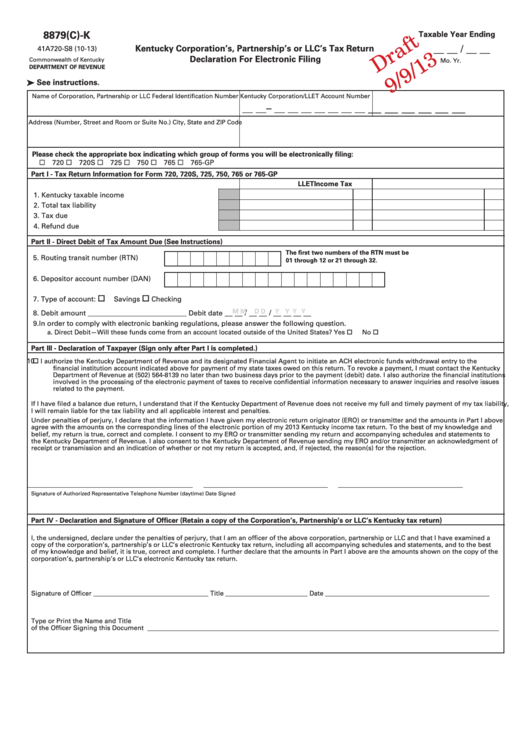

Form 8879(C)-K Draft - Kentucky Corporation'S, Partnership'S Or Llc'S Tax Return Declaration For Electronic Filing - 2013

ADVERTISEMENT

8879(C)-K

Taxable Year Ending

__ __ / __ __

Kentucky Corporation’s, Partnership’s or LLC’s Tax Return

41A720-S8 (10-13)

Declaration For Electronic Filing

Commonwealth of Kentucky

Mo.

Yr.

DEPARTMENT OF REVENUE

ä See instructions.

Name of Corporation, Partnership or LLC

Federal Identification Number

Kentucky Corporation/LLET Account Number

__ __ __ __ __ __

__ __– __ __ __ __ __ __ __

Address (Number, Street and Room or Suite No.)

City, State and ZIP Code

Please check the appropriate box indicating which group of forms you will be electronically filing:

¨ 720 ¨ 720S ¨ 725 ¨ 750 ¨ 765 ¨ 765-GP

Part I - Tax Return Information for Form 720, 720S, 725, 750, 765 or 765-GP

LLET

Income Tax

1. Kentucky taxable income ...........................................

1

00

00

2. Total tax liability .........................................................

2

00

00

3. Tax due ........................................................................

3

00

00

4. Refund due ..................................................................

4

00

00

Part II - Direct Debit of Tax Amount Due (See Instructions)

The first two numbers of the RTN must be

5. Routing transit number (RTN)

01 through 12 or 21 through 32.

6. Depositor account number (DAN)

7. Type of account:

Savings

Checking

M M

D D

Y Y Y Y

__ __ / __ __ / __ __ __ __

8. Debit amount ____________________________

Debit date

9. In order to comply with electronic banking regulations, please answer the following question.

a.

Direct Debit—Will these funds come from an account located outside of the United States?

Yes No

Part III - Declaration of Taxpayer (Sign only after Part I is completed.)

10.

I authorize the Kentucky Department of Revenue and its designated Financial Agent to initiate an ACH electronic funds withdrawal entry to the

financial institution account indicated above for payment of my state taxes owed on this return. To revoke a payment, I must contact the Kentucky

Department of Revenue at (502) 564-8139 no later than two business days prior to the payment (debit) date. I also authorize the financial institutions

involved in the processing of the electronic payment of taxes to receive confidential information necessary to answer inquiries and resolve issues

related to the payment.

If I have filed a balance due return, I understand that if the Kentucky Department of Revenue does not receive my full and timely payment of my tax liability,

I will remain liable for the tax liability and all applicable interest and penalties.

Under penalties of perjury, I declare that the information I have given my electronic return originator (ERO) or transmitter and the amounts in Part I above

agree with the amounts on the corresponding lines of the electronic portion of my 2013 Kentucky income tax return. To the best of my knowledge and

belief, my return is true, correct and complete. I consent to my ERO or transmitter sending my return and accompanying schedules and statements to

the Kentucky Department of Revenue. I also consent to the Kentucky Department of Revenue sending my ERO and/or transmitter an acknowledgment of

receipt or transmission and an indication of whether or not my return is accepted, and, if rejected, the reason(s) for the rejection.

Signature of Authorized Representative

Telephone Number (daytime)

Date Signed

Part IV - Declaration and Signature of Officer (Retain a copy of the Corporation’s, Partnership’s or LLC’s Kentucky tax return)

I, the undersigned, declare under the penalties of perjury, that I am an officer of the above corporation, partnership or LLC and that I have examined a

copy of the corporation’s, partnership’s or LLC’s electronic Kentucky tax return, including all accompanying schedules and statements, and to the best

of my knowledge and belief, it is true, correct and complete. I further declare that the amounts in Part I above are the amounts shown on the copy of the

corporation’s, partnership’s or LLC’s electronic Kentucky tax return.

Signature of Officer ___________________________________ Title _________________________ Date __________________________________________________

Type or Print the Name and Title

of the Officer Signing this Document ___________________________________________________________________________________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2