purpose of Loan

Property will be:

Purchase

Construction

Other (explain):

Refinance

Construction-Permanent

Primary Residence

Secondary Residence

Investment

Complete this line if construction or construction-permanent loan.

Year Lot

Original Cost

Amount Existing Liens

(a) Present Value of Lot

(b) Cost of Improvements

Total (a+b)

Acquired

$

$

$

$

$

Complete this line if this is a refinance loan.

Year

Original Cost

Amount Existing Liens

Purpose of Refinance

Describe Improvements

made

to be made

Acquired

$

$

Cost: $

Title will be held in what Name(s)

Manner in which Title will be held

Estate will be held in:

Fee Simple

Leasehold

(show

expiration date)

Source of Down Payment, Settlement Charges and/or Subordinate Financing (explain)

Borrower

III. BORROWER INFORMATION

Co-Borrower

Borrower's Name (include Jr. or Sr. if applicable)

Co-Borrower's Name (include Jr. or Sr. if applicable)

Social Security Number Home Phone (incl. area code) DOB (mm/dd/yyyy) Yrs. School

Social Security Number Home Phone (incl. area code) DOB (mm/dd/yyyy) Yrs. School

(not listed by

(not listed by

Dependents

Dependents

Married (includes registered domestic partners)

Married (includes registered domestic partners)

Co-Borrower)

Borrower)

Unmarried (includes single, divorced, widowed)

No.

Unmarried (includes single, divorced, widowed)

No.

Separated

Ages

Separated

Ages

Present Address (street, city, state, ZIP/ country)

Own

Rent

No. Yrs.

Present Address (street, city, state, ZIP/ country)

Own

Rent

No. Yrs.

/ United States

/ United States

Mailing Address, if different from Present Address

Mailing Address, if different from Present Address

If residing at present address for less than two years, complete the following:

Former Address (street, city, state, ZIP)

Own

Rent

No. Yrs.

Former Address (street, city, state, ZIP)

Own

Rent

No. Yrs.

Former Address (street, city, state, ZIP)

Own

Rent

No. Yrs.

Former Address (street, city, state, ZIP)

Own

Rent

No. Yrs.

Borrower

Uniform Residential Loan Application

Co-Borrower

Freddie Mac Form 65

7/05 (rev. 6/09)

Fannie Mae Form 1003 7/05 (rev. 6/09)

Page 1

of 4

Calyx Form - Loanapp1.frm (11/09)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4