Fidelity Transfer / Rollover Form

ADVERTISEMENT

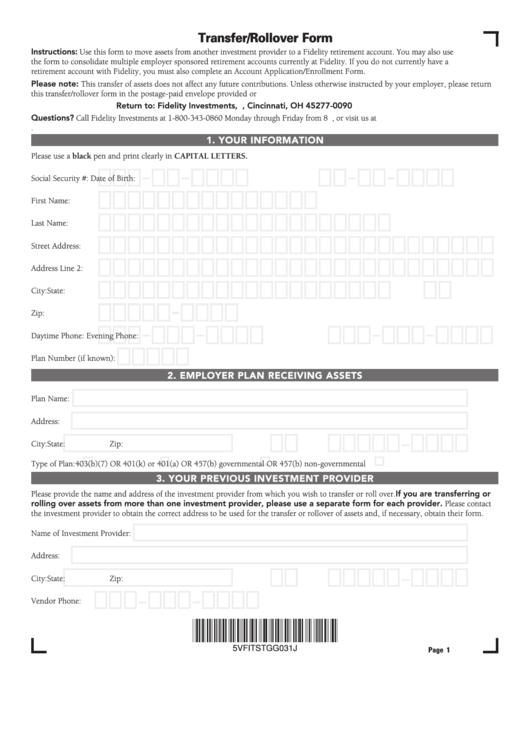

Transfer/Rollover Form

Instructions: Use this form to move assets from another investment provider to a Fidelity retirement account. You may also use

the form to consolidate multiple employer sponsored retirement accounts currently at Fidelity. If you do not currently have a

retirement account with Fidelity, you must also complete an Account Application/Enrollment Form.

Please note: This transfer of assets does not affect any future contributions. Unless otherwise instructed by your employer, please return

this transfer/rollover form in the postage-paid envelope provided or

Return to: Fidelity Investments, P.O. Box 770002, Cincinnati, OH 45277-0090

Questions? Call Fidelity Investments at 1-800-343-0860 Monday through Friday from 8 a.m. to midnight ET, or visit us at

1. YOUR INFORMATION

Please use a black pen and print clearly in CAPITAL LETTERS.

Social Security #:

Date of Birth:

First Name:

Last Name:

Street Address:

Address Line 2:

City:

State:

Zip:

Daytime Phone:

Evening Phone:

Plan Number (if known):

2. EMPLOYER PLAN RECEIVING ASSETS

Plan Name:

Address:

City:

State:

Zip:

Type of Plan:

403(b)(7) OR

401(k) or 401(a) OR

457(b) governmental OR

457(b) non-governmental

3. YOUR PREVIOUS INVESTMENT PROVIDER

Please provide the name and address of the investment provider from which you wish to transfer or roll over. If you are transferring or

rolling over assets from more than one investment provider, please use a separate form for each provider. Please contact

the investment provider to obtain the correct address to be used for the transfer or rollover of assets and, if necessary, obtain their form.

Name of Investment Provider:

Address:

City:

State:

Zip:

Vendor Phone:

5VFITSTGG031J

Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4