Instructions - Form 8879(C)-K

ADVERTISEMENT

Page 3

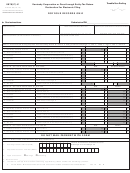

8879(C)-K

41A720-S8 (10-16)

INSTRUCTIONS — Form 8879(C)-K

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

PURPOSE OF SCHEDULE

•

Type or print authorized representative’s name and

title in Part III.

An authorized representative of the entity and the electronic

•

Return the completed Form 8879(C)-K to the ERO by

return originator (ERO) shall use Form 8879(C)-K as a

hand delivery, U.S. mail, private delivery service or

declaration document and signature authorization for an

fax.

electronic filing (e-file) of a Kentucky Form 720, 720S, 725,

765 or 765-GP filed by an ERO.

The Kentucky entity’s tax return shall not be transmitted to

the Kentucky Department of Revenue until the ERO receives

Do not send this form to the Kentucky Department of

the authorized representative’s signed Form 8879(C)-K.

Revenue. The ERO shall retain Form 8879(C)-K for 4 years

from the return due date or the Kentucky Department of

PART I – Tax Return Information

Revenue receipt date, whichever is later.

ERO RESPONSIBILITIES

Enter the required data from Kentucky Form 720, 720S,

725, 765 or 765-GP in Section A - Form 720, Section B -

The ERO will:

Form 720S, Section C - Form 725, Section D - Form 765 or

Section E- Form 765-GP .

•

Enter the name, Federal Identification Number,

Kentucky

Corporation/LLET Account

Number

(if

PART II – Direct Debit of Tax Amount Due

applicable), address and ZIP code of the entity at the

top of the form.

The entity can choose to pay the amount due by completing

•

Check the appropriate box indicating which tax return

Part II, Lines 1 through 5, and checking the box on Part III.

is being electronically filed.

The entity can choose direct debit for Kentucky regardless

•

Complete Part I using the amounts from the entity’s

of the choice for federal purposes. The entity must ensure

Kentucky tax return.

that the following information relating to the financial

•

Complete Part II using the entity’s Routing transit

institution’s account is provided in the tax preparation

number (RTN) and Depositor account number (DAN).

software: Routing transit number (RTN), Depositor account

•

Check the box in Part IV if the ERO is also the paid

number (DAN), Type of account (Savings or Checking) and

preparer.

Debit amount.

•

Check the box in Part IV if the ERO is self-employed.

•

Complete Part IV including a signature, date and I.D.

The payment amount will be processed (debited from

Number of ERO.

the designated bank account) upon acceptance of the tax

•

Enter in Part IV the ERO’s firm name (NOT the individual

return for processing. Direct debit is not available for Form

preparing the return), FEIN, address and ZIP code.

765-GP .

•

If the ERO is not the preparer, have the preparer

complete Part IV including the signature, date and I.D

PART III – Declaration of Authorized Representative of

Number of Preparer. Enter in Part IV the preparer’s

Entity

firm name (or the preparer’s name if self-employed),

FEIN, address and ZIP code.

•

Give the authorized representative of the entity Form

The authorized representative of the entity shall sign and

8879(C)-K for completion and review – this can be done

date Form 8879(C)-K after reviewing the tax return and

by hand delivery, U.S. mail, private delivery service,

before it is transmitted to the Kentucky Department of

email or Internet website.

Revenue.

•

Provide the authorized representative of the entity

with a corrected copy of the Form 8879(C)-K if changes

PART IV – Declaration and Signature of Electronic Return

are made to the tax return (for example, based on the

Originator (ERO) and Paid Preparer

authorized representative’s review).

•

Provide the authorized representative of the entity with

The ERO shall sign and date Form 8879(C)-K.

a copy of the signed Form 8879(C)-K upon request.

If the ERO is also the paid preparer, the ERO must check

AUTHORIZED

REPRESENTATIVE

OF

ENTITY

the paid preparer box, but is not required to complete and

RESPONSIBILITIES

sign the paid preparer’s section. If self-employed, check

the self-employed box.

The authorized representative will:

A paid preparer who is not the ERO must complete and

•

Verify the accuracy of the entity’s Kentucky tax return.

sign the paid preparer’s section.

•

Verify the amounts in Part I using the amounts from

the entity’s Kentucky tax return.

If the ERO cannot obtain the paid preparer’s signature

•

Verify the entity’s Routing transit number (RTN) and

on Form 8879(C)-K, a copy of the tax return with the paid

Depositor account number (DAN) in Part II.

preparer’s signature should be attached to the 8879(C)-K.

•

Sign and date Form 8879(C)-K in Part III.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1