2015 Schedule Kf Instructions

ADVERTISEMENT

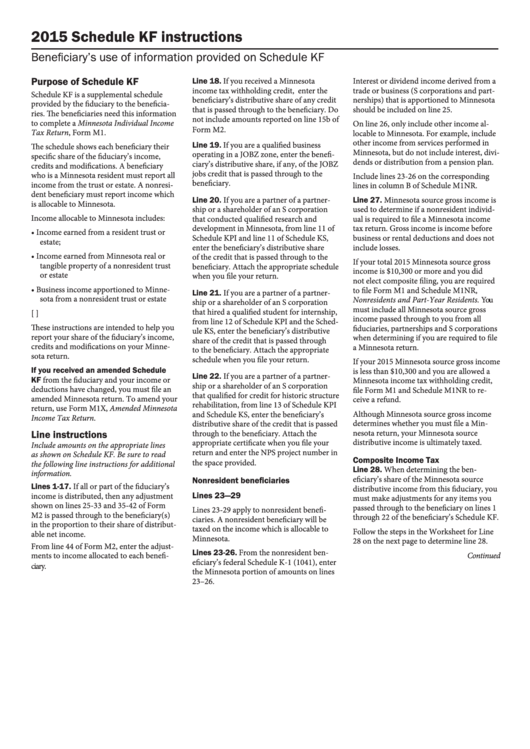

2015 Schedule KF instructions

Beneficiary’s use of information provided on Schedule KF

Purpose of Schedule KF

Line 18. If you received a Minnesota

Interest or dividend income derived from a

income tax withholding credit, enter the

trade or business (S corporations and part-

Schedule KF is a supplemental schedule

beneficiary’s distributive share of any credit

nerships) that is apportioned to Minnesota

provided by the fiduciary to the beneficia-

that is passed through to the beneficiary. Do

should be included on line 25.

ries. The beneficiaries need this information

not include amounts reported on line 15b of

to complete a Minnesota Individual Income

On line 26, only include other income al-

Form M2.

Tax Return, Form M1.

locable to Minnesota. For example, include

other income from services performed in

Line 19. If you are a qualified business

The schedule shows each beneficiary their

Minnesota, but do not include interest, divi-

operating in a JOBZ zone, enter the benefi-

specific share of the fiduciary’s income,

dends or distribution from a pension plan.

ciary’s distributive share, if any, of the JOBZ

credits and modifications. A beneficiary

jobs credit that is passed through to the

who is a Minnesota resident must report all

Include lines 23-26 on the corresponding

beneficiary.

income from the trust or estate. A nonresi-

lines in column B of Schedule M1NR.

dent beneficiary must report income which

Line 20. If you are a partner of a partner-

Line 27. Minnesota source gross income is

is allocable to Minnesota.

ship or a shareholder of an S corporation

used to determine if a nonresident individ-

Income allocable to Minnesota includes:

that conducted qualified research and

ual is required to file a Minnesota income

development in Minnesota, from line 11 of

tax return. Gross income is income before

• Income earned from a resident trust or

Schedule KPI and line 11 of Schedule KS,

business or rental deductions and does not

estate;

include losses.

enter the beneficiary’s distributive share

• Income earned from Minnesota real or

of the credit that is passed through to the

If your total 2015 Minnesota source gross

tangible property of a nonresident trust

beneficiary. Attach the appropriate schedule

income is $10,300 or more and you did

or estate

when you file your return.

not elect composite filing, you are required

• Business income apportioned to Minne-

to file Form M1 and Schedule M1NR,

Line 21. If you are a partner of a partner-

sota from a nonresident trust or estate

Nonresidents and Part-Year Residents. You

ship or a shareholder of an S corporation

must include all Minnesota source gross

that hired a qualified student for internship,

[M.S.290.17]

income passed through to you from all

from line 12 of Schedule KPI and the Sched-

These instructions are intended to help you

fiduciaries, partnerships and S corporations

ule KS, enter the beneficiary’s distributive

report your share of the fiduciary’s income,

when determining if you are required to file

share of the credit that is passed through

credits and modifications on your Minne-

a Minnesota return.

to the beneficiary. Attach the appropriate

sota return.

schedule when you file your return.

If your 2015 Minnesota source gross income

If you received an amended Schedule

is less than $10,300 and you are allowed a

Line 22. If you are a partner of a partner-

KF from the fiduciary and your income or

Minnesota income tax withholding credit,

ship or a shareholder of an S corporation

deductions have changed, you must file an

file Form M1 and Schedule M1NR to re-

that qualified for credit for historic structure

amended Minnesota return. To amend your

ceive a refund.

rehabilitation, from line 13 of Schedule KPI

return, use Form M1X, Amended Minnesota

and Schedule KS, enter the beneficiary’s

Although Minnesota source gross income

Income Tax Return.

distributive share of the credit that is passed

determines whether you must file a Min-

nesota return, your Minnesota source

through to the beneficiary. Attach the

Line instructions

distributive income is ultimately taxed.

appropriate certificate when you file your

Include amounts on the appropriate lines

return and enter the NPS project number in

as shown on Schedule KF. Be sure to read

Composite Income Tax

the space provided.

the following line instructions for additional

Line 28. When determining the ben-

information.

eficiary’s share of the Minnesota source

Nonresident beneficiaries

Lines 1-17. If all or part of the fiduciary’s

distributive income from this fiduciary, you

Lines 23—29

income is distributed, then any adjustment

must make adjustments for any items you

shown on lines 25-33 and 35-42 of Form

passed through to the beneficiary on lines 1

Lines 23-29 apply to nonresident benefi-

M2 is passed through to the beneficiary(s)

through 22 of the beneficiary’s Schedule KF.

ciaries. A nonresident beneficiary will be

in the proportion to their share of distribut-

taxed on the income which is allocable to

Follow the steps in the Worksheet for Line

able net income.

Minnesota.

28 on the next page to determine line 28.

From line 44 of Form M2, enter the adjust-

Lines 23-26. From the nonresident ben-

ments to income allocated to each benefi-

Continued

eficiary’s federal Schedule K-1 (1041), enter

ciary.

the Minnesota portion of amounts on lines

23–26.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2